The UK market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over China's economic recovery. In such conditions, investors often turn their attention to smaller or newer companies that might offer unique opportunities for growth. Penny stocks, though an older term, remain relevant as they can present value in today's market when backed by strong financials and potential for long-term growth.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.435 | £498.13M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.17 | £336.88M | ✅ 4 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.85 | £1.15B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.44 | £47.61M | ✅ 5 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.886 | £327.62M | ✅ 4 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.17 | £326.55M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.725 | £133.96M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.105 | £176.29M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.825 | £11.36M | ✅ 4 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.10 | £65.3M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Big Technologies (AIM:BIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Big Technologies PLC, operating under the Buddi brand, develops and delivers remote monitoring technologies and services for the offender and remote personal monitoring industry, with a market cap of £270.26 million.

Operations: The company generates revenue of £50.31 million from its electronic tracking devices, products, and services segment.

Market Cap: £270.26M

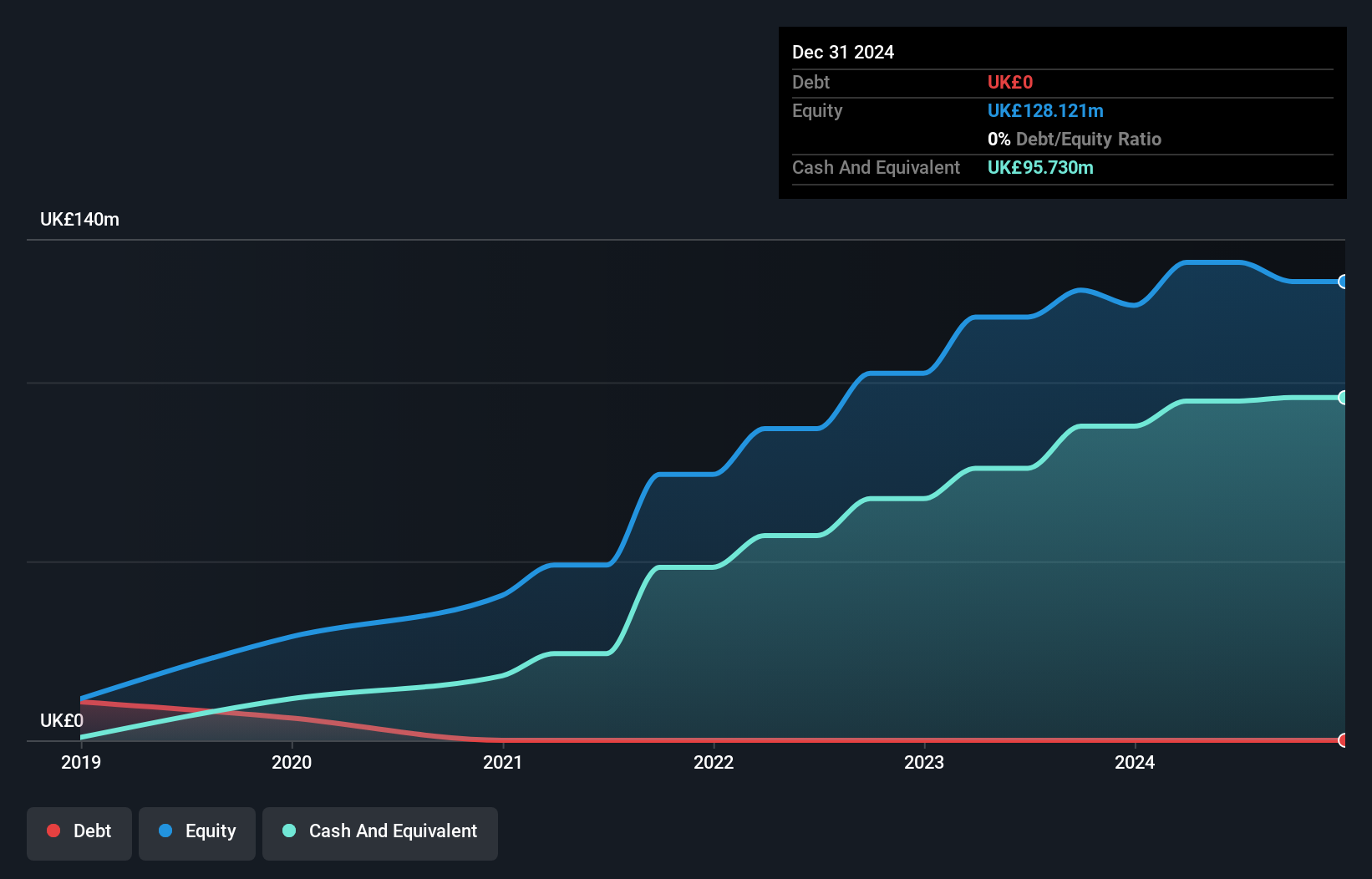

Big Technologies PLC, trading significantly below its estimated fair value, has experienced notable volatility and a challenging year with earnings declining by 85%. Despite this, the company remains debt-free with strong short-term asset coverage of liabilities. Recent board and executive changes, including the appointment of a new CEO and CFO, indicate strategic shifts underway. The company's profit margins have contracted to 4.8% from last year's 29.3%, impacted by a substantial one-off loss of £8.8M. However, earnings are forecasted to grow significantly in the future, suggesting potential recovery opportunities for investors mindful of its high volatility profile.

- Get an in-depth perspective on Big Technologies' performance by reading our balance sheet health report here.

- Learn about Big Technologies' future growth trajectory here.

Cavendish (AIM:CAV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cavendish plc, along with its subsidiaries, functions as an investment bank in the United Kingdom and has a market capitalization of £46.53 million.

Operations: Cavendish plc has not reported any specific revenue segments.

Market Cap: £46.53M

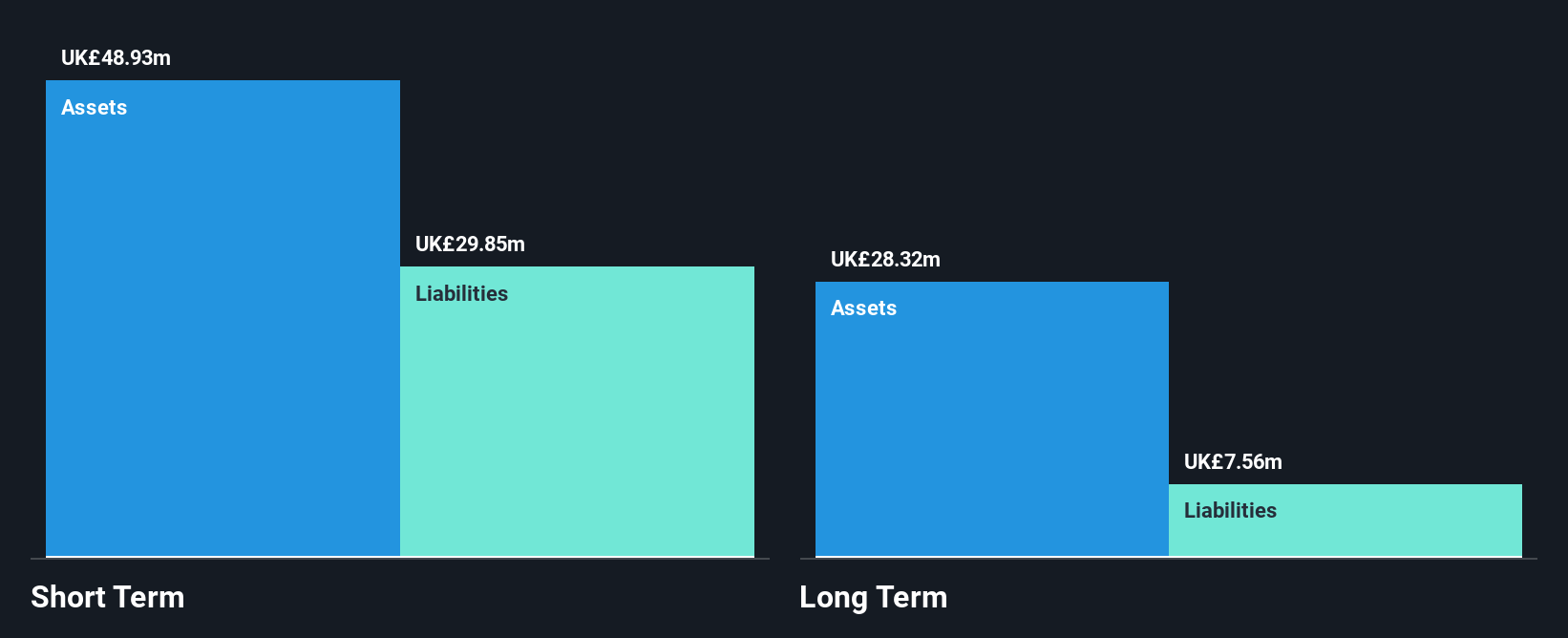

Cavendish plc, with a market capitalization of £46.53 million, has transitioned to profitability this year, reporting a net income of £0.765 million for the full year ending March 31, 2025. The company is debt-free and maintains strong asset coverage over its liabilities. Despite significant insider selling recently and an inexperienced management team with an average tenure of 1.8 years, Cavendish aims to expand as a fully integrated small and mid-cap investment bank rather than divest its private M&A business. A proposed final dividend of 0.5 pence per share reflects cautious optimism amid earnings stabilization efforts.

- Jump into the full analysis health report here for a deeper understanding of Cavendish.

- Examine Cavendish's past performance report to understand how it has performed in prior years.

Breedon Group (LSE:BREE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Breedon Group plc is involved in the quarrying, manufacture, and sale of construction materials and building products primarily in the United Kingdom and internationally, with a market cap of approximately £1.34 billion.

Operations: The company's revenue is derived from its operations in Cement (£309.2 million), Ireland (£233.4 million), Great Britain (£997.4 million), and the United States (£132.5 million).

Market Cap: £1.34B

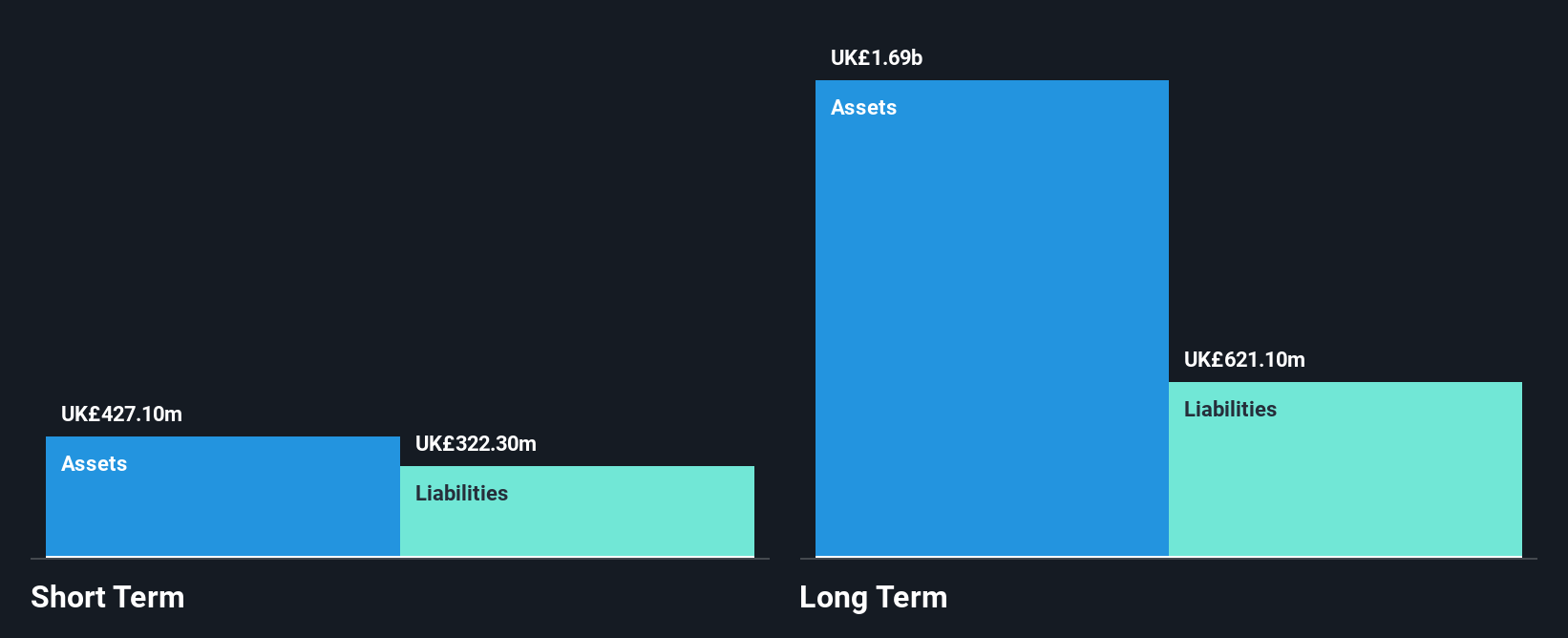

Breedon Group, with a market cap of £1.34 billion, presents a mixed investment case. Despite trading at 46.7% below estimated fair value and having well-covered debt by operating cash flow, the company's short-term assets do not cover its long-term liabilities. Recent acquisitions have bolstered revenue growth by 9% in Q1 2025 despite adverse weather impacts in the USA. However, negative earnings growth over the past year and lower profit margins suggest caution. The experienced board and management team provide stability, but an unstable dividend track record may concern income-focused investors seeking consistent returns.

- Unlock comprehensive insights into our analysis of Breedon Group stock in this financial health report.

- Examine Breedon Group's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Embark on your investment journey to our 295 UK Penny Stocks selection here.

- Ready To Venture Into Other Investment Styles? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Big Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BIG

Big Technologies

Engages in the development and delivery of remote monitoring technologies and services to the offender and remote personal monitoring industry under the Buddi brand name.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives