- United Kingdom

- /

- Diversified Financial

- /

- LSE:PAG

Top UK Dividend Stocks Offering Up To 5% Yield

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices face downward pressure due to weak trade data from China, investors are increasingly seeking stability in uncertain markets. In such conditions, dividend stocks can offer a reliable income stream, making them an attractive option for those looking to mitigate volatility while still participating in the market.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 7.06% | ★★★★★★ |

| Treatt (LSE:TET) | 3.06% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.70% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.68% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.29% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.21% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.75% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.62% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.64% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.09% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

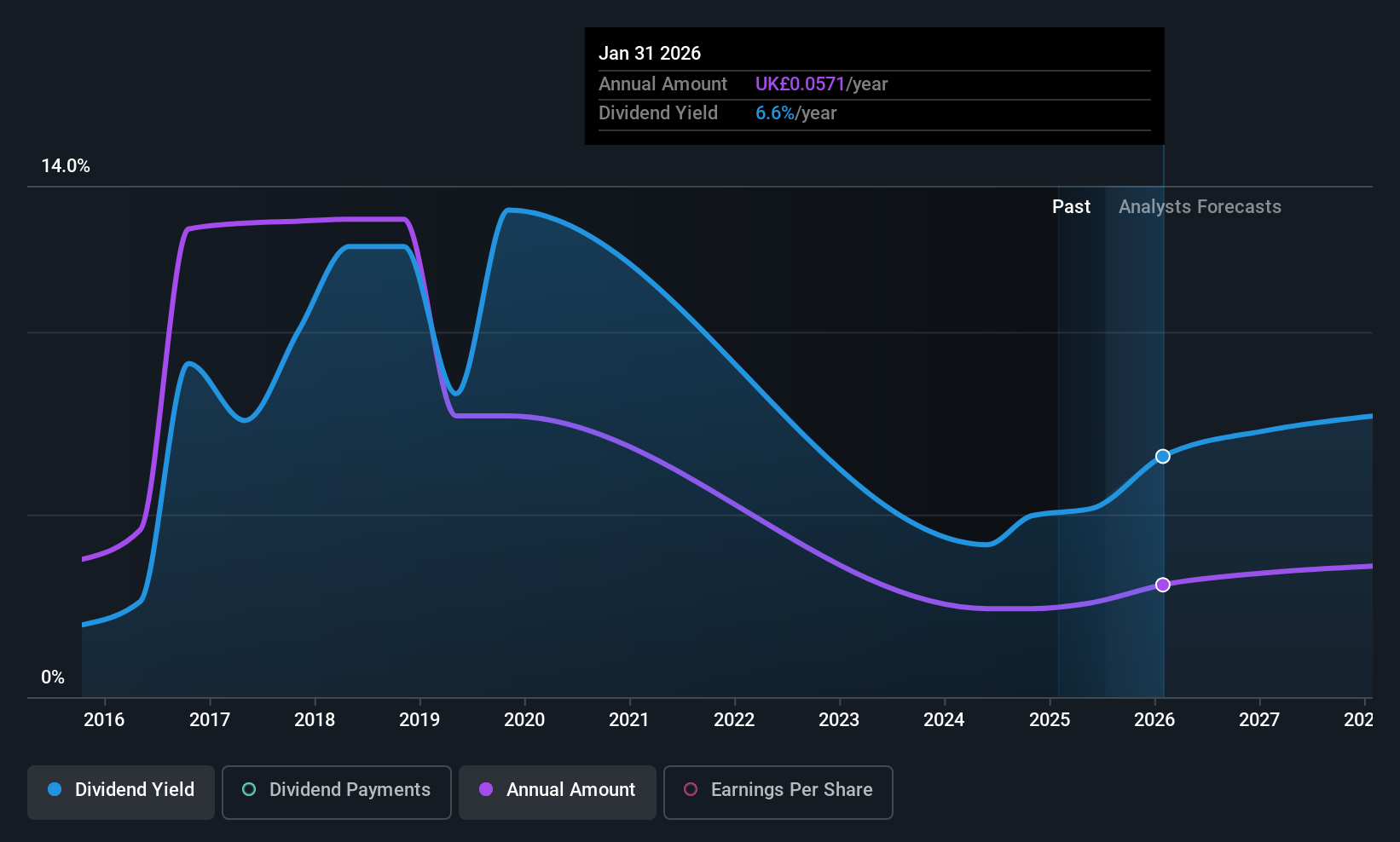

Card Factory (LSE:CARD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Card Factory plc is a specialist retailer of cards, gifts, and celebration essentials with operations in the UK, South Africa, Republic of Ireland, the US, and internationally; it has a market cap of £333.20 million.

Operations: Card Factory plc generates revenue through its Cardfactory Stores (£506.80 million), Cardfactory Online (including Getting Personal, £13.20 million), and Partnerships (£22.20 million).

Dividend Yield: 5%

Card Factory's dividend payments have been volatile over the past decade, but recent increases suggest potential stability. The company trades at a significant discount to its estimated fair value, offering good relative value in the market. Despite a low dividend yield of 5.04%, below the UK top quartile, dividends are well-covered by earnings and cash flows with payout ratios of 34.8% and 23.8%, respectively. Recent financials show steady sales growth to £542.5 million with net income slightly down at £47.8 million for fiscal year ending January 2025.

- Click to explore a detailed breakdown of our findings in Card Factory's dividend report.

- The analysis detailed in our Card Factory valuation report hints at an deflated share price compared to its estimated value.

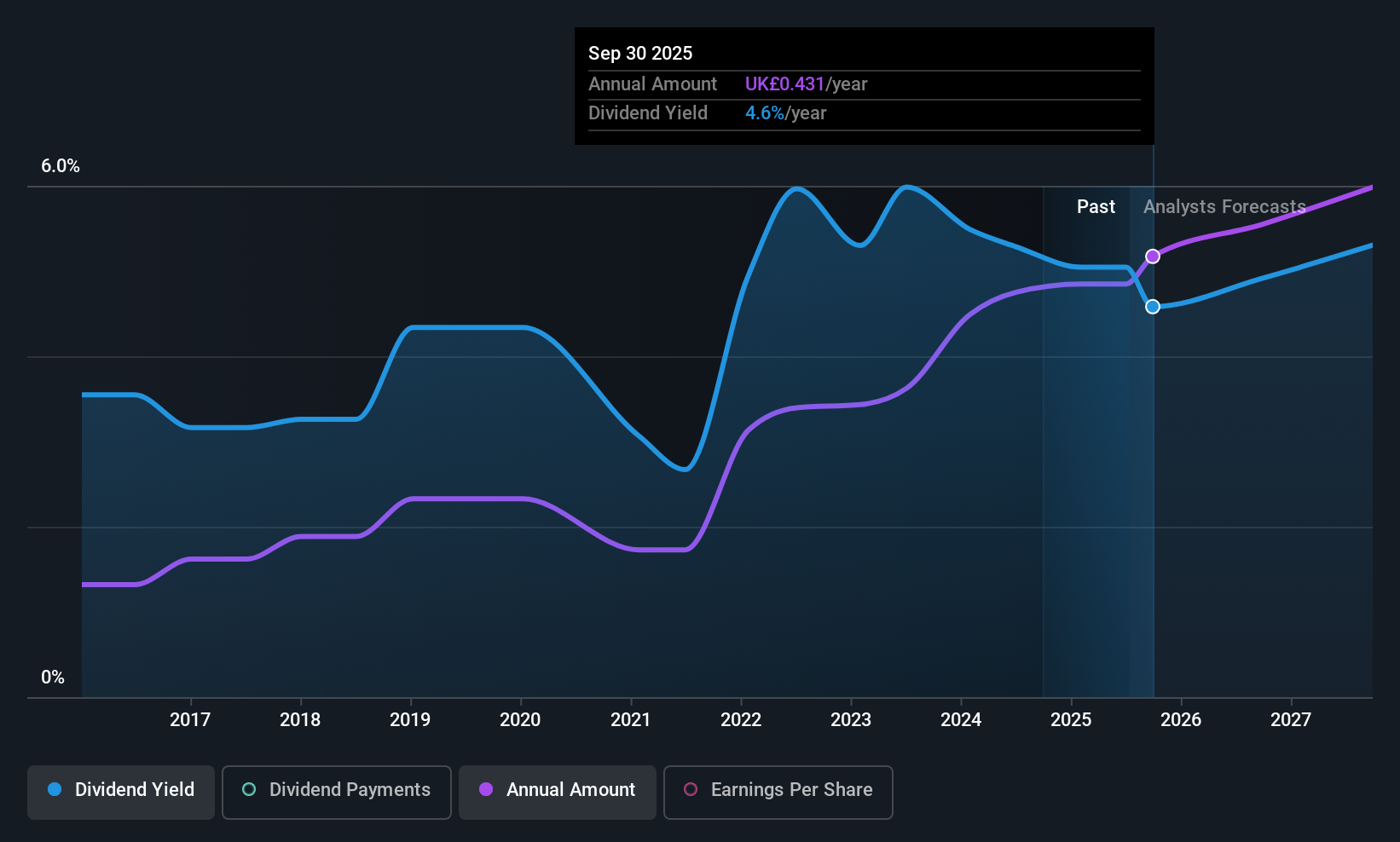

Paragon Banking Group (LSE:PAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Paragon Banking Group PLC offers financial products and services in the United Kingdom, with a market cap of £1.77 billion.

Operations: Paragon Banking Group PLC generates its revenue through segments including Mortgage Lending (£278.30 million) and Commercial Lending (£106.80 million) in the United Kingdom.

Dividend Yield: 4.5%

Paragon Banking Group's dividend payments have been volatile, yet recent increases indicate potential improvement. The interim dividend of £0.136 per share is well-covered by earnings and cash flows, with payout ratios at 40.6% and 17.9%, respectively. Trading at a significant discount to its fair value, the stock offers good relative value despite a lower-than-top-tier UK dividend yield of 4.46%. Recent earnings growth supports financial stability with net income reaching £100.8 million for H1 2025.

- Take a closer look at Paragon Banking Group's potential here in our dividend report.

- Our valuation report unveils the possibility Paragon Banking Group's shares may be trading at a discount.

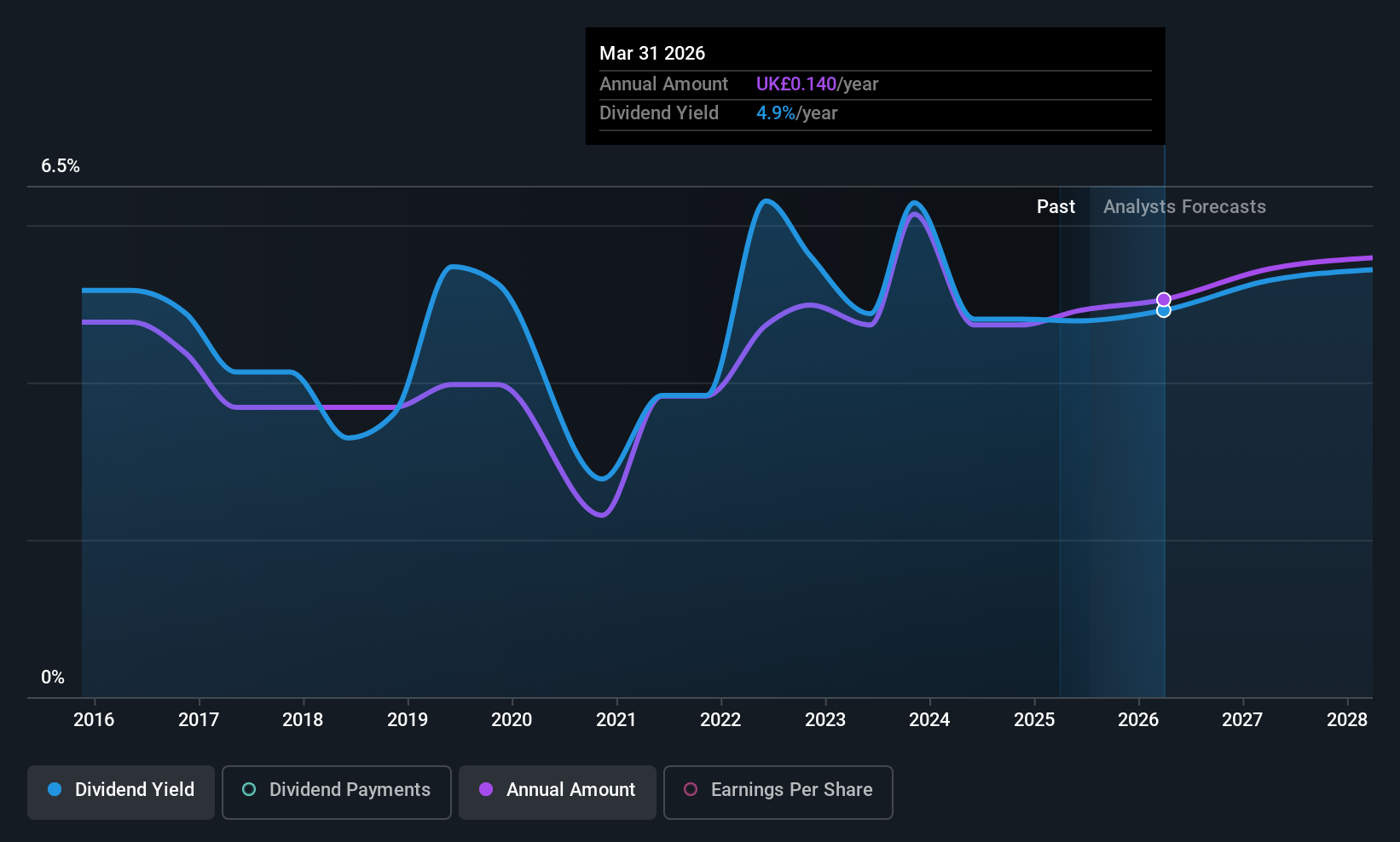

J Sainsbury (LSE:SBRY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: J Sainsbury plc operates in the United Kingdom, offering food, general merchandise, clothing retailing and financial services, with a market cap of £6.44 billion.

Operations: J Sainsbury plc generates revenue through its retail segment, contributing £32.63 billion, and its financial services segment, adding £182 million.

Dividend Yield: 4.8%

J Sainsbury's dividend payments have been inconsistent, yet recent increases suggest a shift towards stability. The final dividend of 9.7 pence per share reflects a modest rise, supported by strong earnings coverage and a cash payout ratio of 27.6%. Despite trading at an attractive value, the stock's yield remains below top-tier UK payers. A £200 million share buyback and planned special dividend from bank disposal proceeds further enhance shareholder returns amidst ongoing business expansions.

- Get an in-depth perspective on J Sainsbury's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that J Sainsbury is priced lower than what may be justified by its financials.

Summing It All Up

- Click this link to deep-dive into the 58 companies within our Top UK Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PAG

Paragon Banking Group

Provides financial products and services in the United Kingdom.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion