- United States

- /

- Metals and Mining

- /

- NasdaqGS:TMC

TMC the Metals (NasdaqGS:TMC) Reports Reduced Q1 2025 Net Loss of US$21 Million

Reviewed by Simply Wall St

TMC the Metals (NasdaqGS:TMC) recently announced a follow-on equity offering and its Q1 2025 earnings, reporting a reduced net loss of $20.59 million against the previous year’s $25.19 million. Despite market growth of 12% over the last 12 months, TMC's impressive 137% rise last quarter signals a notable divergence. The company's application for commercial recovery permits and executive appointments likely added weight to its substantial share price growth. Additionally, its inclusion in the S&P/TSX Global Mining Index potentially boosted investor interest, aligning with broader market optimism.

TMC the metals has 5 risks (and 2 which can't be ignored) we think you should know about.

Over the past three years, TMC The Metals Company Inc. has achieved a significant total shareholder return of 170.75%, reflecting substantial long-term growth, especially compared to the previous year where the US Metals and Mining industry only returned 0.4%. This performance over a longer period indicates a robust appreciation in shareholder value, contrasting the company's recent quarterly boom highlighted in the introduction.

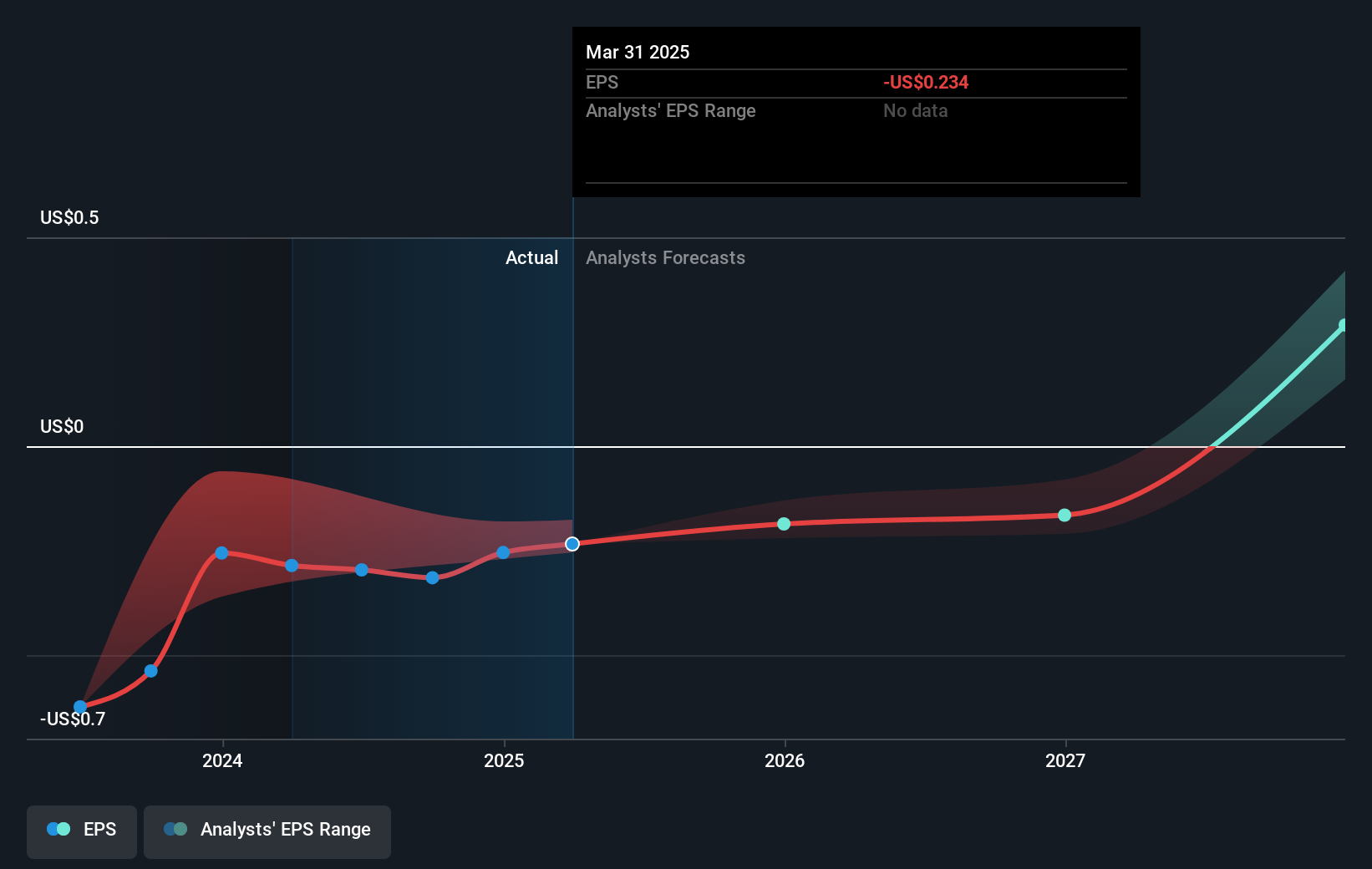

The conjunction of a reduced net loss and the application for commercial recovery permits may influence TMC's revenue and earnings projections. While the company's initiatives could potentially drive growth, current revenue remains at US$0. The Q1 earnings reduction, though positive, still points to an unprofitable status with future earnings forecasts remaining cautious.

TMC's share price, now at US$3.98, represents a 85.93% discount to the consensus fair value price target of US$7.40. This discrepancy suggests that market participants may anticipate future improvements or remain cautious due to recent developments. Continued volatility in the share price could reflect ongoing adjustments to these expectations.

Take a closer look at TMC the metals' potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TMC the metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMC

TMC the metals

A deep-sea minerals exploration company, focuses on the collection, processing, and refining of polymetallic nodules found on the seafloor in California.

Moderate and slightly overvalued.

Market Insights

Community Narratives