- China

- /

- Metals and Mining

- /

- SZSE:002532

Top Asian Dividend Stocks To Consider In July 2025

Reviewed by Simply Wall St

In July 2025, Asian markets are experiencing a mix of modest gains and cautious optimism amid political uncertainties and economic developments. As investors navigate these conditions, dividend stocks in Asia present an attractive option for those seeking steady income streams, particularly when corporate earnings remain robust and inflationary pressures show signs of easing.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.21% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.05% | ★★★★★★ |

| NCD (TSE:4783) | 4.20% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.26% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.25% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.24% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.45% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.13% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.45% | ★★★★★★ |

| Daicel (TSE:4202) | 4.58% | ★★★★★★ |

Click here to see the full list of 1167 stocks from our Top Asian Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

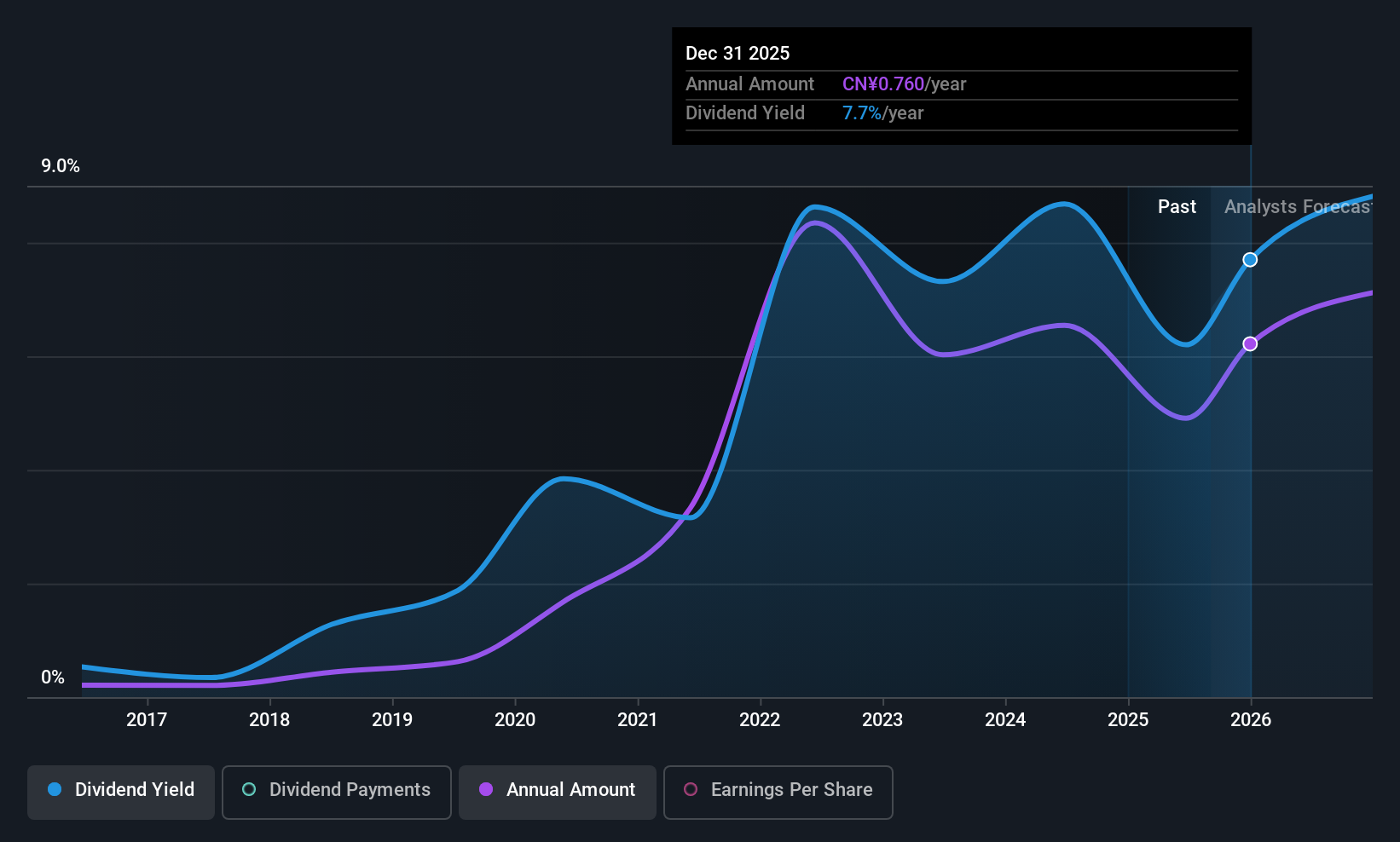

Inner Mongolia ERDOS ResourcesLtd (SHSE:600295)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Inner Mongolia ERDOS Resources Co., Ltd. operates in the clothing, power metallurgy, and chemical sectors in China, with a market cap of CN¥26.20 billion.

Operations: Inner Mongolia ERDOS Resources Co., Ltd. generates revenue from its operations in the clothing, power metallurgy, and chemical sectors in China.

Dividend Yield: 5.8%

Inner Mongolia ERDOS Resources Ltd. offers a compelling dividend yield of 5.84%, ranking in the top 25% in the CN market, yet its dividend history is marked by volatility and unreliability over the past decade. The company's dividends are well-covered by earnings and cash flows, with payout ratios at 85.5% and 45.8%, respectively, indicating sustainability despite previous instability. Recent earnings reveal improved net income to CNY 459 million for Q1 2025, suggesting potential resilience amidst fluctuating revenues.

- Get an in-depth perspective on Inner Mongolia ERDOS ResourcesLtd's performance by reading our dividend report here.

- The analysis detailed in our Inner Mongolia ERDOS ResourcesLtd valuation report hints at an deflated share price compared to its estimated value.

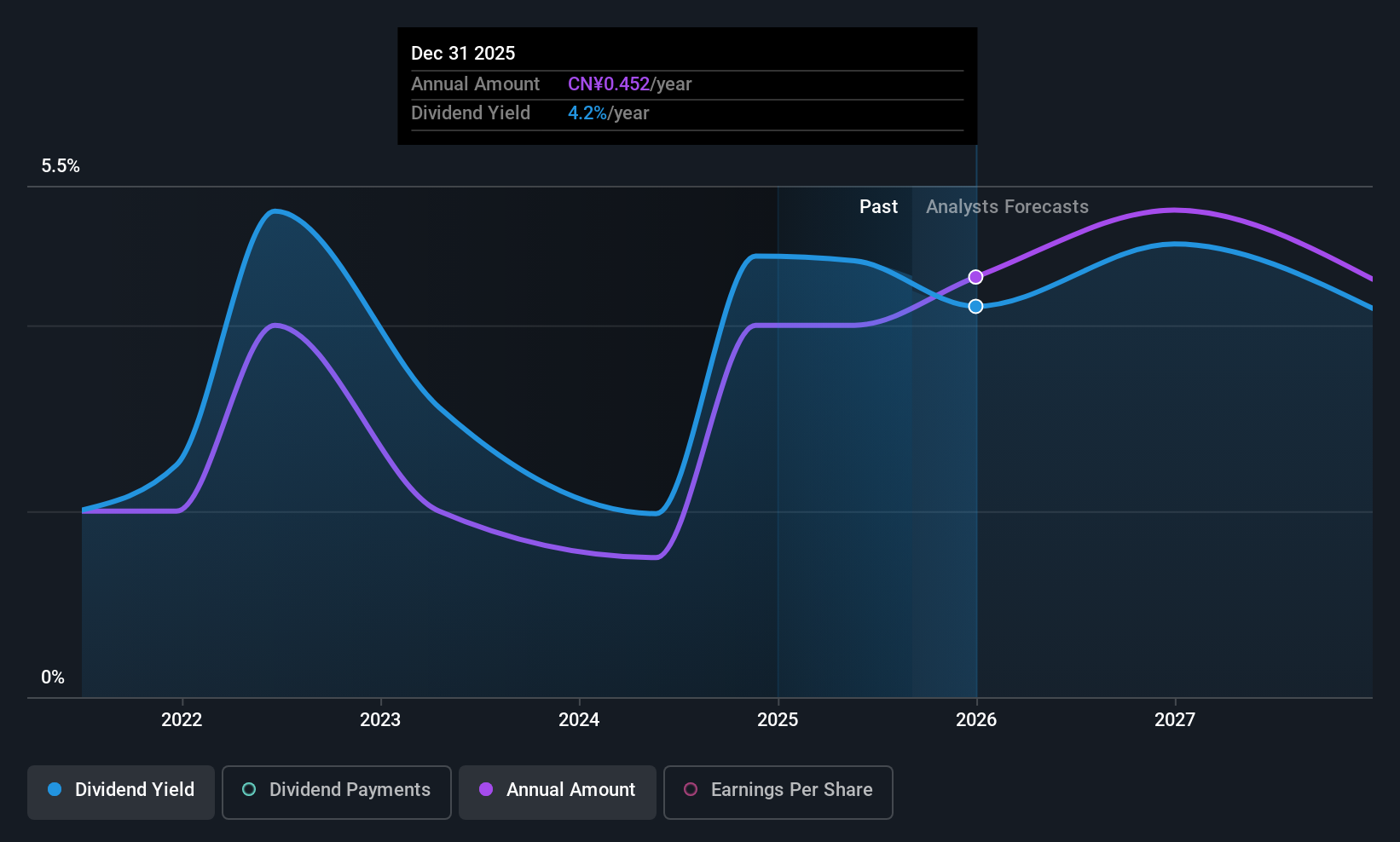

Tianshan Aluminum GroupLtd (SZSE:002532)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tianshan Aluminum Group Co., Ltd, with a market cap of CN¥43.78 billion, produces and sells primary aluminum, alumina, prebaked anodes, high-purity aluminum, and aluminum deep-processed products both in China and internationally.

Operations: Tianshan Aluminum Group Co., Ltd generates revenue from the production and sale of primary aluminum, alumina, prebaked anodes, high-purity aluminum, and deep-processed aluminum products and materials across domestic and international markets.

Dividend Yield: 4.2%

Tianshan Aluminum Group Ltd. provides a dividend yield of 4.22%, placing it among the top 25% in the CN market, but its dividend history is less stable, with past volatility and only four years of payments. Recent approvals confirmed a cash dividend for 2024, indicating commitment despite instability. The company's dividends are well-supported by earnings and cash flow, with payout ratios at 38.9% and 46.9%, respectively, while trading significantly below estimated fair value suggests potential upside.

- Click here and access our complete dividend analysis report to understand the dynamics of Tianshan Aluminum GroupLtd.

- Our expertly prepared valuation report Tianshan Aluminum GroupLtd implies its share price may be lower than expected.

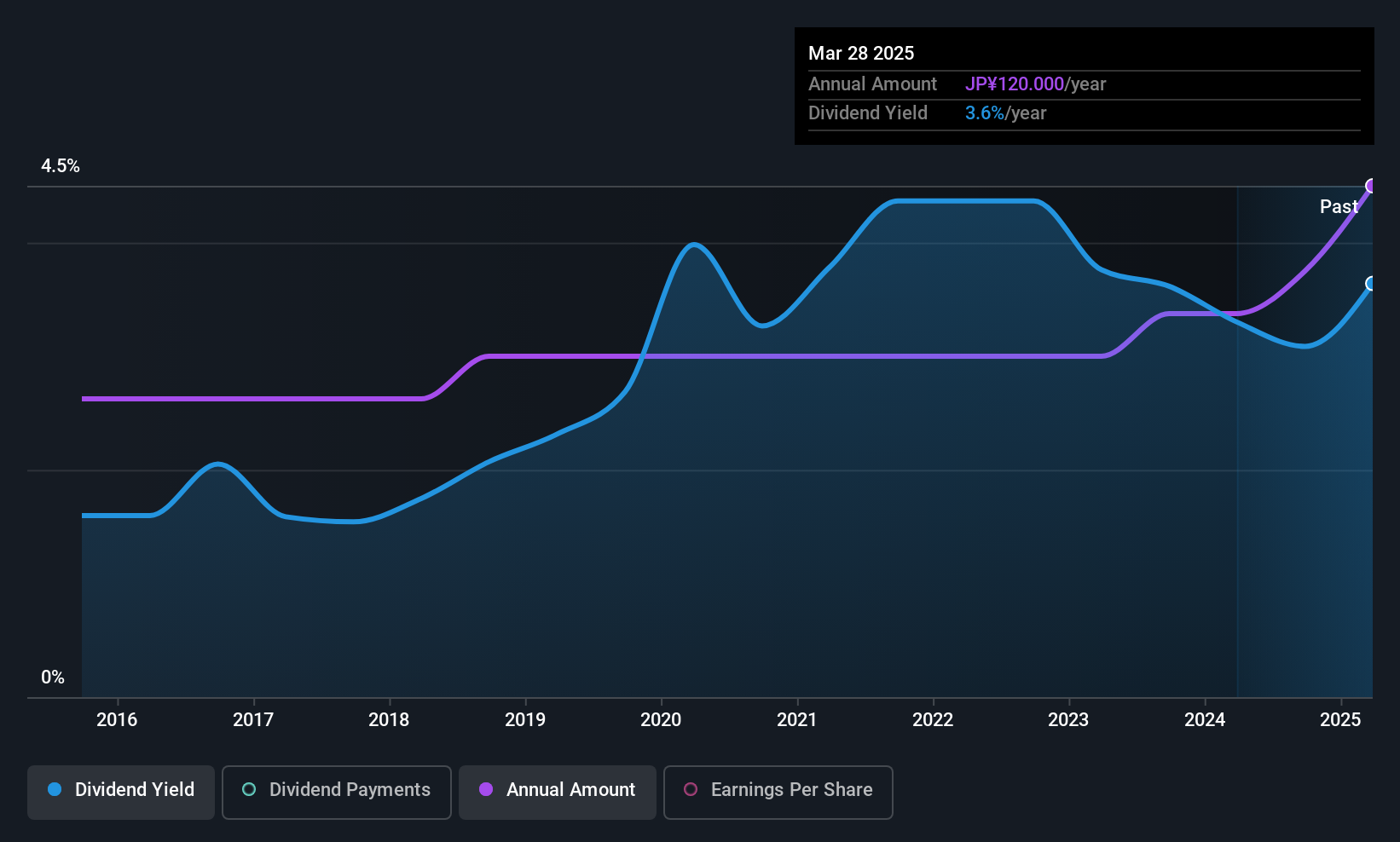

Oita Bank (TSE:8392)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Oita Bank, Ltd. offers a range of banking products and services to both individual and corporate clients mainly in Japan, with a market cap of ¥73.67 billion.

Operations: Oita Bank generates its revenue from a variety of banking products and services catering to both individual and corporate clients in Japan.

Dividend Yield: 3.1%

Oita Bank offers a stable dividend yield of 3.11%, with dividends reliably paid and increased over the past decade. The bank maintains a low payout ratio of 18.7%, ensuring dividends are well-covered by earnings, though its yield is below the top quartile in Japan. Recent guidance indicates strong financial performance, with expected ordinary revenues reaching ¥80.30 billion for the full year ending March 2026, supporting future dividend sustainability despite a low allowance for bad loans at 58%.

- Click to explore a detailed breakdown of our findings in Oita Bank's dividend report.

- The valuation report we've compiled suggests that Oita Bank's current price could be quite moderate.

Next Steps

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1164 more companies for you to explore.Click here to unveil our expertly curated list of 1167 Top Asian Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tianshan Aluminum GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002532

Tianshan Aluminum GroupLtd

Produces and sells primary aluminum, alumina, prebaked anodes, high-purity aluminum, and aluminum deep-processed products and materials in China and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives