- United States

- /

- Commercial Services

- /

- NYSE:EBF

Top Dividend Stocks Featuring Fulton Financial And Two Others

Reviewed by Simply Wall St

The United States market has shown a positive trend, rising 1.7% over the last week and up 18% in the past year, with earnings anticipated to grow by 15% annually in the coming years. In this favorable environment, identifying strong dividend stocks like Fulton Financial can offer investors a reliable income stream while potentially benefiting from overall market growth.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.88% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.46% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.69% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.17% | ★★★★★★ |

| Ennis (EBF) | 5.49% | ★★★★★★ |

| Dillard's (DDS) | 5.26% | ★★★★★★ |

| Credicorp (BAP) | 4.63% | ★★★★★☆ |

| CompX International (CIX) | 4.90% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.91% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.66% | ★★★★★☆ |

Click here to see the full list of 136 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

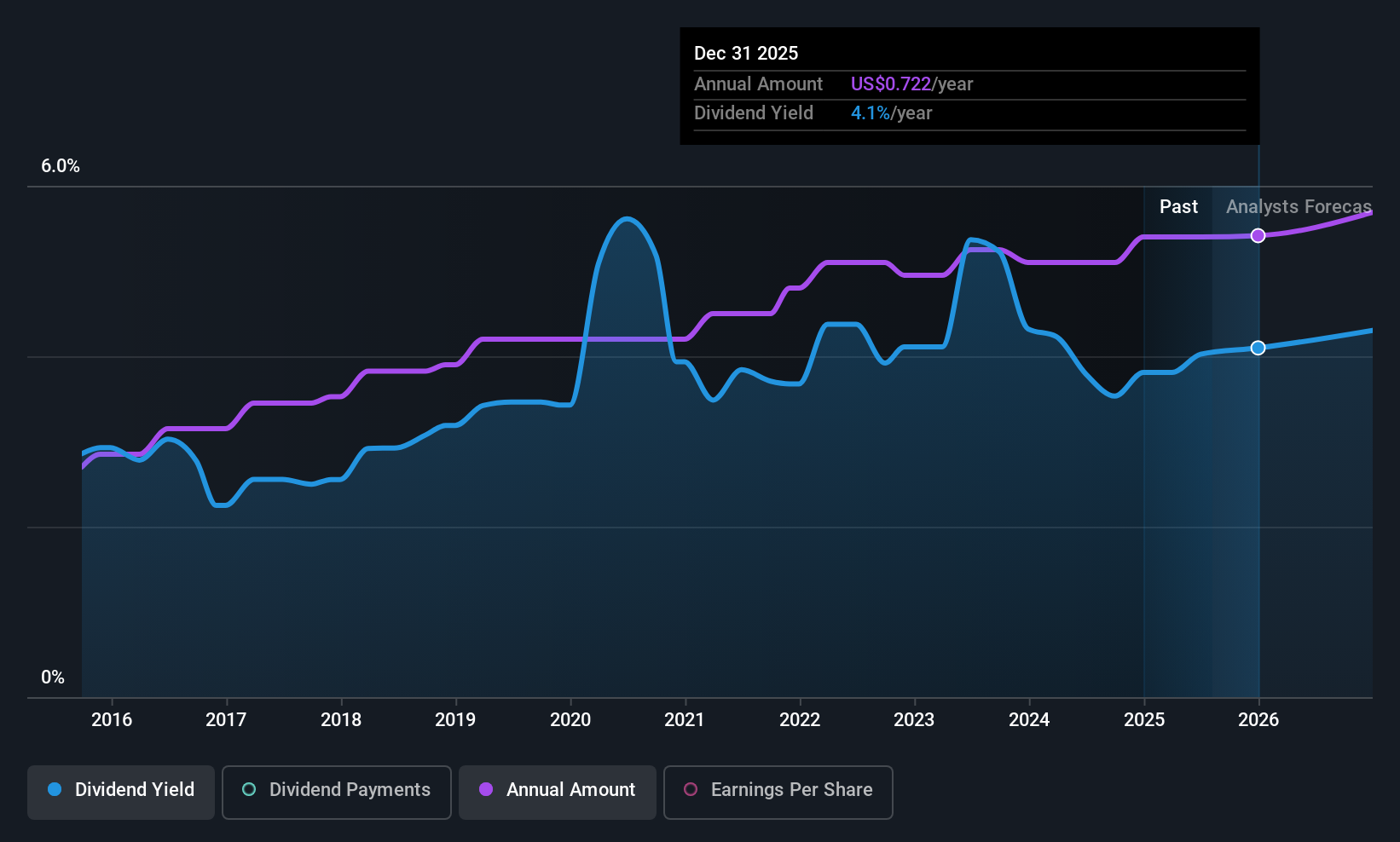

Fulton Financial (FULT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fulton Financial Corporation, with a market cap of $3.53 billion, operates as the bank holding company for Fulton Bank, offering a range of banking and financial products and services in the United States.

Operations: Fulton Financial Corporation generates its revenue primarily from its banking segment, which accounts for $1.21 billion.

Dividend Yield: 3.7%

Fulton Financial's dividend stability is supported by a low payout ratio of 41.2%, ensuring coverage by earnings. Over the past decade, dividends have been reliable and growing with minimal volatility. The recent quarterly cash dividend of $0.18 per share reflects this trend. Despite trading at a good value, its 3.74% yield is below the top tier in the US market but remains attractive due to consistent earnings growth, evidenced by increased net interest income and net income for Q2 2025.

- Click to explore a detailed breakdown of our findings in Fulton Financial's dividend report.

- Our comprehensive valuation report raises the possibility that Fulton Financial is priced lower than what may be justified by its financials.

American Eagle Outfitters (AEO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: American Eagle Outfitters, Inc. is a multi-brand specialty retailer operating in the United States and internationally with a market cap of approximately $1.77 billion.

Operations: American Eagle Outfitters, Inc. generates revenue primarily from its American Eagle segment at $3.35 billion and its Aerie segment at $1.73 billion.

Dividend Yield: 4.6%

American Eagle Outfitters' dividend sustainability is supported by a payout ratio of 48% and a cash payout ratio of 40.8%, indicating strong coverage by earnings and cash flows. However, the dividend has been volatile over the past decade, with no growth in payments. Despite trading at a good value with a price-to-earnings ratio of 9.5x, recent financial results show challenges, including a net loss for Q1 2025 and removal from several Russell growth indices.

- Navigate through the intricacies of American Eagle Outfitters with our comprehensive dividend report here.

- Our expertly prepared valuation report American Eagle Outfitters implies its share price may be lower than expected.

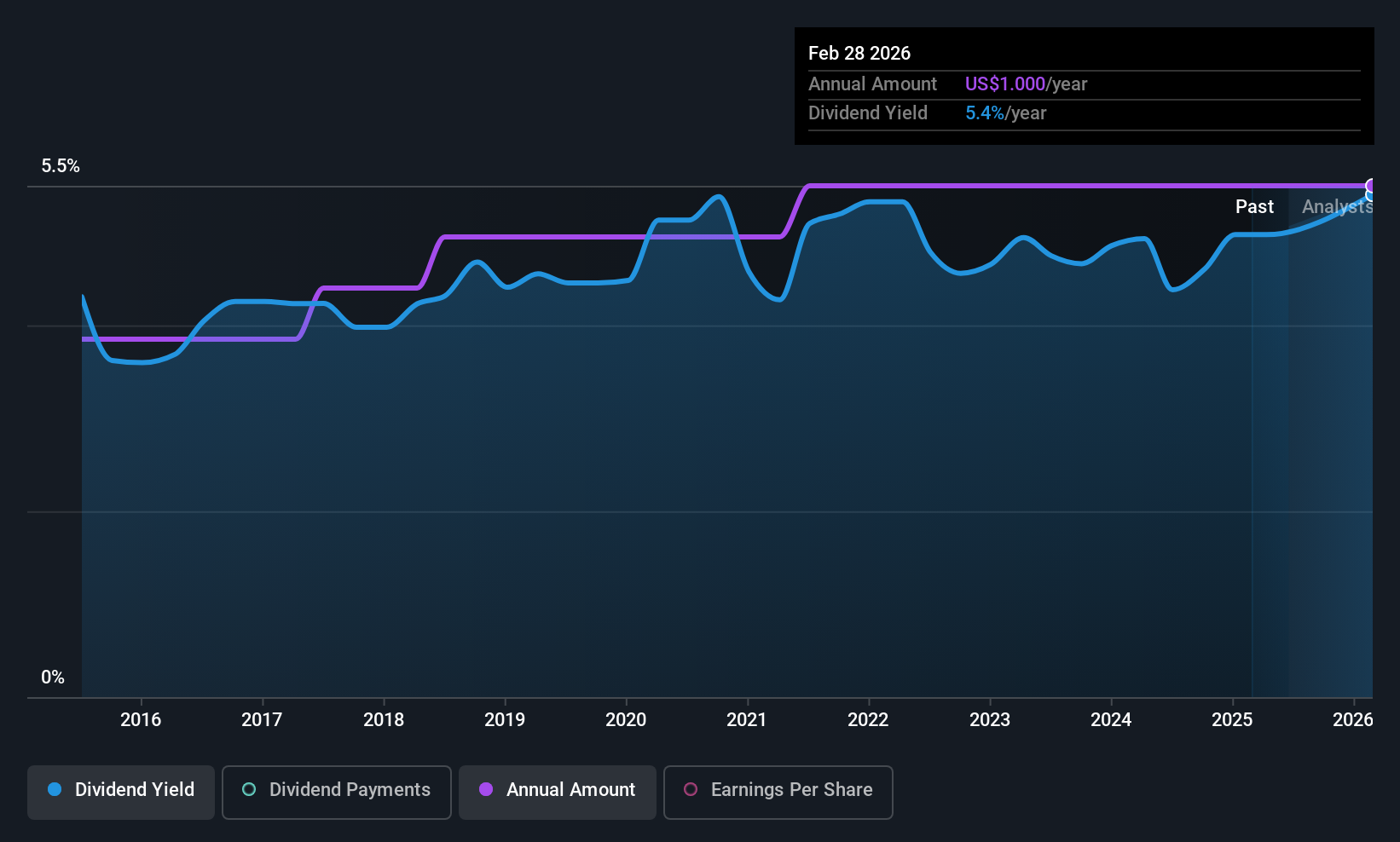

Ennis (EBF)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Ennis, Inc. is a company that produces and sells business forms and other printed products in the United States, with a market cap of $464.83 million.

Operations: Ennis, Inc. generates revenue primarily from its print segment, which amounts to $388.71 million.

Dividend Yield: 5.5%

Ennis, Inc. maintains a solid dividend profile with a payout ratio of 66% and cash payout coverage at 56.1%, ensuring dividends are backed by earnings and cash flows. The dividend yield of 5.49% positions it in the top quartile among U.S. dividend payers, reflecting its attractiveness to income-focused investors. Recent board changes include appointing Michael D. Magill as director, while Q1 earnings showed slight declines in sales and net income compared to last year.

- Get an in-depth perspective on Ennis' performance by reading our dividend report here.

- The valuation report we've compiled suggests that Ennis' current price could be quite moderate.

Key Takeaways

- Click here to access our complete index of 136 Top US Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ennis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EBF

Ennis

Produces and sells business forms and other printed products in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives