The Unicaja Banco (BME:UNI) Share Price Is Down 50% So Some Shareholders Are Getting Worried

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Unicaja Banco, S.A. (BME:UNI) share price is down 50% in the last year. That's disappointing when you consider the market returned -4.5%. We wouldn't rush to judgement on Unicaja Banco because we don't have a long term history to look at. Furthermore, it's down 26% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

See our latest analysis for Unicaja Banco

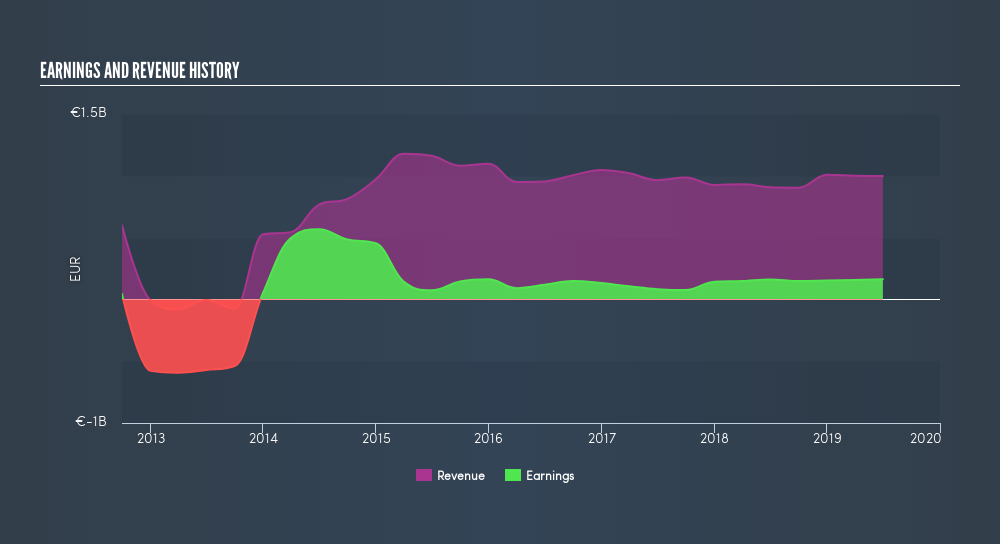

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Unicaja Banco share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped. By glancing at these numbers, we'd posit that the the market had expectations of much higher growth, last year. But other metrics might shed some light on why the share price is down.

We don't see any weakness in the Unicaja Banco's dividend so the steady payout can't really explain the share price drop. From what we can see, revenue is pretty flat, so that doesn't really explain the share price drop. Unless, of course, the market was expecting a revenue uptick.

Unicaja Banco is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Unicaja Banco in this interactive graph of future profit estimates.

A Different Perspective

We doubt Unicaja Banco shareholders are happy with the loss of 48% over twelve months (even including dividends). That falls short of the market, which lost 4.5%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 26% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Importantly, we haven't analysed Unicaja Banco's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BME:UNI

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives