- United Kingdom

- /

- Banks

- /

- LSE:HSBA

Top UK Dividend Stocks To Consider In July 2025

Reviewed by Simply Wall St

As the FTSE 100 index faces pressure from weak trade data out of China, impacting companies with strong ties to the global economy, investors in the UK are closely monitoring market developments. In such uncertain times, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to navigate these challenging conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 7.45% | ★★★★★★ |

| Treatt (LSE:TET) | 3.30% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.80% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.51% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.76% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.30% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.47% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.78% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.82% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.70% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top UK Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Anglo-Eastern Plantations (LSE:AEP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anglo-Eastern Plantations Plc, with a market cap of £344.31 million, owns, operates, and develops oil palm plantations in Indonesia and Malaysia.

Operations: Anglo-Eastern Plantations generates revenue primarily from the cultivation of plantation activities, amounting to $372.26 million.

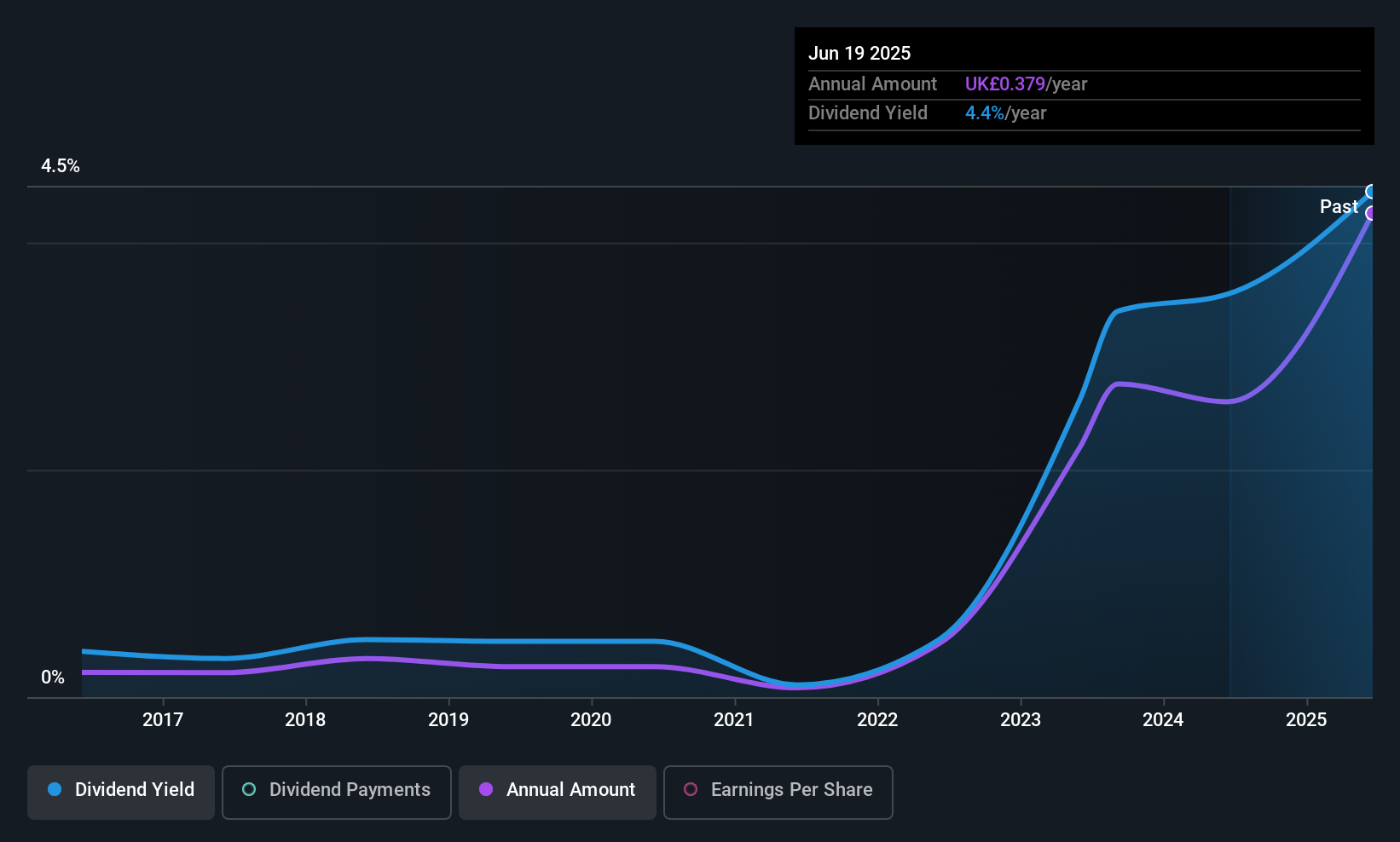

Dividend Yield: 4.3%

Anglo-Eastern Plantations offers a dividend yield of 4.28%, below the UK market's top quartile, but its dividends are well-covered by earnings and cash flows, boasting a payout ratio of 29.8%. Despite historical volatility in dividends, recent increases reflect improved profitability with net income rising to US$67.51 million for 2024. The company approved a final dividend payment of 51 cents per share for shareholders on record by June 20, payable on July 18.

- Unlock comprehensive insights into our analysis of Anglo-Eastern Plantations stock in this dividend report.

- Our valuation report unveils the possibility Anglo-Eastern Plantations' shares may be trading at a premium.

HSBC Holdings (LSE:HSBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HSBC Holdings plc provides banking and financial products and services globally, with a market cap of approximately £153.63 billion.

Operations: HSBC Holdings plc's revenue is primarily derived from Corporate and Institutional Banking, which contributes $20.05 billion, and International Wealth and Premier Banking, which adds $17.15 billion.

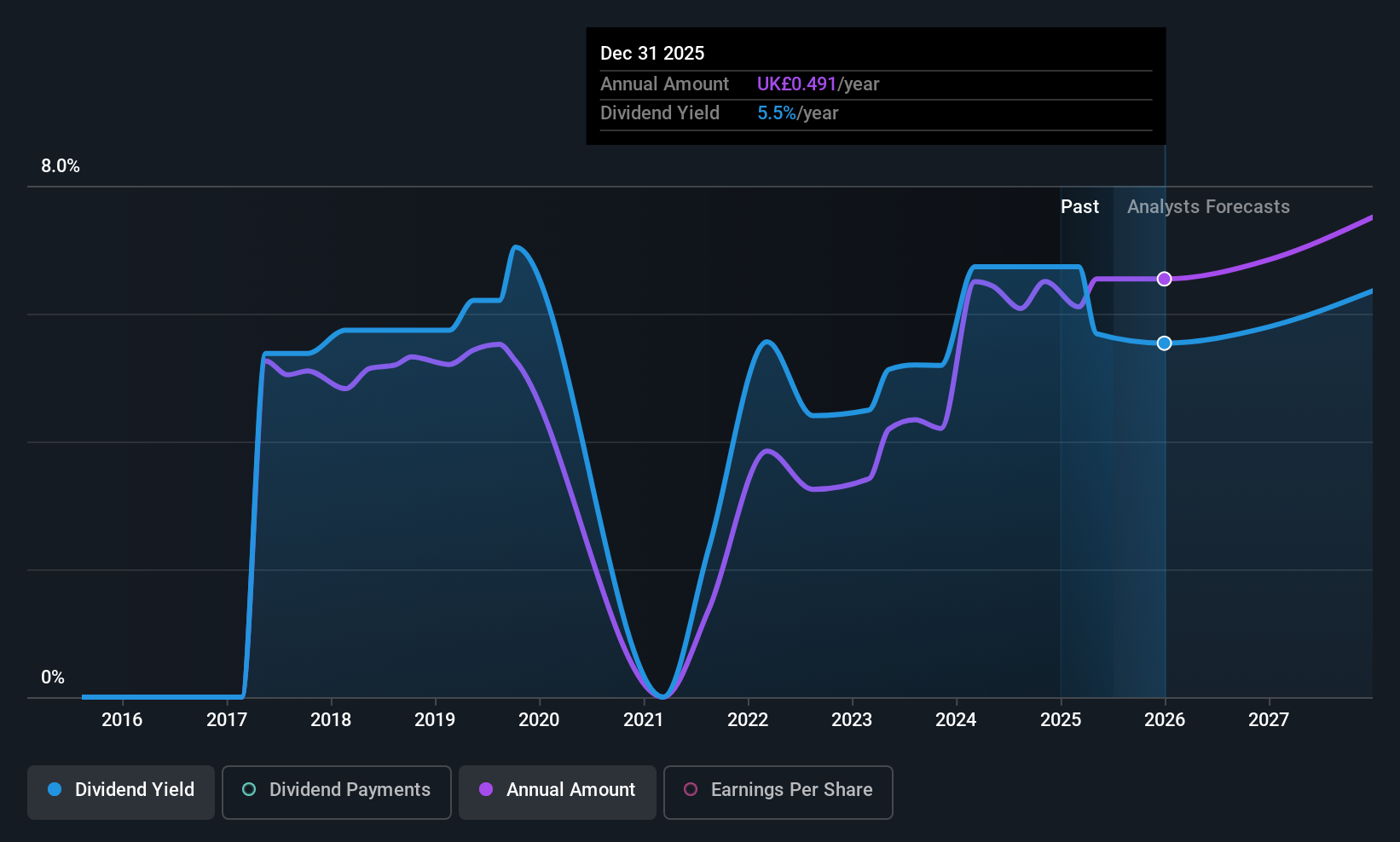

Dividend Yield: 5.5%

HSBC Holdings' dividend yield ranks in the top 25% of UK payers, but its eight-year track record shows volatility and unreliability. Despite a reasonable payout ratio of 60.7%, the dividend's stability remains questionable. Recent strategic shifts include leadership changes and a $3 billion share buyback plan, potentially impacting future dividends. The company completed several fixed-income offerings totaling billions, indicating robust capital market activity amid ongoing executive transitions and strategic initiatives like blockchain-based services in Hong Kong.

- Delve into the full analysis dividend report here for a deeper understanding of HSBC Holdings.

- According our valuation report, there's an indication that HSBC Holdings' share price might be on the expensive side.

Seplat Energy (LSE:SEPL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Seplat Energy Plc is an independent energy company involved in oil and gas exploration, production, and gas processing across Nigeria, Bahamas, Italy, Switzerland, England, and Singapore with a market cap of £1.30 billion.

Operations: Seplat Energy's revenue is primarily derived from its oil segment, generating $1.60 billion, and its gas segment, contributing $140.44 million.

Dividend Yield: 7.2%

Seplat Energy offers a compelling dividend yield of 7.22%, ranking in the top 25% of UK payers, though its dividend history is marked by volatility and instability. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios at 50.5% and 41.1%, respectively. Recent developments include an interim dividend announcement of USD 0.046 per share and significant production growth, enhancing revenue prospects despite forecasted earnings declines over the next few years.

- Take a closer look at Seplat Energy's potential here in our dividend report.

- The valuation report we've compiled suggests that Seplat Energy's current price could be inflated.

Seize The Opportunity

- Dive into all 59 of the Top UK Dividend Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HSBC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSBA

HSBC Holdings

Engages in the provision of banking and financial products and services worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives