As the U.S. government shutdown continues, the Canadian market remains resilient, buoyed by strong consumer spending and significant investments in artificial intelligence. For investors exploring opportunities beyond established giants, penny stocks still hold relevance despite their seemingly outdated name. These smaller or newer companies can offer surprising value when built on solid financial foundations, and in this article, we explore three such stocks that combine balance sheet strength with potential for outsized gains.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.67 | CA$69.27M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.395 | CA$3.43M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.355 | CA$53.32M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.335 | CA$931.42M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.10 | CA$19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.89 | CA$484.47M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.51 | CA$172.57M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.20 | CA$209.8M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.80 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 413 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

FPX Nickel (TSXV:FPX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FPX Nickel Corp. is a junior mining company focused on acquiring, exploring, and developing nickel mineral resource properties in Canada, with a market cap of CA$149.53 million.

Operations: FPX Nickel Corp. has not reported any revenue segments.

Market Cap: CA$149.53M

FPX Nickel Corp., with a market cap of CA$149.53 million, is a pre-revenue junior mining company focused on nickel exploration in Canada. Recent developments include an Exploration Agreement with the Takla Nation for the Klow property and an option agreement to acquire the Advocate Nickel Property in Newfoundland, both supported by JOGMEC. The company benefits from zero debt and sufficient cash runway, but remains unprofitable with increasing losses over five years. Despite trading significantly below estimated fair value and having experienced management and board teams, FPX faces challenges typical of early-stage resource companies without established revenue streams.

- Click here and access our complete financial health analysis report to understand the dynamics of FPX Nickel.

- Review our historical performance report to gain insights into FPX Nickel's track record.

Nubeva Technologies (TSXV:NBVA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nubeva Technologies Ltd. develops and licenses software-based decryption solutions, such as Ransomware Reversal, for businesses, governments, and other organizations, with a market cap of CA$22.46 million.

Operations: The company generates revenue of $0.32 million from its software development and commercialization activities.

Market Cap: CA$22.46M

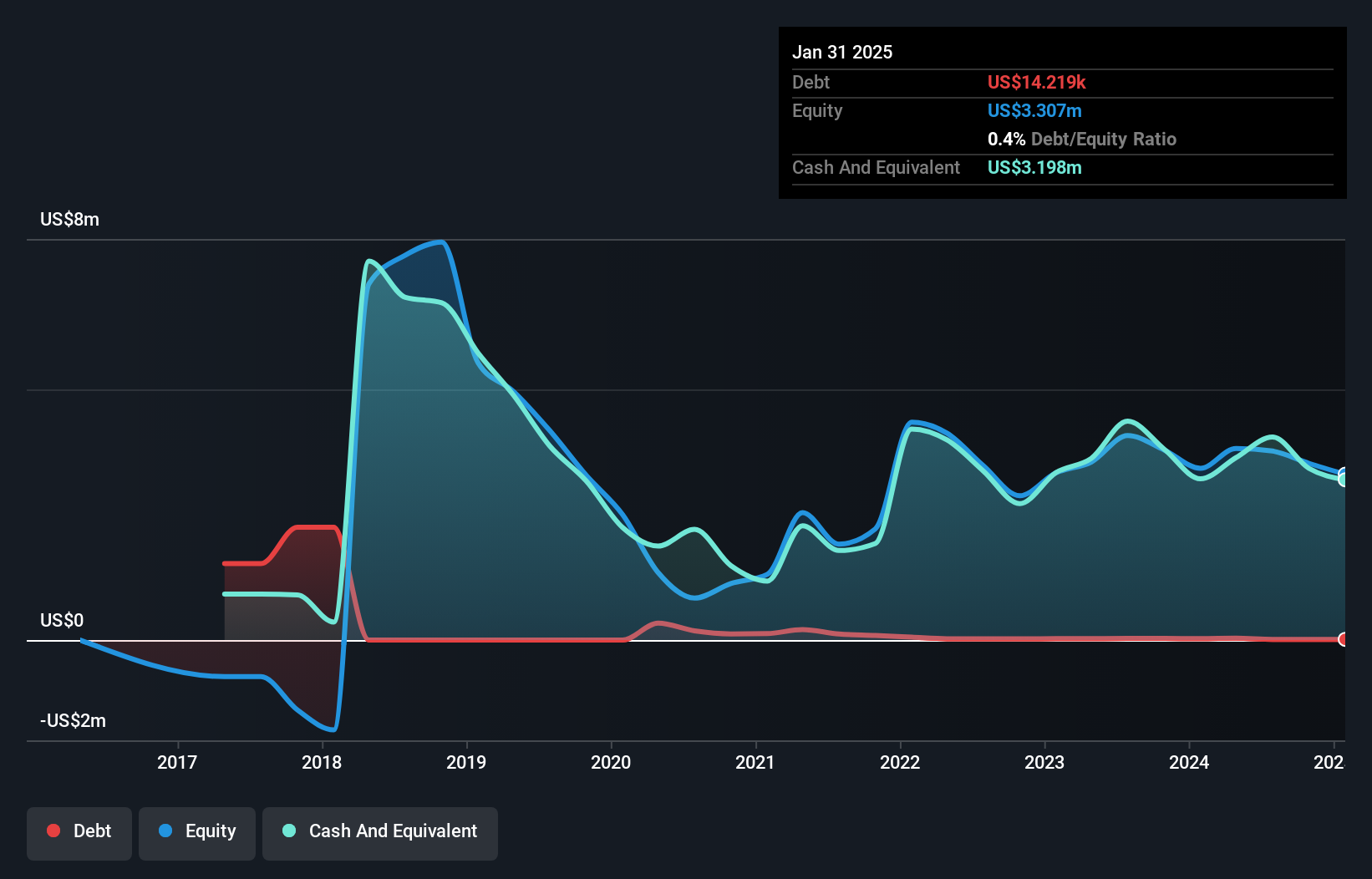

Nubeva Technologies Ltd., with a market cap of CA$22.46 million, remains pre-revenue, generating less than US$1 million annually. Despite reducing its debt to equity ratio significantly over five years and maintaining a cash runway exceeding three years, the company's recent financials show declining sales and increasing net losses. The auditor's report expressed doubts about Nubeva's ability to continue as a going concern. Short-term assets comfortably cover liabilities, yet the share price has been highly volatile recently. While the board is experienced, management tenure data is insufficient for assessment on experience grounds.

- Take a closer look at Nubeva Technologies' potential here in our financial health report.

- Learn about Nubeva Technologies' historical performance here.

Namibia Critical Metals (TSXV:NMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Namibia Critical Metals Inc. is involved in the acquisition, exploration, development, and evaluation of critical metals properties in Namibia, with a market cap of CA$20.69 million.

Operations: No revenue segments are reported for the company.

Market Cap: CA$20.69M

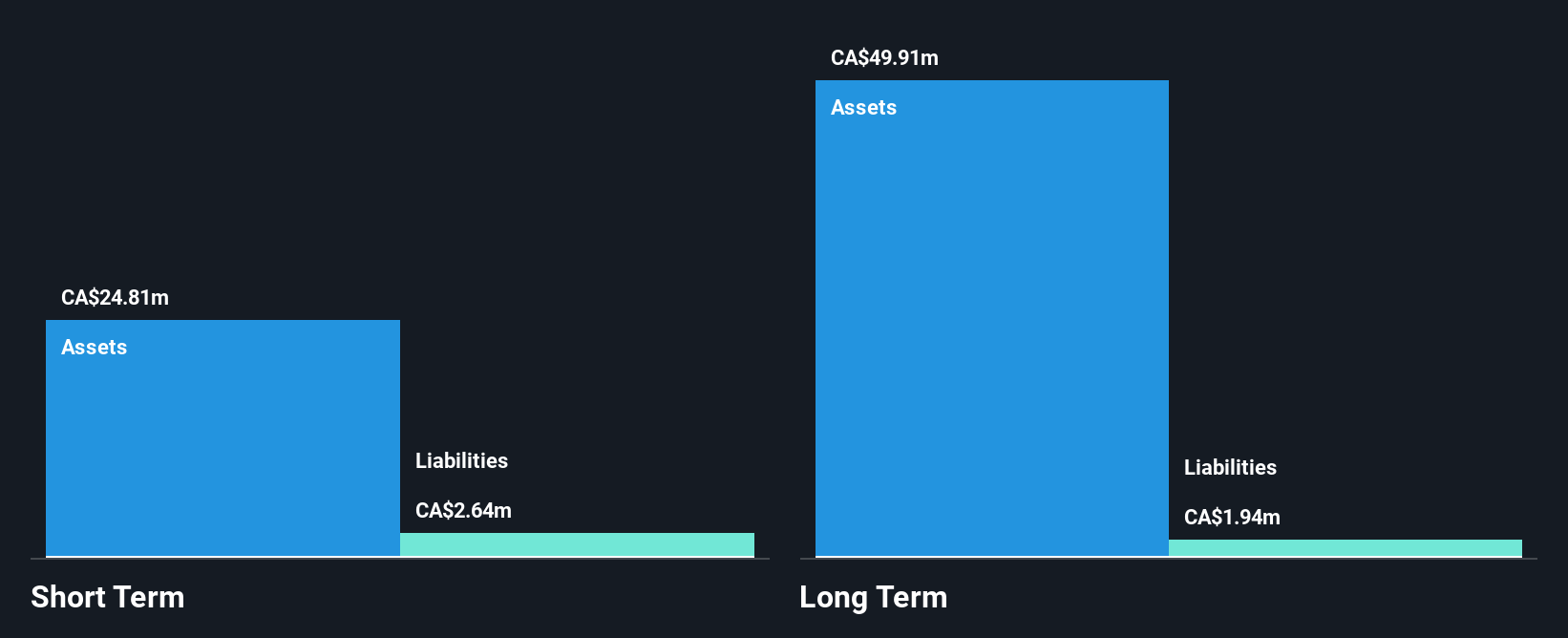

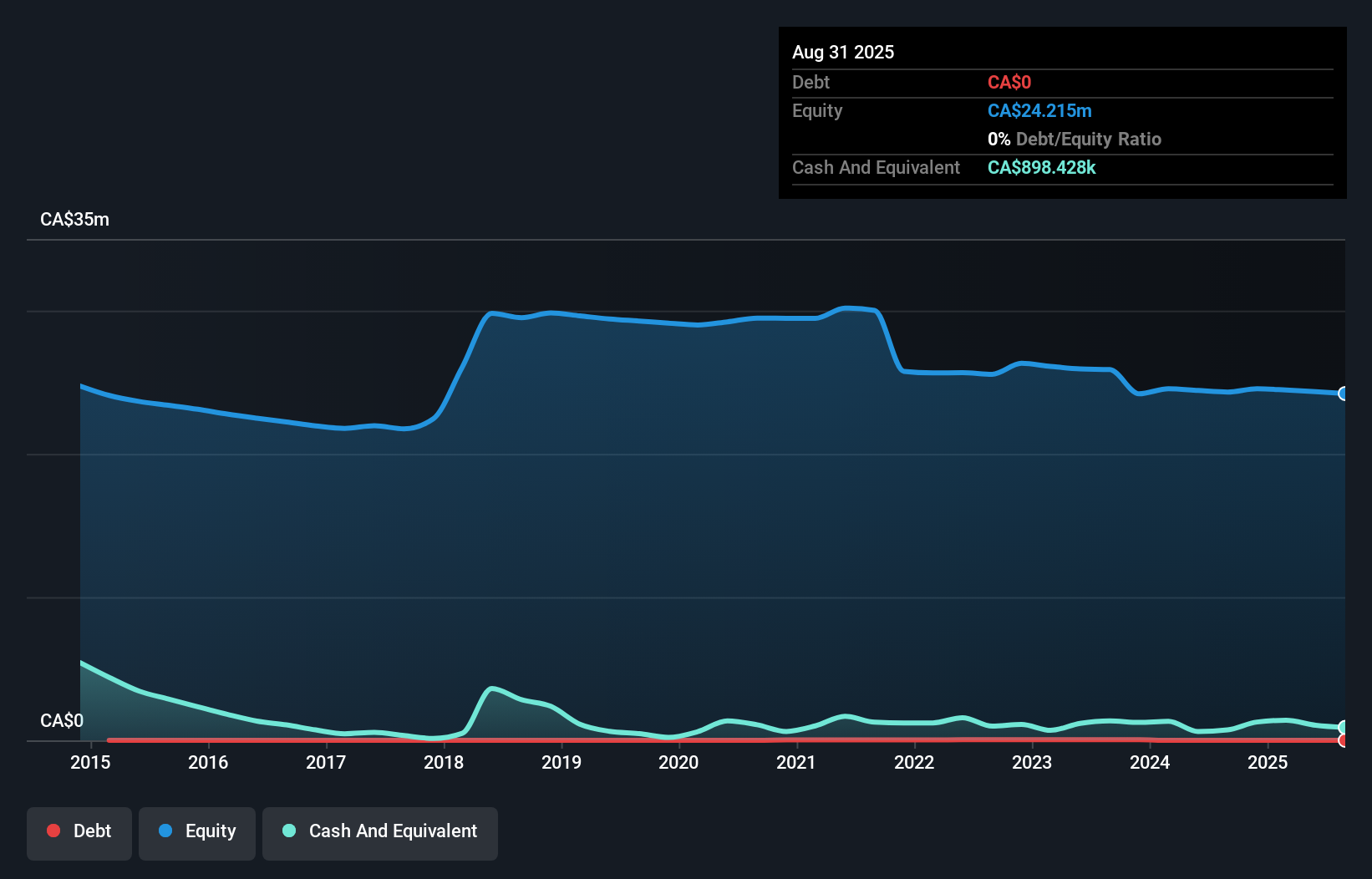

Namibia Critical Metals Inc., with a market cap of CA$20.69 million, is pre-revenue, generating less than US$1 million annually. The company operates debt-free and has reduced its losses by 10.1% per year over the past five years. Despite its unprofitability, Namibia Critical Metals maintains a cash runway exceeding three years and has short-term assets surpassing liabilities. However, the stock exhibits high volatility compared to most Canadian stocks and reported increased net losses for the recent quarter and six months ending May 31, 2025. The board and management team are experienced with average tenures of 8.4 and 4.6 years respectively.

- Get an in-depth perspective on Namibia Critical Metals' performance by reading our balance sheet health report here.

- Gain insights into Namibia Critical Metals' historical outcomes by reviewing our past performance report.

Key Takeaways

- Take a closer look at our TSX Penny Stocks list of 413 companies by clicking here.

- Contemplating Other Strategies? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nubeva Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NBVA

Nubeva Technologies

Engages in the development and licensing of software-based decryption solutions, including Ransomware Reversal for businesses, governments, and other organizations.

Flawless balance sheet with low risk.

Market Insights

Community Narratives