- Canada

- /

- Oil and Gas

- /

- TSXV:SEI

TSX Penny Stocks To Watch In August 2025

Reviewed by Simply Wall St

As the Canadian market grapples with inflationary pressures and potential rate cuts from the Fed, investors are eyeing opportunities that may arise from these economic shifts. Penny stocks, though a somewhat outdated term, continue to represent a niche investment area where smaller or newer companies can offer unexpected growth potential. In this article, we explore three penny stocks that stand out for their balance sheet strength and long-term promise amidst current market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.61 | CA$63.72M | ✅ 3 ⚠️ 4 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.235 | CA$1.96M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.325 | CA$48.06M | ✅ 2 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.04 | CA$3.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.92 | CA$585.46M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.91 | CA$18.04M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.91 | CA$200.48M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.94 | CA$182.72M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.55 | CA$9.65M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 428 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Trilogy Metals (TSX:TMQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Trilogy Metals Inc. is involved in the exploration and development of mineral properties in the United States, with a market cap of CA$369.54 million.

Operations: Trilogy Metals Inc. does not report any revenue segments as it is focused on the exploration and development of mineral properties in the United States.

Market Cap: CA$369.54M

Trilogy Metals Inc., a pre-revenue company focused on mineral exploration in the U.S., reported a net loss of US$2.18 million for Q2 2025, reflecting increased losses compared to the previous year. The firm recently filed a US$25 million follow-on equity offering, indicating efforts to raise capital amid ongoing development activities. Despite being unprofitable with earnings declining over five years, Trilogy benefits from no debt and sufficient short-term assets exceeding liabilities. Its seasoned board and management team support strategic direction while maintaining over three years of cash runway at current free cash flow levels, despite negative return on equity.

- Navigate through the intricacies of Trilogy Metals with our comprehensive balance sheet health report here.

- Examine Trilogy Metals' past performance report to understand how it has performed in prior years.

High Tide (TSXV:HITI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Tide Inc. operates in the cannabis retail sector in Canada with a market cap of CA$345.11 million.

Operations: The company generates revenue through two primary segments: E-commerce, contributing CA$27.83 million, and Bricks and Mortar, accounting for CA$522.42 million.

Market Cap: CA$345.11M

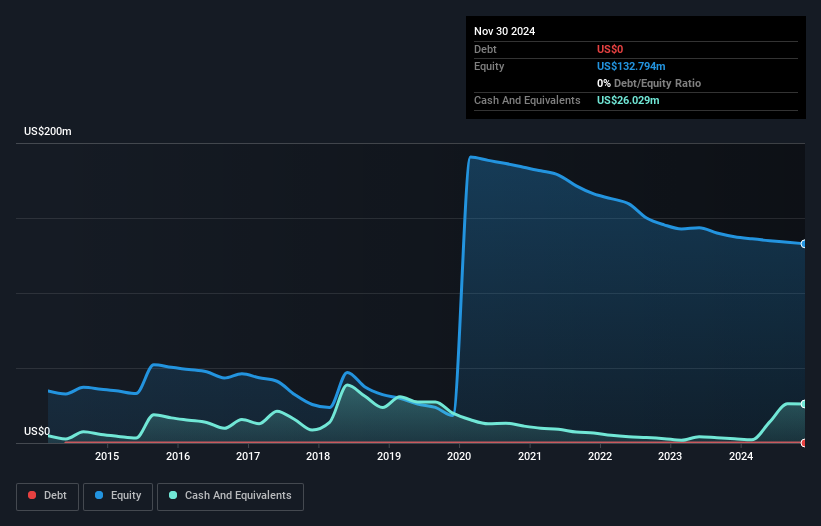

High Tide Inc., operating in the cannabis retail sector, demonstrates resilience despite being unprofitable, with a positive and growing free cash flow supporting a cash runway exceeding three years. The company has strategically reduced its debt to equity ratio significantly over the past five years and maintains more cash than total debt. Recent expansions include new Canna Cabana stores in Saskatchewan and Ontario, enhancing its retail footprint to 205 locations across Canada. With short-term assets surpassing liabilities and trading at good value compared to peers, High Tide's seasoned management team continues to drive growth amid industry challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of High Tide.

- Gain insights into High Tide's outlook and expected performance with our report on the company's earnings estimates.

Sintana Energy (TSXV:SEI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sintana Energy Inc. is involved in the exploration and development of crude oil and natural gas, with a market cap of CA$215.96 million.

Operations: Sintana Energy Inc. currently does not report any specific revenue segments.

Market Cap: CA$215.96M

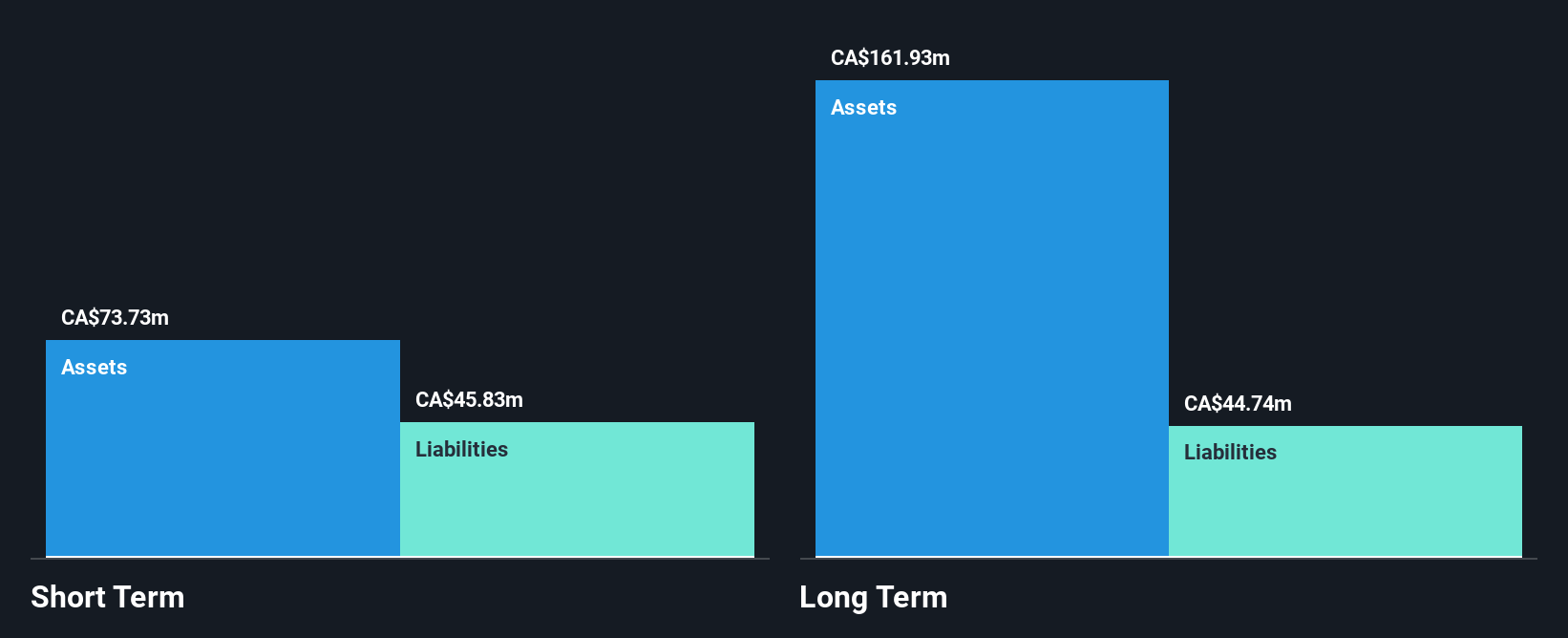

Sintana Energy Inc., a pre-revenue company in the oil and gas exploration sector, holds a 49% stake in Namibia's PEL 79, recently extended to July 2026. The asset is strategically positioned near successful drilling activities by neighboring operators, suggesting potential future value. Despite being unprofitable with losses increasing over the past five years, Sintana benefits from seasoned leadership and no debt burden. Short-term assets of CA$17.1 million comfortably cover liabilities, providing financial stability alongside a cash runway exceeding three years if historical cash flow reduction rates persist. However, recent insider selling may warrant investor caution.

- Jump into the full analysis health report here for a deeper understanding of Sintana Energy.

- Assess Sintana Energy's previous results with our detailed historical performance reports.

Next Steps

- Embark on your investment journey to our 428 TSX Penny Stocks selection here.

- Interested In Other Possibilities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SEI

Sintana Energy

Engages in the crude oil and natural gas exploration and development business.

Flawless balance sheet with low risk.

Market Insights

Community Narratives