- China

- /

- Oil and Gas

- /

- SHSE:601101

Top Asian Dividend Stocks To Consider In July 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by shifting inflation rates and trade dynamics, Asian indices have shown resilience, with China's growth figures exceeding expectations despite ongoing deflationary pressures. In this environment, dividend stocks in Asia can offer a compelling opportunity for investors seeking income stability; these stocks are often characterized by strong cash flows and robust financial health, which can be particularly attractive amid economic uncertainties.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.32% | ★★★★★★ |

| NCD (TSE:4783) | 4.19% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.25% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.18% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.27% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.53% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.16% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.51% | ★★★★★★ |

| Daicel (TSE:4202) | 4.81% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.00% | ★★★★★★ |

Click here to see the full list of 1199 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Beijing Haohua Energy Resource (SHSE:601101)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing Haohua Energy Resource Co., Ltd. operates in the mining, washing, manufacturing, processing, export, and sale of coal in China with a market cap of CN¥11.35 billion.

Operations: Beijing Haohua Energy Resource Co., Ltd.'s revenue primarily comes from its activities in coal mining, washing, manufacturing, processing, export, and sales within China.

Dividend Yield: 5.8%

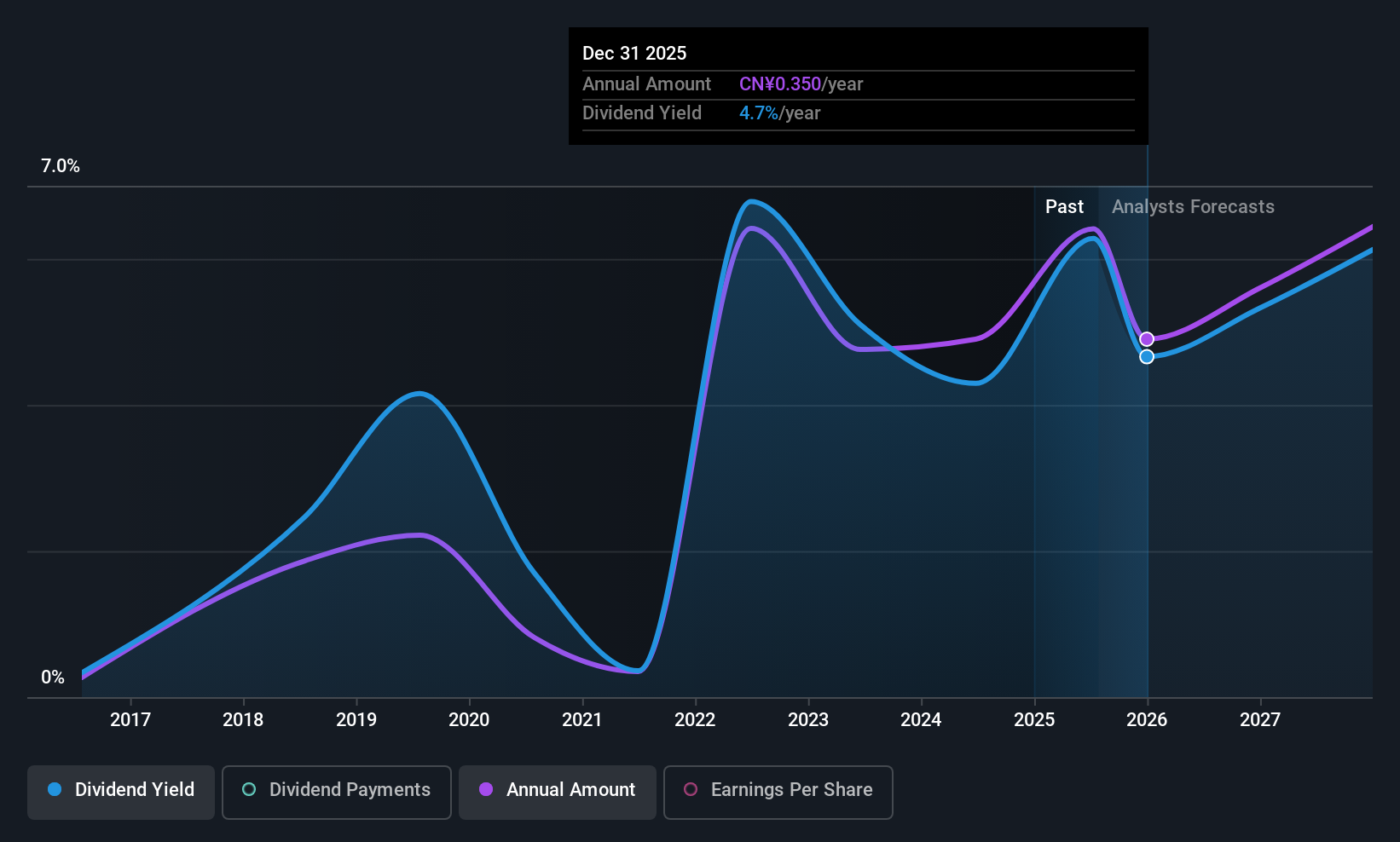

Beijing Haohua Energy Resource offers a dividend yield of 5.81%, placing it in the top 25% of dividend payers in China. The dividends are covered by earnings with a payout ratio of 76.5% and cash flows with a cash payout ratio of 35.2%. However, the company's dividend history has been volatile over the past decade, indicating potential instability despite recent increases in payments and solid coverage by both earnings and cash flow.

- Click here to discover the nuances of Beijing Haohua Energy Resource with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Beijing Haohua Energy Resource shares in the market.

Henan Shenhuo Coal Industry and Electricity Power (SZSE:000933)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Henan Shenhuo Coal Industry and Electricity Power Co. operates in the coal mining and electricity generation sectors, with a market cap of CN¥43.61 billion.

Operations: Henan Shenhuo Coal Industry and Electricity Power Co. generates revenue through its operations in the coal mining and electricity generation sectors.

Dividend Yield: 5.2%

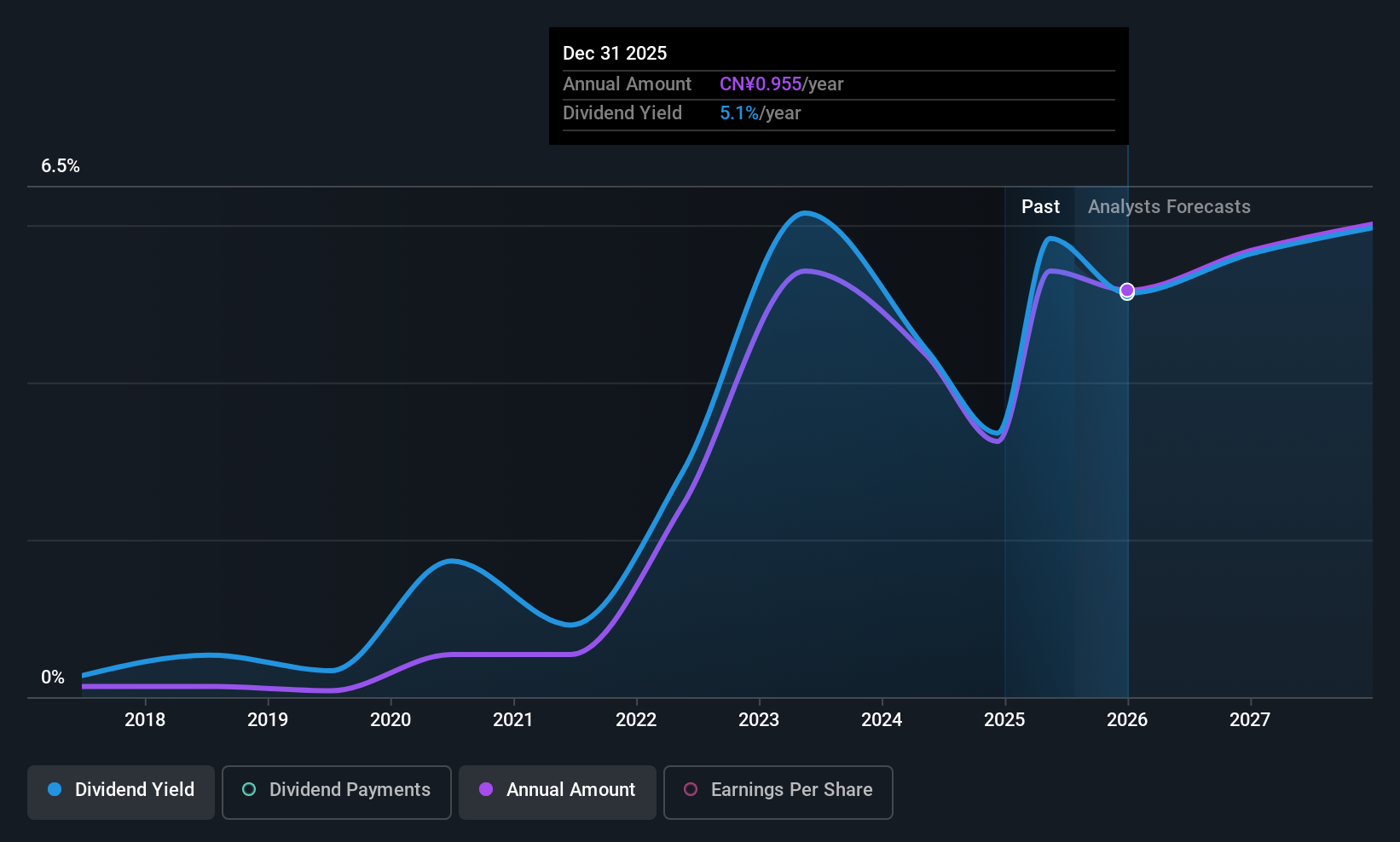

Henan Shenhuo Coal Industry and Electricity Power's dividend yield of 5.16% is among the top 25% in China, supported by a low payout ratio of 45.2% and a cash payout ratio of 35.5%. Despite solid coverage, the company's dividend history is marked by volatility over its eight-year payment period, with no consistent growth in dividends. Recent share buybacks totaling CNY 260.16 million may impact future dividend stability positively or negatively depending on capital allocation decisions.

- Take a closer look at Henan Shenhuo Coal Industry and Electricity Power's potential here in our dividend report.

- The valuation report we've compiled suggests that Henan Shenhuo Coal Industry and Electricity Power's current price could be quite moderate.

Guangdong Construction Engineering Group (SZSE:002060)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Guangdong Construction Engineering Group Co., Ltd. (SZSE:002060) operates in the construction industry, focusing on engineering and infrastructure projects, with a market cap of approximately CN¥15.47 billion.

Operations: Unfortunately, the provided Business operations text does not contain specific revenue segment details for Guangdong Construction Engineering Group Co., Ltd. (SZSE:002060), so I am unable to summarize the company's revenue segments at this time.

Dividend Yield: 3.4%

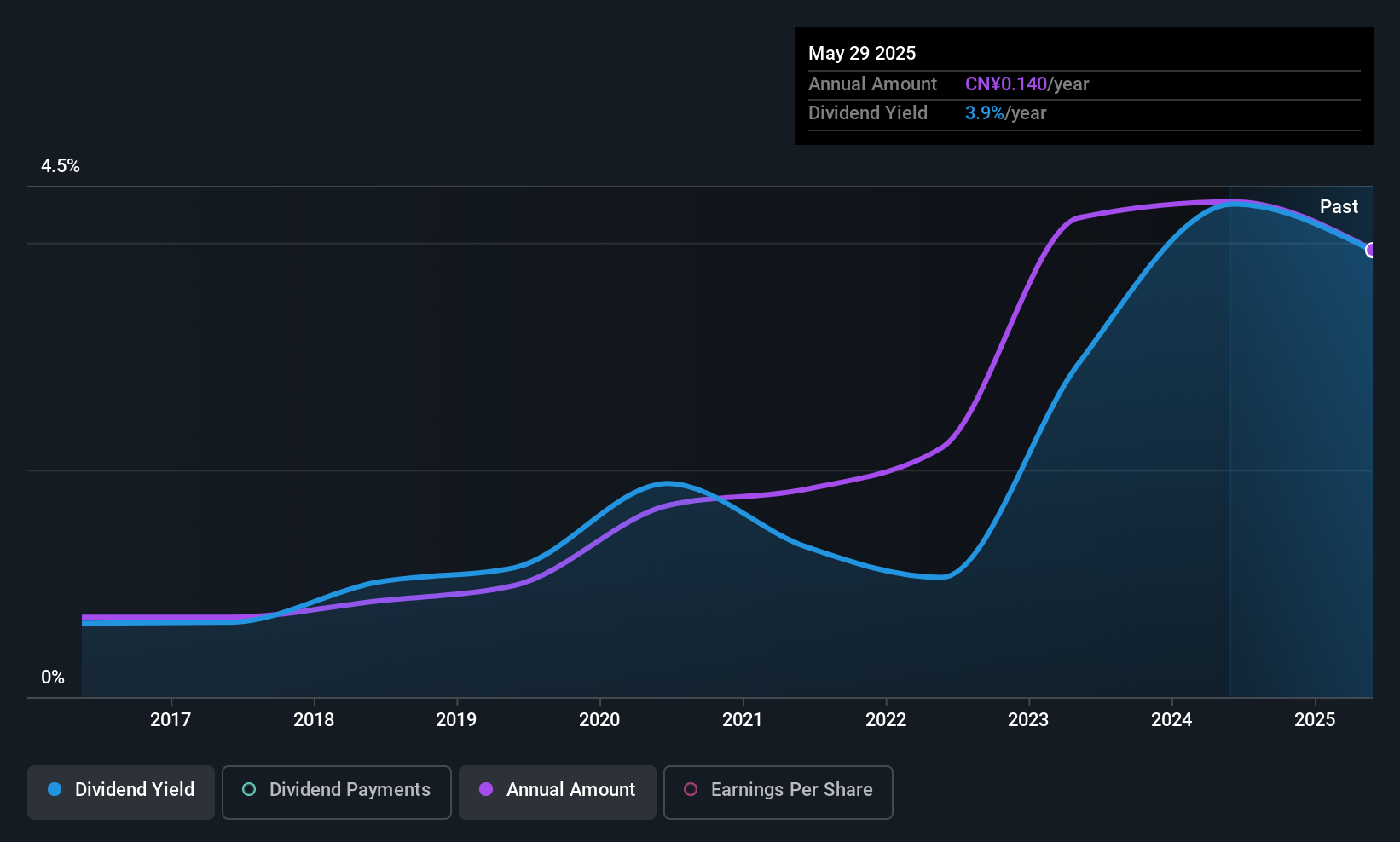

Guangdong Construction Engineering Group offers a dividend yield of 3.4%, placing it in the top 25% of Chinese dividend payers. Despite stable and growing dividends over the past decade, recent cash flow issues raise sustainability concerns, as dividends are not covered by free cash flows. The company trades at a favorable P/E ratio of 13.5x versus the CN market average, but its recent earnings report showed declining net income, potentially impacting future payouts.

- Navigate through the intricacies of Guangdong Construction Engineering Group with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Guangdong Construction Engineering Group is trading behind its estimated value.

Key Takeaways

- Unlock our comprehensive list of 1199 Top Asian Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Haohua Energy Resource might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601101

Beijing Haohua Energy Resource

Engages in the mining, washing, manufacturing, processing, export, and sale of coal in China.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives