- United States

- /

- Diversified Financial

- /

- NasdaqGS:ACTG

Top Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq Composite surge to new all-time highs, buoyed by a strong jobs report and optimism around trade agreements, investors are exploring diverse opportunities across the stock market. Penny stocks, despite being a somewhat outdated term, still capture the essence of investing in smaller or newer companies that may offer significant growth potential at lower price points. By focusing on those with solid fundamentals and financial resilience, these stocks can present compelling opportunities for investors seeking to capitalize on promising yet under-the-radar investments.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.35 | $488.24M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8963 | $150.62M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.40 | $244.44M | ✅ 3 ⚠️ 0 View Analysis > |

| Talkspace (TALK) | $2.63 | $451.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $98.67M | ✅ 3 ⚠️ 2 View Analysis > |

| Sequans Communications (SQNS) | $1.44 | $37M | ✅ 4 ⚠️ 4 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.84368 | $6.1M | ✅ 2 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $3.40 | $448.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.19 | $26.81M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 421 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Metalpha Technology Holding (MATH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metalpha Technology Holding Limited, with a market cap of $121.86 million, offers wealth management services through its subsidiaries in Hong Kong.

Operations: The company generates revenue of $31.40 million from trading proprietary digital assets and derivative contracts.

Market Cap: $121.86M

Metalpha Technology Holding, with a market cap of US$121.86 million, has recently become profitable and offers digital asset-focused wealth management services. The company anticipates revenue of approximately US$40 million for the fiscal year ended March 31, 2025, marking significant growth from the previous year. Metalpha is debt-free and its short-term assets exceed both its short-term and long-term liabilities. Recent executive changes include appointing Ms. Xiaosi Zhang as COO to support global expansion efforts. A strategic partnership with DogeOS aims to enhance Dogecoin's utility in decentralized finance applications, potentially increasing institutional liquidity in this space.

- Click to explore a detailed breakdown of our findings in Metalpha Technology Holding's financial health report.

- Understand Metalpha Technology Holding's track record by examining our performance history report.

Acacia Research (ACTG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Acacia Research Corporation is an acquirer and operator of businesses in the industrial, energy, and technology sectors across various global regions, with a market cap of $352.95 million.

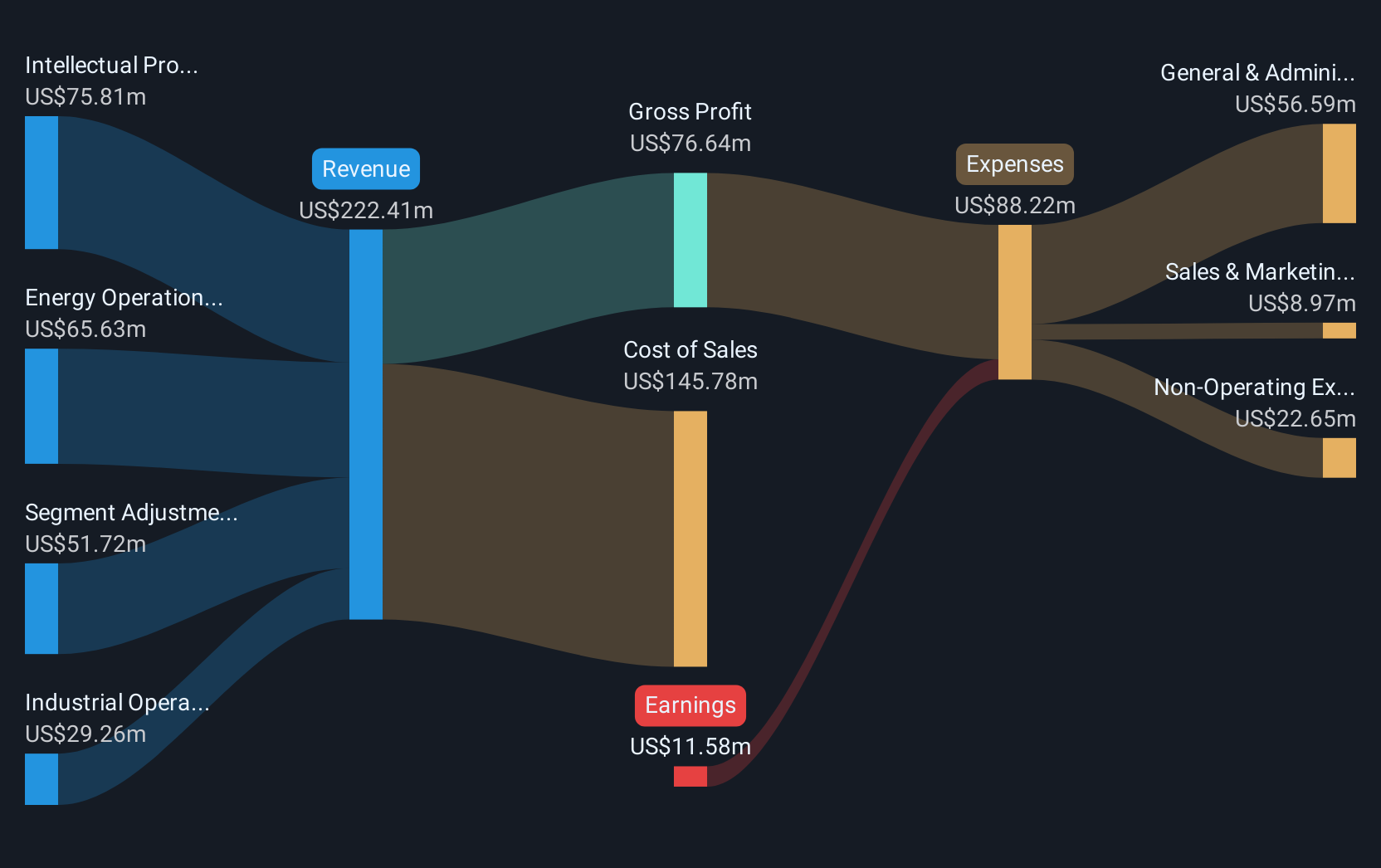

Operations: The company generates revenue from its Energy Operations ($65.63 million), Industrial Operations ($29.26 million), and Intellectual Property Operations ($75.81 million) segments.

Market Cap: $352.95M

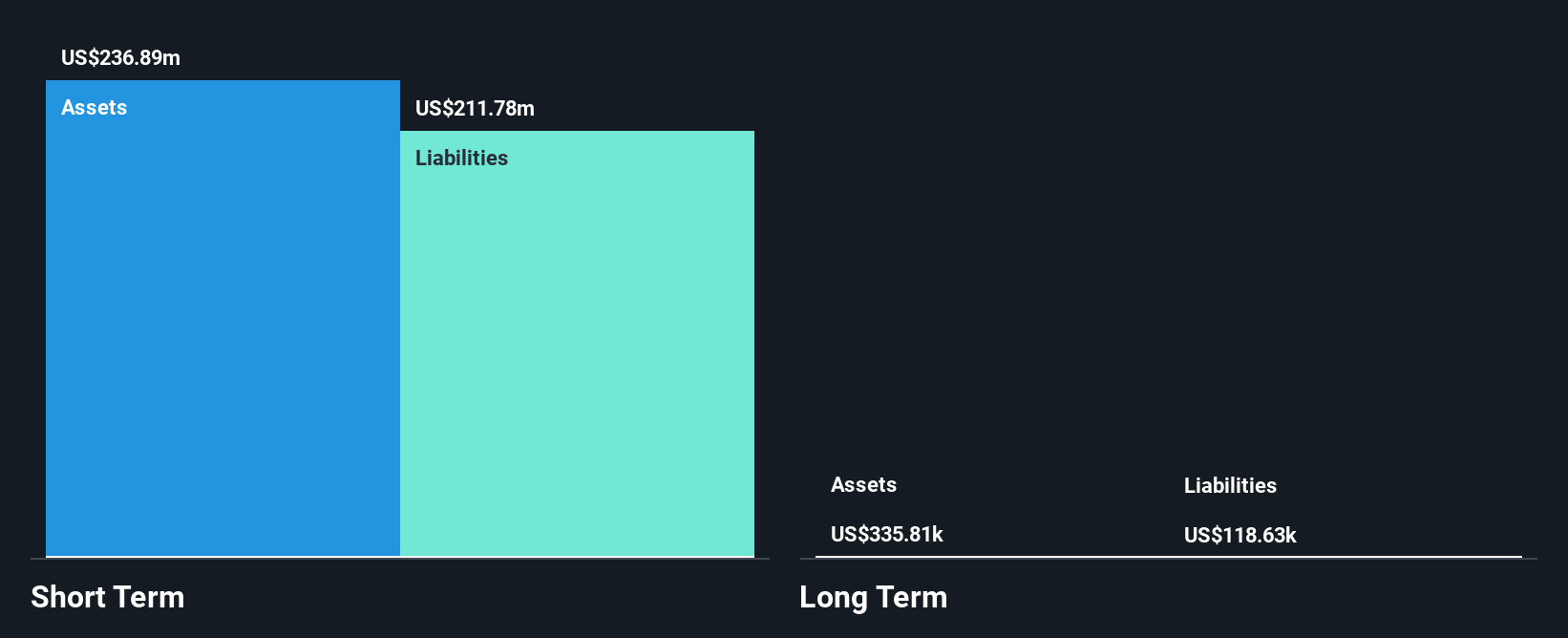

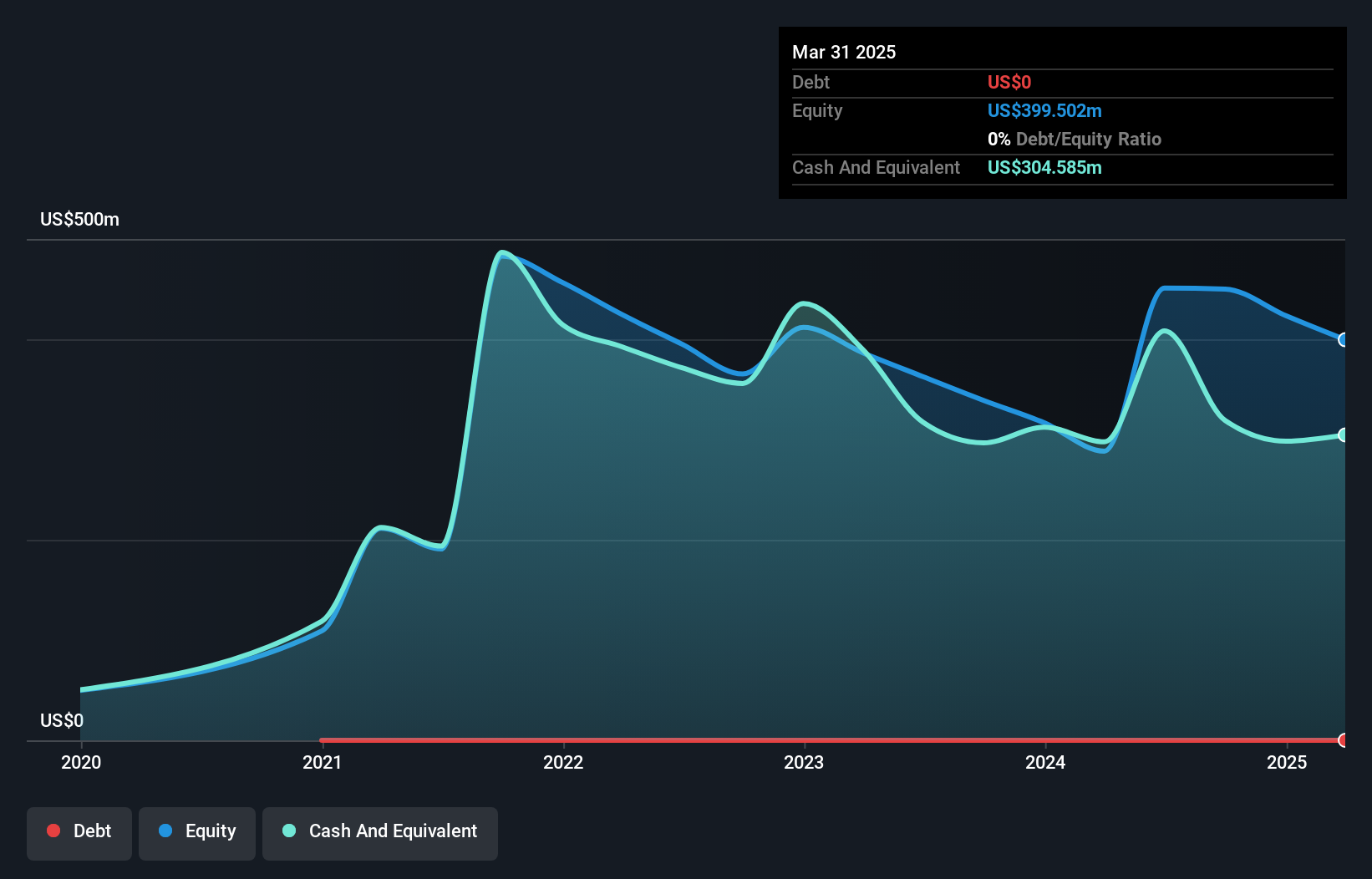

Acacia Research, with a market cap of US$352.95 million, has seen a substantial increase in revenue to US$124.42 million for Q1 2025 from US$24.32 million the previous year, alongside net income reaching US$24.29 million compared to a prior loss. Despite this positive shift, the company remains unprofitable overall and faces challenges such as significant insider selling and a negative return on equity of -1.9%. The recent appointment of Michael Zambito as CFO may bolster financial strategy as Acacia navigates its cash runway exceeding one year while managing liabilities effectively with short-term assets at US$464.6 million surpassing both short- and long-term obligations.

- Jump into the full analysis health report here for a deeper understanding of Acacia Research.

- Explore Acacia Research's analyst forecasts in our growth report.

Erasca (ERAS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Erasca, Inc. is a clinical-stage precision oncology company dedicated to discovering, developing, and commercializing therapies for patients with RAS/MAPK pathway-driven cancers, with a market cap of approximately $385.27 million.

Operations: Erasca, Inc. currently does not report any revenue segments.

Market Cap: $385.27M

Erasca, Inc., with a market cap of US$385.27 million, is a pre-revenue clinical-stage oncology company focused on RAS/MAPK pathway-driven cancers. Recent FDA clearance for investigational drugs ERAS-4001 and ERAS-0015 highlights its potential in targeting KRAS-mutant tumors. Despite being unprofitable with a net loss of US$30.97 million for Q1 2025, Erasca benefits from having no debt and sufficient cash runway for over two years under current conditions. The management team and board are experienced, yet the stock remains highly volatile with no significant revenue streams reported to date.

- Click here and access our complete financial health analysis report to understand the dynamics of Erasca.

- Gain insights into Erasca's outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Investigate our full lineup of 421 US Penny Stocks right here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACTG

Acacia Research

Operates as an acquirer and operator of businesses across industrial, energy, and technology sectors in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives