- United States

- /

- Software

- /

- NYSE:PERF

Top Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape marked by recent record highs for the S&P 500 and Nasdaq, investors are keeping a close eye on shifting economic indicators and sector performances. For those exploring investment opportunities beyond established giants, penny stocks—often representing smaller or newer companies—remain an intriguing area of interest despite their somewhat outdated moniker. By focusing on companies with strong financials and potential for growth, investors can uncover valuable opportunities in this segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.04 | $437.18M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.97 | $705.24M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.16 | $201.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.90 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.98 | $636.96M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.97 | $7.21M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.81 | $88.82M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.99 | $10.96M | ✅ 2 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.92 | $165.51M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 362 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Royalty Management Holding (RMCO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Royalty Management Holding Corporation is a royalty company that acquires and develops assets across various markets, with a market cap of $35.93 million.

Operations: The company generates revenue from its unclassified services segment, totaling $2.64 million.

Market Cap: $35.93M

Royalty Management Holding Corporation, with a market cap of US$35.93 million, has seen its revenue rise to US$2.25 million for the first half of 2025, but remains unprofitable with a net loss of US$0.11 million over the same period. The company has maintained positive free cash flow and sufficient cash runway for over three years despite high share price volatility and an inexperienced board. Its recent dividend affirmation indicates shareholder returns remain a focus, although its short-term liabilities exceed assets slightly. The company's debt level is satisfactory with a net debt to equity ratio of 0.7%.

- Get an in-depth perspective on Royalty Management Holding's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Royalty Management Holding's track record.

Acacia Research (ACTG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Acacia Research Corporation is an acquirer and operator of businesses in the industrial, energy, and technology sectors across various global regions, with a market cap of approximately $317.30 million.

Operations: The company's revenue is derived from Energy Operations ($66.78 million), Industrial Operations ($29.51 million), and Intellectual Property Operations ($70.80 million).

Market Cap: $317.3M

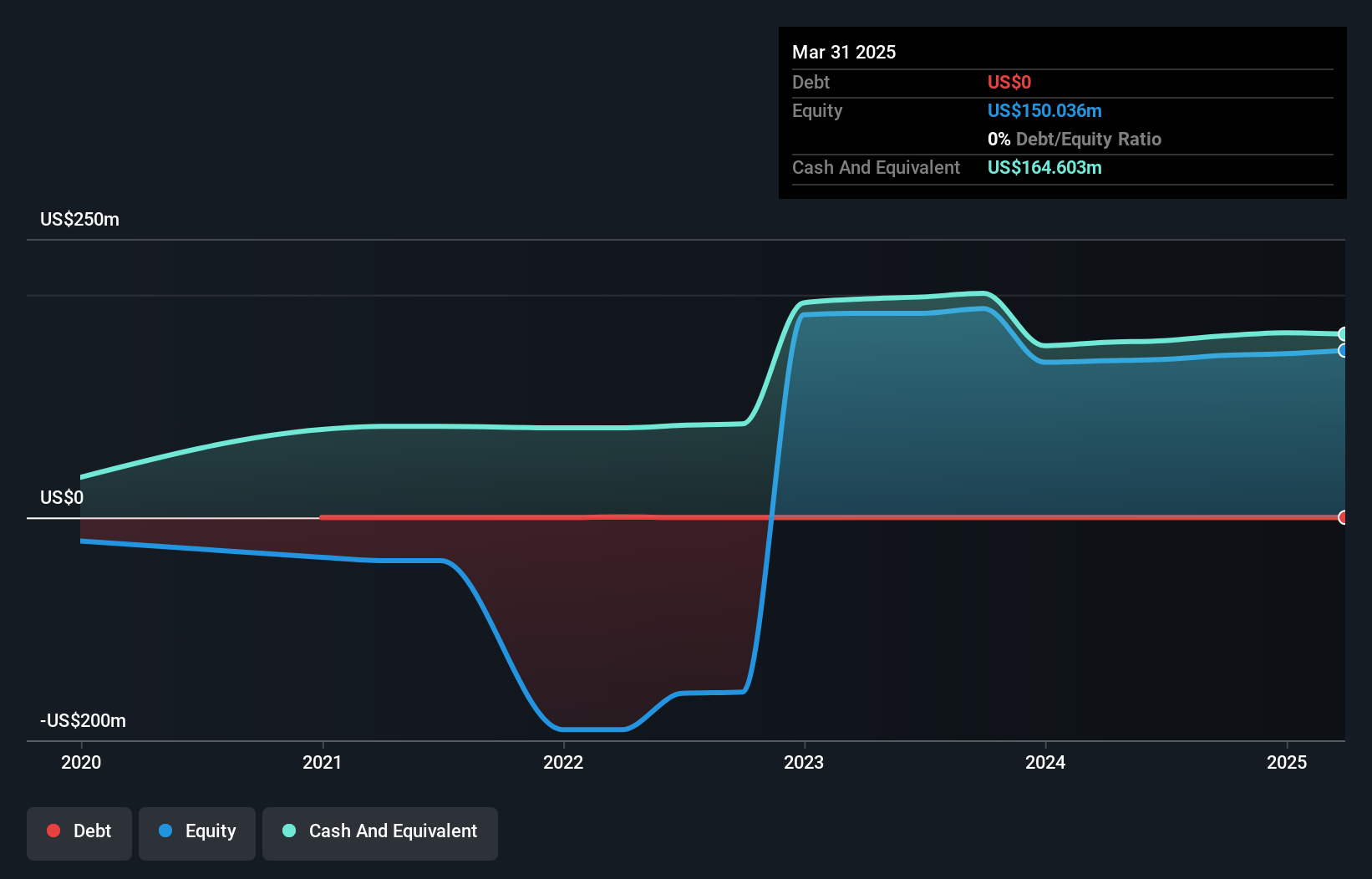

Acacia Research Corporation, with a market cap of approximately US$317.30 million, reported significant revenue growth in the first half of 2025 to US$175.66 million, yet remains unprofitable with a net income of US$20.99 million due to prior losses. The company has been actively pursuing mergers and acquisitions while maintaining strong cash reserves exceeding its liabilities and reducing its debt-to-equity ratio over five years from 55.7% to 18.1%. Despite management's experience and stable volatility, earnings are forecasted to decline significantly over the next three years as they continue exploring strategic opportunities in various sectors.

- Navigate through the intricacies of Acacia Research with our comprehensive balance sheet health report here.

- Evaluate Acacia Research's prospects by accessing our earnings growth report.

Perfect (PERF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perfect Corp. is an artificial intelligence software as a service company offering AI and AR-powered solutions for the beauty, fashion, and skincare industries globally, with a market cap of $191.48 million.

Operations: The company generates $64.37 million in revenue from its Internet Software & Services segment.

Market Cap: $191.48M

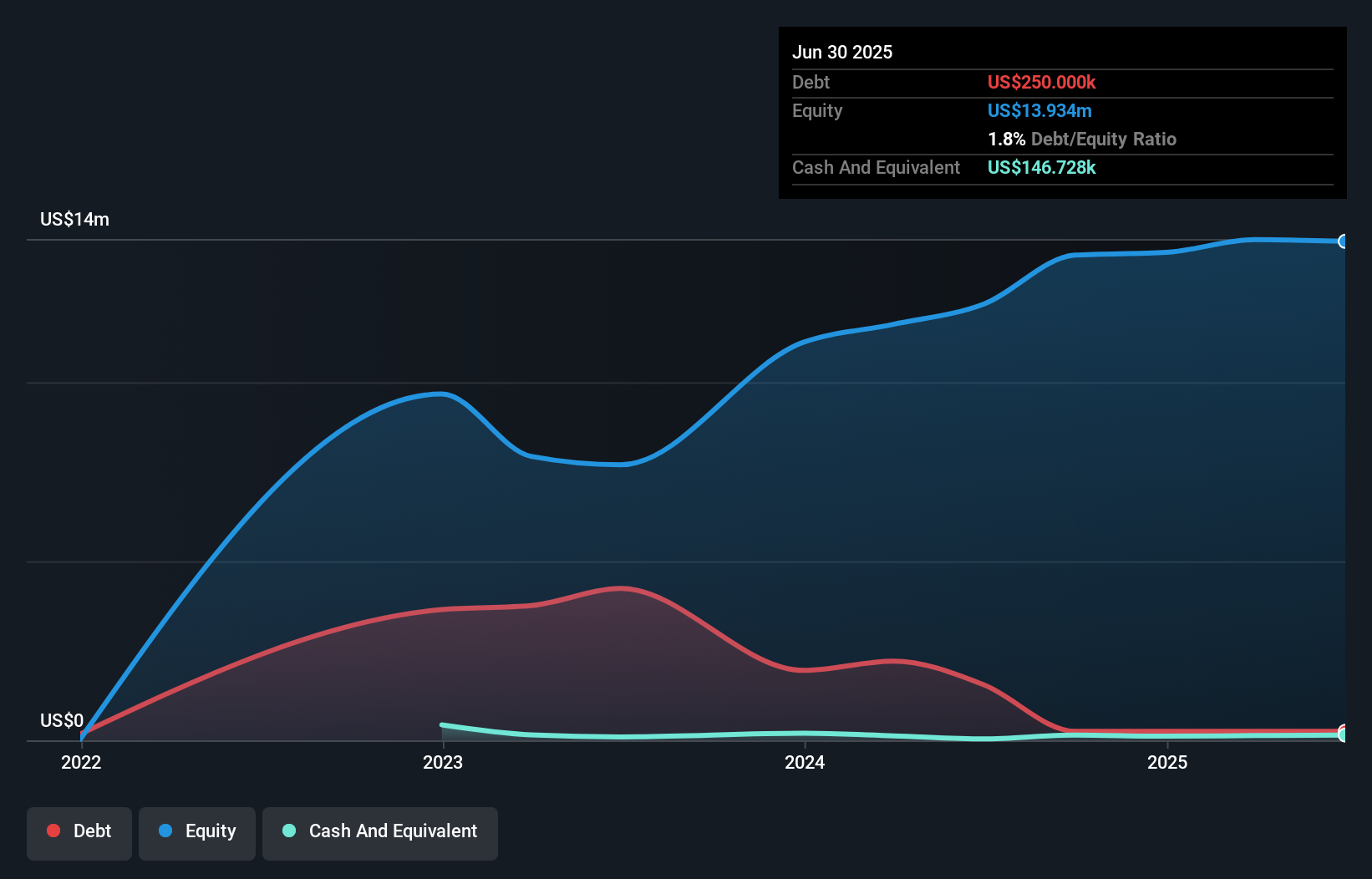

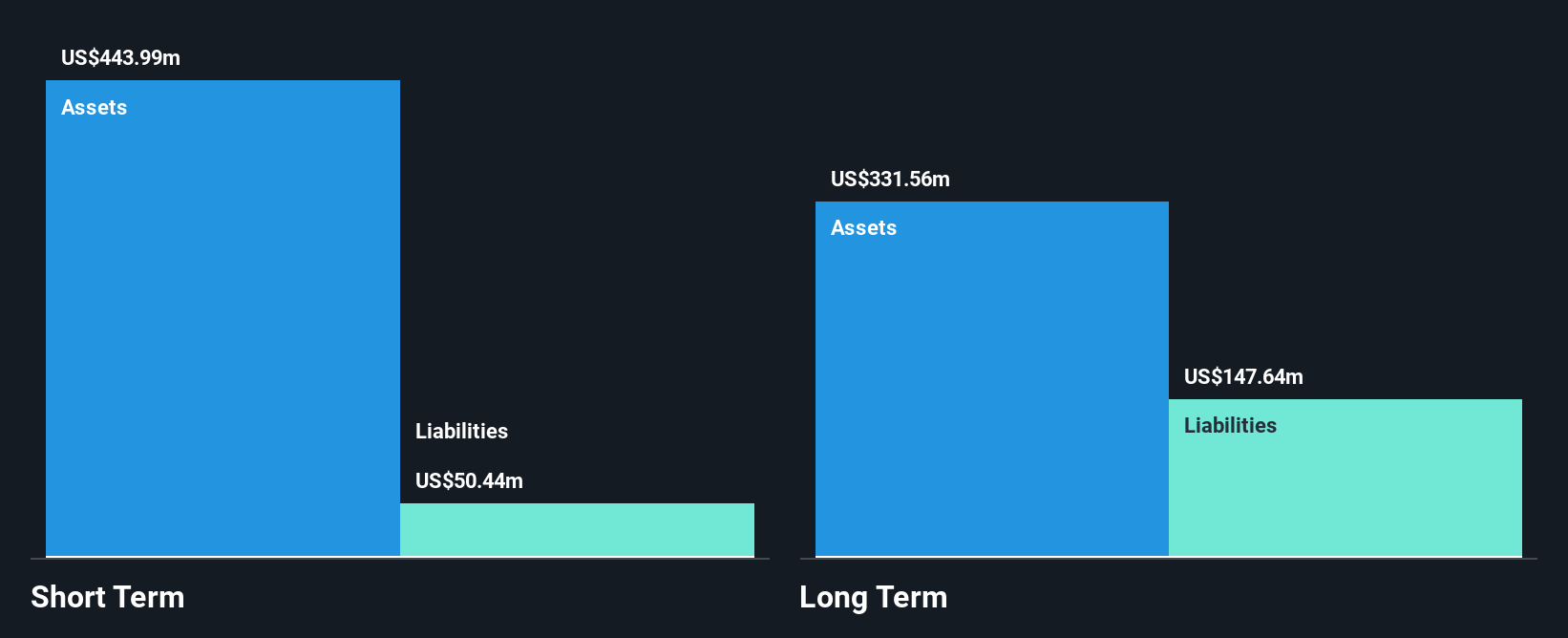

Perfect Corp., with a market cap of US$191.48 million, is leveraging its AI and AR technologies to enhance digital experiences in beauty and fashion industries. Recent product updates include an extensive virtual glasses try-on library, streamlining the onboarding process for brands and enhancing consumer engagement. Despite negative earnings growth last year, the company forecasts a 32.26% annual earnings increase moving forward. Perfect Corp.'s financial health is robust, with no debt and assets exceeding liabilities significantly. However, its return on equity remains low at 4.1%. The company continues to innovate through strategic collaborations like the one with Marini SkinSolutions for AI-driven skin analysis solutions.

- Click here and access our complete financial health analysis report to understand the dynamics of Perfect.

- Learn about Perfect's future growth trajectory here.

Make It Happen

- Jump into our full catalog of 362 US Penny Stocks here.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PERF

Perfect

An artificial intelligence software as a service company, provides artificial intelligence (AI)- and augmented reality (AR)-powered solutions for beauty, fashion, and skincare industries worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives