Anyone interested in UDR, Inc. (NYSE:UDR) should probably be aware that the President & COO, Jerry Davis, recently divested US$467k worth of shares in the company, at an average price of US$46.72 each. On the bright side, that sale was only 5.5% of their holding, so we doubt it's very meaningful, on its own.

View our latest analysis for UDR

The Last 12 Months Of Insider Transactions At UDR

Over the last year, we can see that the biggest insider sale was by the Chairman & CEO, Thomas Toomey, for US$2.3m worth of shares, at about US$45.06 per share. That means that an insider was selling shares at below the current price (US$45.82). When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. We note that the biggest single sale was only 2.9% of Thomas Toomey's holding.

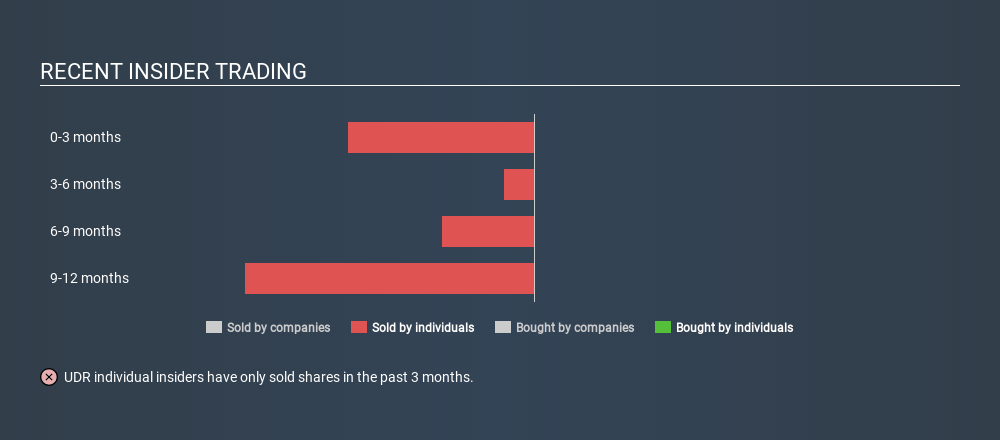

Over the last year we saw more insider selling of UDR shares, than buying. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Insider Ownership of UDR

Many investors like to check how much of a company is owned by insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. UDR insiders own 1.1% of the company, currently worth about US$153m based on the recent share price. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Do The UDR Insider Transactions Indicate?

Insiders sold stock recently, but they haven't been buying. Despite some insider buying, the longer term picture doesn't make us feel much more positive. It is good to see high insider ownership, but the insider selling leaves us cautious. Of course, the future is what matters most. So if you are interested in UDR, you should check out this free report on analyst forecasts for the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:UDR

UDR

UDR, Inc. (NYSE: UDR), an S&P 500 company, is a leading multifamily real estate investment trust with a demonstrated performance history of delivering superior and dependable returns by successfully managing, buying, selling, developing and redeveloping attractive real estate communities in targeted U.S.

Established dividend payer low.

Similar Companies

Market Insights

Community Narratives