These 4 Measures Indicate That Bombay Dyeing and Manufacturing (NSE:BOMDYEING) Is Using Debt In A Risky Way

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies The Bombay Dyeing and Manufacturing Company Limited (NSE:BOMDYEING) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Bombay Dyeing and Manufacturing

How Much Debt Does Bombay Dyeing and Manufacturing Carry?

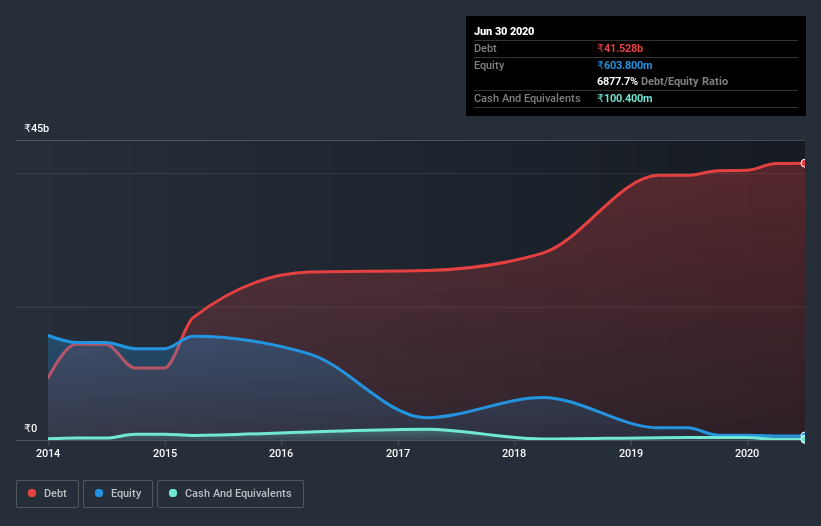

You can click the graphic below for the historical numbers, but it shows that as of March 2020 Bombay Dyeing and Manufacturing had ₹41.5b of debt, an increase on ₹39.7b, over one year. Net debt is about the same, since the it doesn't have much cash.

A Look At Bombay Dyeing and Manufacturing's Liabilities

According to the last reported balance sheet, Bombay Dyeing and Manufacturing had liabilities of ₹13.9b due within 12 months, and liabilities of ₹33.6b due beyond 12 months. On the other hand, it had cash of ₹100.4m and ₹7.33b worth of receivables due within a year. So its liabilities total ₹40.1b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the ₹13.3b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Bombay Dyeing and Manufacturing would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 0.32 times and a disturbingly high net debt to EBITDA ratio of 20.7 hit our confidence in Bombay Dyeing and Manufacturing like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Even worse, Bombay Dyeing and Manufacturing saw its EBIT tank 91% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Bombay Dyeing and Manufacturing will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Bombay Dyeing and Manufacturing saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Bombay Dyeing and Manufacturing's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And furthermore, its interest cover also fails to instill confidence. Considering everything we've mentioned above, it's fair to say that Bombay Dyeing and Manufacturing is carrying heavy debt load. If you harvest honey without a bee suit, you risk getting stung, so we'd probably stay away from this particular stock. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Bombay Dyeing and Manufacturing (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Bombay Dyeing and Manufacturing, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bombay Dyeing and Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:BOMDYEING

Bombay Dyeing and Manufacturing

Produces and sells polyester staple fiber products in India and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026