As European markets experience a boost from easing trade tensions and optimism over potential U.S. interest rate cuts, dividend stocks continue to attract investors seeking reliable income streams. In this environment, a good dividend stock is often characterized by its ability to maintain stable payouts and strong fundamentals despite fluctuating economic conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.26% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.03% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.58% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.94% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.03% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.37% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.71% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.52% | ★★★★★☆ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.76% | ★★★★★☆ |

| Afry (OM:AFRY) | 3.97% | ★★★★★☆ |

Click here to see the full list of 216 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Piquadro (BIT:PQ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Piquadro S.p.A. designs, produces, and markets leather goods and accessories in Italy, the rest of Europe, and internationally with a market cap of €117.60 million.

Operations: Piquadro's revenue is derived from its segments: Lancel (€69.18 million), Piquadro (€82.34 million), and The Bridge (€35.84 million).

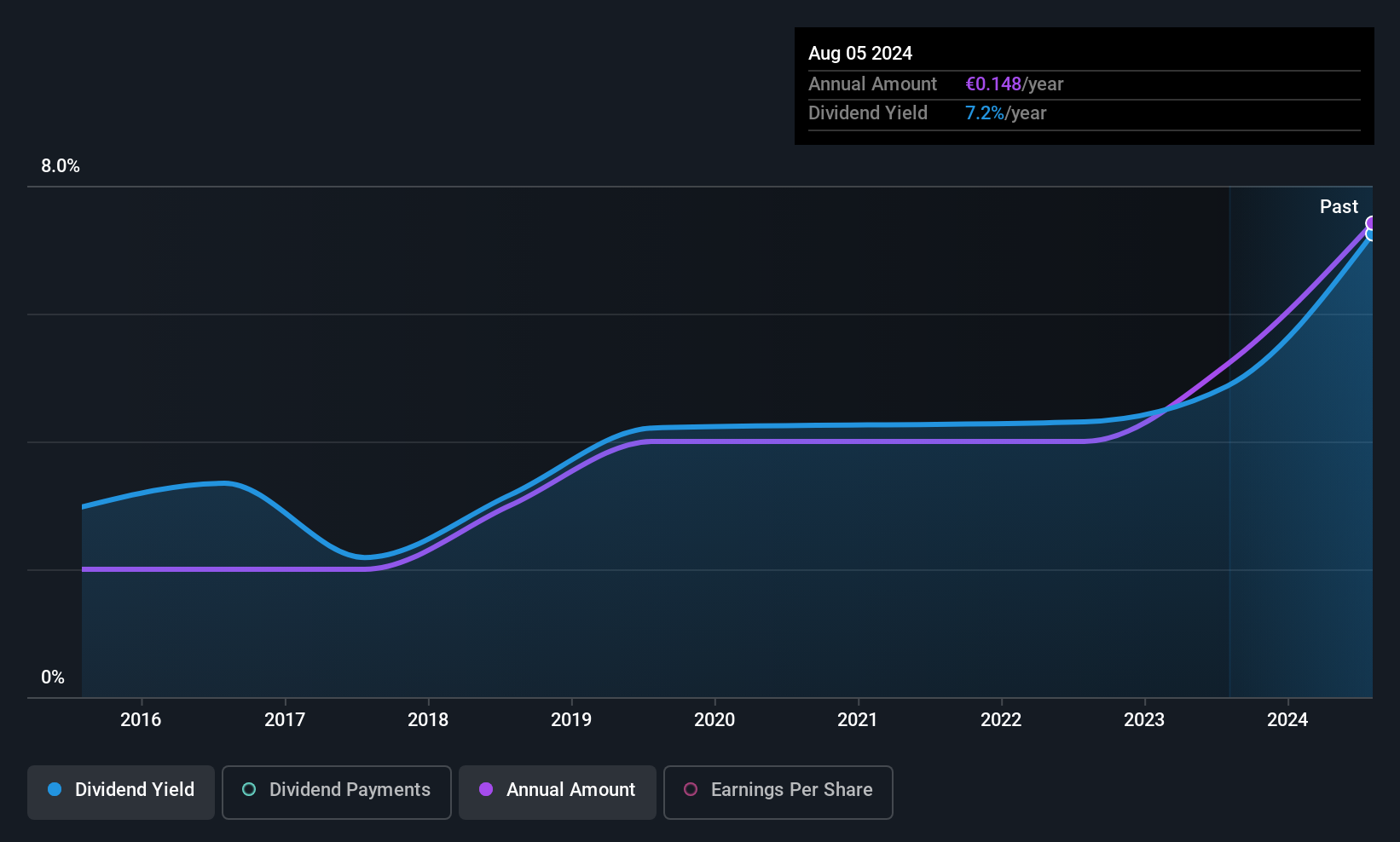

Dividend Yield: 6%

Piquadro's dividend of €0.1482 per share, with a payout ratio of 61.8%, is covered by earnings but has shown volatility over the past decade, making it unreliable despite growth in payments. The dividend yield is in the top 25% for Italy at 5.95%. Recent financials show sales and net income growth to €183.61 million and €11.58 million, respectively, yet insufficient data exists on cash flow coverage or long-term sustainability of dividends.

- Navigate through the intricacies of Piquadro with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Piquadro is trading beyond its estimated value.

SpareBank 1 Helgeland (OB:HELG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SpareBank 1 Helgeland offers a range of financial products and services to retail customers, small and medium enterprises, municipal authorities, and institutions in Norway, with a market cap of NOK4.72 billion.

Operations: SpareBank 1 Helgeland's revenue is derived from providing a variety of financial products and services to retail clients, SMEs, municipal bodies, and institutions across Norway.

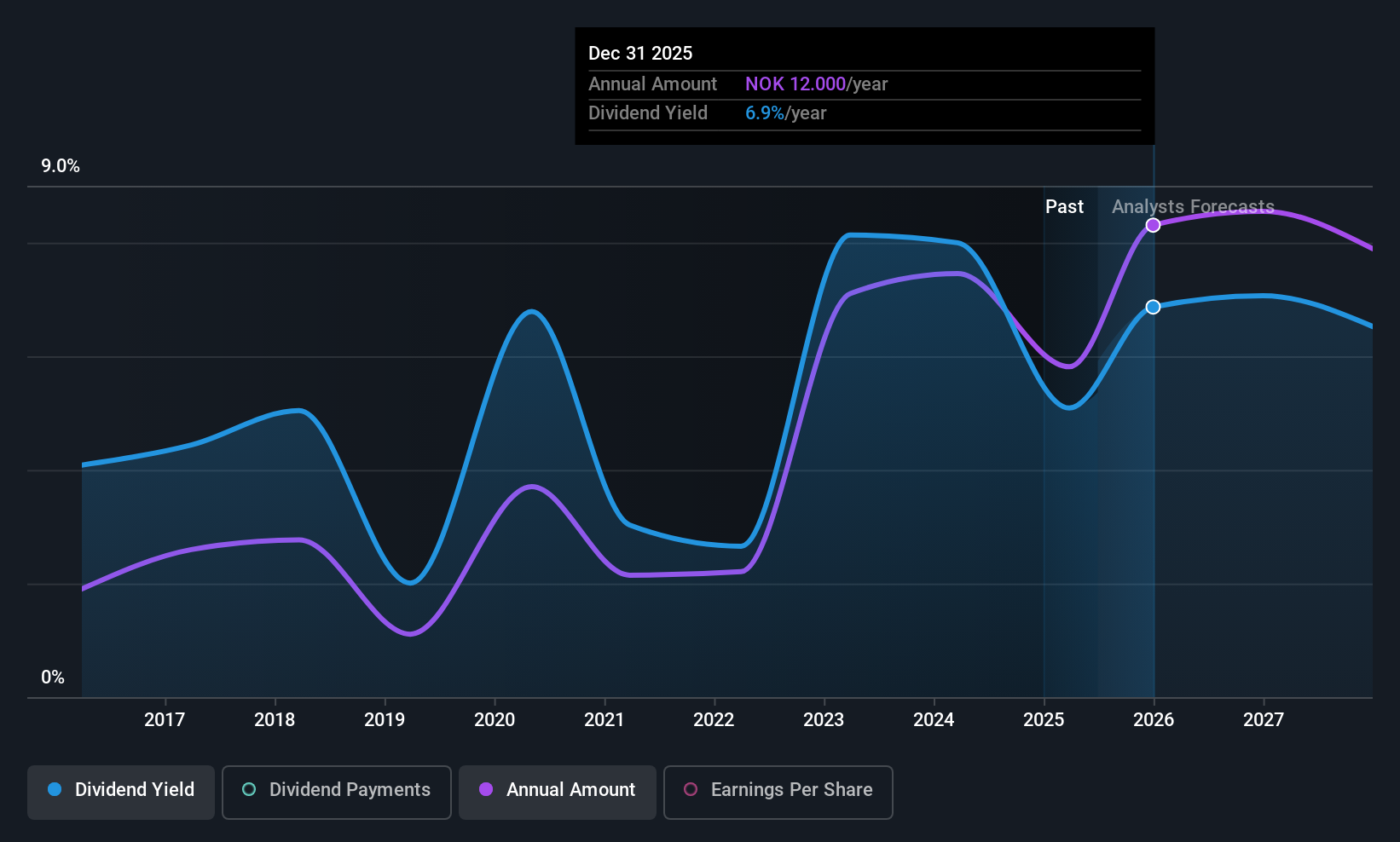

Dividend Yield: 4.8%

SpareBank 1 Helgeland's dividend is covered by earnings with a payout ratio of 51.4%, though past payments have been volatile and unreliable. Despite a 4.8% yield, it trails the top Norwegian payers. Earnings have grown at 18.4% annually over five years, and dividends are forecast to remain covered at 79%. Recent Q2 results show stable income, while a NOK 300 million bond offering could impact future financial flexibility and dividend sustainability.

- Dive into the specifics of SpareBank 1 Helgeland here with our thorough dividend report.

- The analysis detailed in our SpareBank 1 Helgeland valuation report hints at an deflated share price compared to its estimated value.

Andritz (WBAG:ANDR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Andritz AG provides industrial machinery, equipment, and services globally, with a market cap of €6.19 billion.

Operations: Andritz AG's revenue is derived from four main segments: Metals (€1.71 billion), Hydro Power (€1.65 billion), Pulp & Paper (€3.10 billion), and Environment & Energy (€1.52 billion).

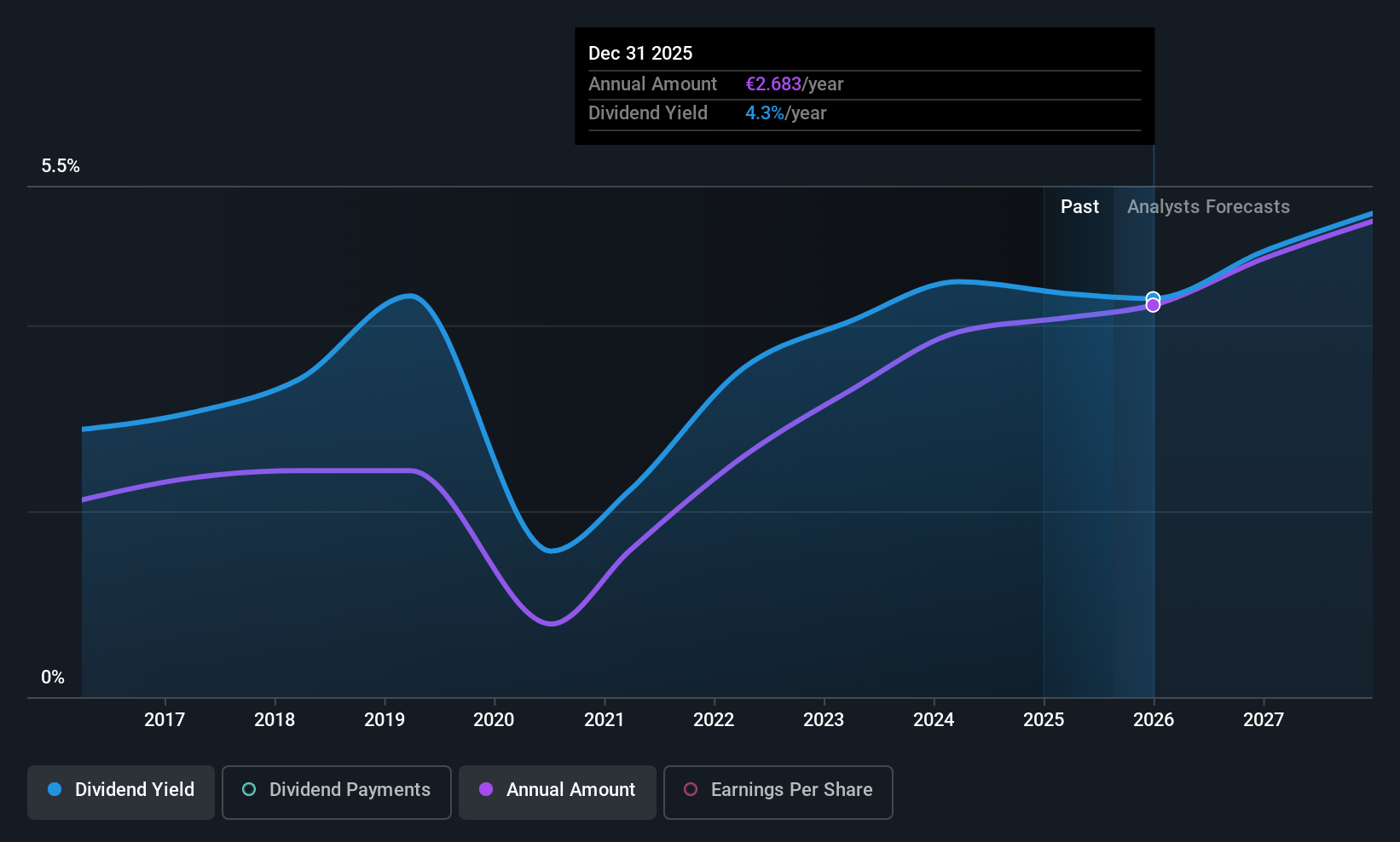

Dividend Yield: 4.1%

Andritz's dividend is supported by a payout ratio of 55%, though past payments have been unreliable and volatile. The current yield of 4.1% is below the top Austrian payers, yet dividends are covered by cash flows at an 83.7% ratio. Trading at nearly half its estimated fair value, Andritz shows potential for capital appreciation. Recent earnings indicate a decline in sales and net income, but guidance remains optimistic with revenue projections up to €8.3 billion for 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Andritz.

- In light of our recent valuation report, it seems possible that Andritz is trading behind its estimated value.

Key Takeaways

- Click through to start exploring the rest of the 213 Top European Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:ANDR

Andritz

Engages in the provision of industrial machinery, equipment, and services in Europe, North America, South America, China, Asia, Africa, Australia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives