- Canada

- /

- Metals and Mining

- /

- TSXV:NWST

TSX Penny Stocks: Boat Rocker Media And 2 Others To Watch

Reviewed by Simply Wall St

The Canadian stock market has recently reached new highs, showcasing resilience amid global economic uncertainties and policy shifts. In this context, investing in penny stocks can still offer intriguing opportunities for growth, particularly when these smaller or newer companies demonstrate strong financial health. Although the term "penny stocks" is somewhat outdated, it continues to represent a segment of the market where investors can uncover potential gems with solid balance sheets and promising futures.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.79 | CA$79.91M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.17 | CA$91.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.38 | CA$136.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Silvercorp Metals (TSX:SVM) | CA$4.98 | CA$1.08B | ✅ 5 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.02 | CA$537.5M | ✅ 4 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.63 | CA$3.6M | ✅ 2 ⚠️ 5 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.59 | CA$539.91M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.61 | CA$132.47M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.89M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.43 | CA$52.89M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 905 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Boat Rocker Media (TSX:BRMI)

Simply Wall St Financial Health Rating: ★★★★★★

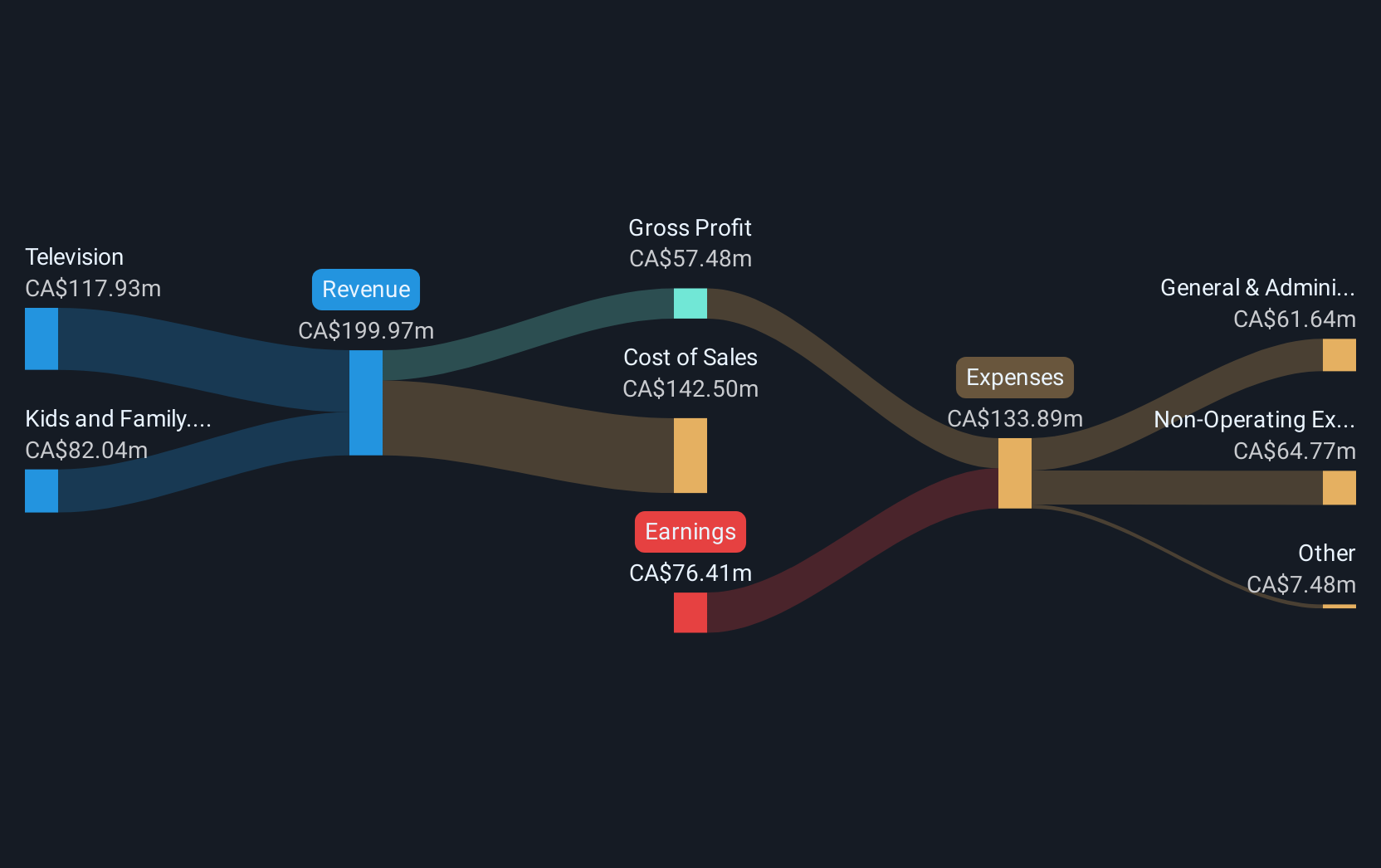

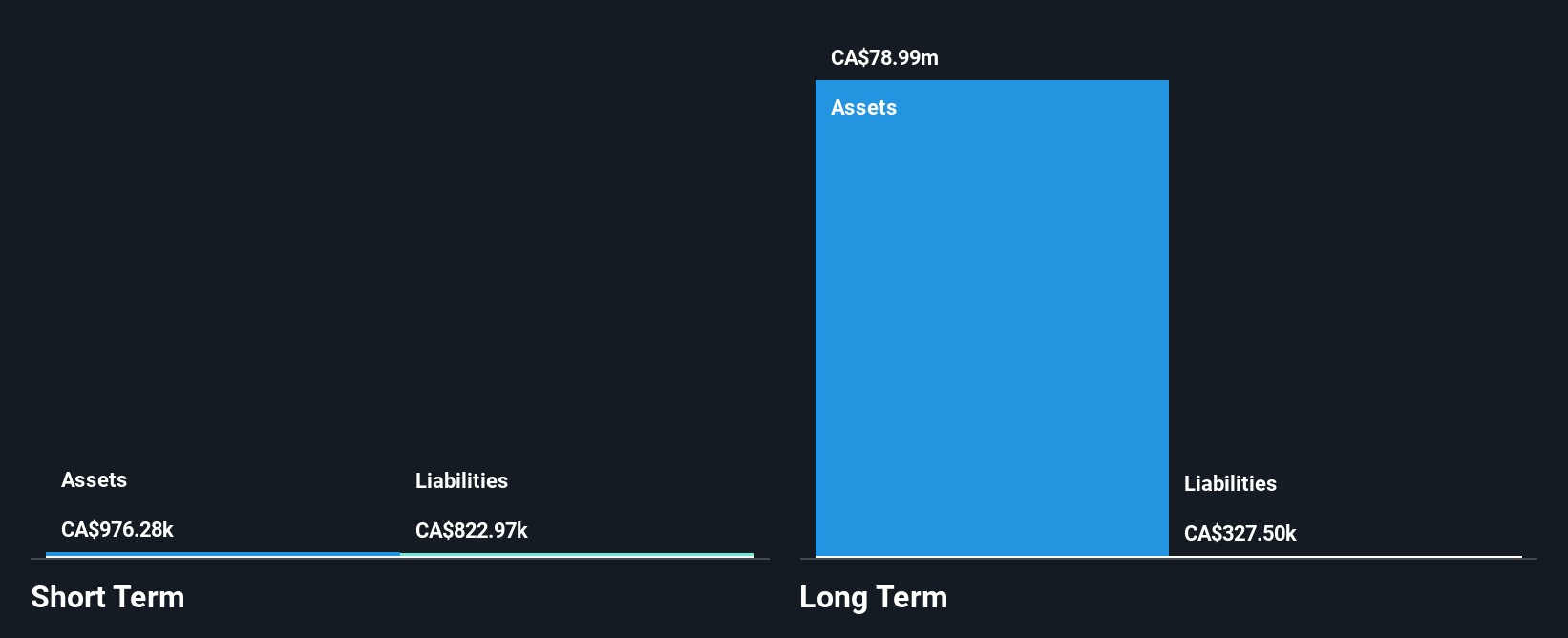

Overview: Boat Rocker Media Inc. is an entertainment company that creates, produces, and distributes television and film content across Canada, the United States, and internationally with a market cap of CA$50.59 million.

Operations: Boat Rocker Media Inc. has not reported any specific revenue segments.

Market Cap: CA$50.59M

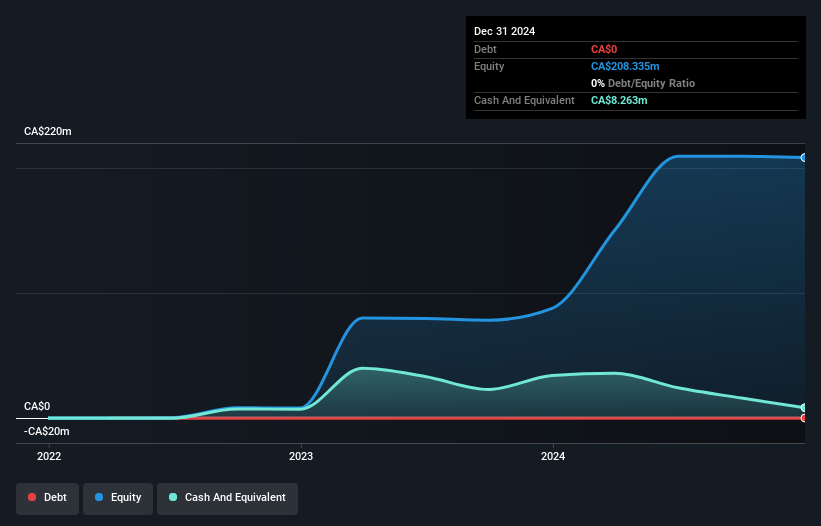

Boat Rocker Media Inc., with a market cap of CA$50.59 million, is undergoing significant changes, highlighted by a reverse merger with Blue Ant Media valued at approximately CA$130 million. This transaction offers a 125% premium over its recent share price and involves BRMI acquiring Blue Ant's shares in exchange for subordinate voting shares. Despite reporting first-quarter sales of CA$34.17 million, the company remains unprofitable with a net loss of CA$135.45 million. The merger aims to consolidate operations and enhance financial stability, leveraging substantial assets and anticipated revenue from Canadian production companies acquired in the deal.

- Dive into the specifics of Boat Rocker Media here with our thorough balance sheet health report.

- Evaluate Boat Rocker Media's prospects by accessing our earnings growth report.

NorthWest Copper (TSXV:NWST)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NorthWest Copper Corp. is involved in the acquisition and exploration of mineral properties in Canada, with a market cap of CA$44.86 million.

Operations: NorthWest Copper Corp. currently does not report any revenue segments.

Market Cap: CA$44.86M

NorthWest Copper Corp., with a market cap of CA$44.86 million, is a pre-revenue company focused on mineral exploration in Canada. Recent developments include the introduction of a higher-grade target model for its Kwanika project, aiming to enhance resource understanding and value through staged development. Despite these strategic initiatives, the company faces challenges such as auditor concerns over its ability to continue as a going concern and less than one year of cash runway at current burn rates. Leadership changes include appointing Geoffrey Chinn as VP of Business Development and Exploration, bringing extensive industry experience to the team.

- Get an in-depth perspective on NorthWest Copper's performance by reading our balance sheet health report here.

- Learn about NorthWest Copper's historical performance here.

Atha Energy (TSXV:SASK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atha Energy Corp. is a mineral company focused on acquiring, exploring, and evaluating mineral resources in Canada, with a market cap of CA$119.25 million.

Operations: Atha Energy Corp. has not reported any revenue segments.

Market Cap: CA$119.25M

Atha Energy Corp., with a market cap of CA$119.25 million, is a pre-revenue mineral exploration company in Canada. Recent developments include completing diamond drill holes for the 2025 Exploration Program at the Angilak Uranium Project, targeting high-grade uranium along the Rib-Nine Iron Trend. Despite raising CA$10 million through private placements, auditors express doubts about its ability to continue as a going concern due to limited cash runway and ongoing losses, with a net loss of CA$11.41 million reported for 2024. The management team and board have relatively short tenures, indicating recent restructuring efforts.

- Jump into the full analysis health report here for a deeper understanding of Atha Energy.

- Review our growth performance report to gain insights into Atha Energy's future.

Next Steps

- Explore the 905 names from our TSX Penny Stocks screener here.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade NorthWest Copper, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NorthWest Copper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NWST

NorthWest Copper

Engages in the acquisition and exploration of mineral properties in Canada.

Adequate balance sheet slight.

Market Insights

Community Narratives