- United States

- /

- Medical Equipment

- /

- NYSE:EW

Trade Alert: The Independent Director Of Edwards Lifesciences Corporation (NYSE:EW), William Link, Has Sold Some Shares Recently

Some Edwards Lifesciences Corporation (NYSE:EW) shareholders may be a little concerned to see that the Independent Director, William Link, recently sold a whopping US$2.3m worth of stock at a price of US$222 per share. That sale reduced their total holding by 34.5% which is hardly insignificant, but far from the worst we've seen.

See our latest analysis for Edwards Lifesciences

The Last 12 Months Of Insider Transactions At Edwards Lifesciences

In fact, the recent sale by Independent Director William Link was not their only sale of Edwards Lifesciences shares this year. Earlier in the year, they fetched US$223 per share in a -US$2.3m sale. That means that an insider was selling shares at around the current price of US$212. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. Given that the sale took place at around current prices, it makes us a little cautious but is hardly a major concern.

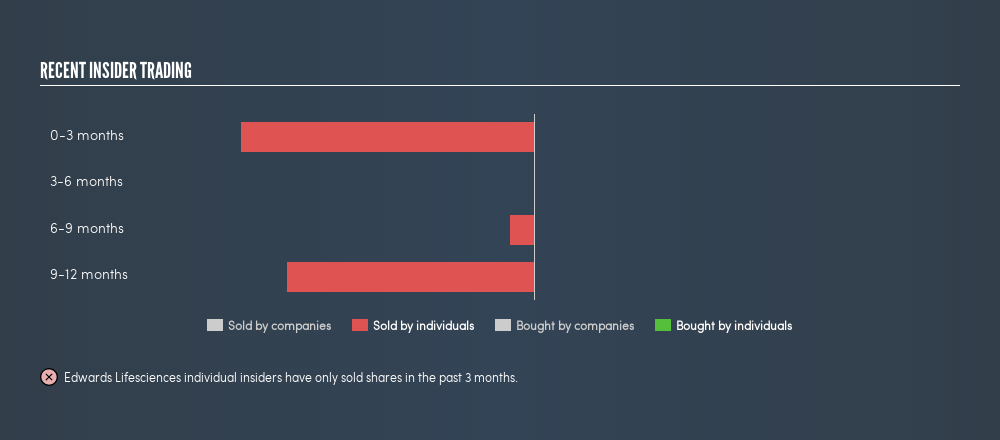

Over the last year, we note insiders sold 31186 shares worth US$5.7m. In the last year Edwards Lifesciences insiders didn't buy any company stock. The chart below shows insider transactions (by individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Insider Ownership of Edwards Lifesciences

For a common shareholder, it is worth checking how many shares are held by company insiders. We usually like to see fairly high levels of insider ownership. Edwards Lifesciences insiders own about US$290m worth of shares (which is 0.7% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About Edwards Lifesciences Insiders?

Insiders sold stock recently, but they haven't been buying. And even if we look to the last year, we didn't see any purchases. But since Edwards Lifesciences is profitable and growing, we're not too worried by this. The company boasts high insider ownership, but we're a little hesitant, given the history of share sales. If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:EW

Edwards Lifesciences

Provides products and technologies to treat advanced cardiovascular diseases in the United States, Europe, Japan, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)