- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla (NasdaqGS:TSLA) Sees 30% Price Jump Over Last Quarter

Reviewed by Simply Wall St

Tesla (NasdaqGS:TSLA) has recently undergone notable changes, including the resignation of Milan Kovac from the Optimus humanoid robot program and the addition of Jack Hartung to its board. These executive adjustments join amendments in company bylaws as Tesla adapts to legislative changes in Texas. Despite these events, Tesla's 30% price increase over the last quarter could be seen in the context of broader market growth of 11% over the past year. The company's adjustments may have added weight to Tesla's upward trend, but other factors would also play a role in this growth.

Every company has risks, and we've spotted 2 weaknesses for Tesla you should know about.

The recent executive changes at Tesla, including Milan Kovac's departure and Jack Hartung's board appointment, come as the company undergoes legislative adaptations in Texas. These shifts may exert influence on Tesla's ambitious projects such as autonomous vehicles and humanoid robots, potentially affecting revenue streams and profit margins due to changes in operational focus or strategy. Considering Tesla's 387.53% total return over five years, its long-term performance remains robust, markedly outpacing recent broader market growth, which returned 11% over the past year. This historical context highlights Tesla's ability to achieve significant returns despite short-term fluctuations.

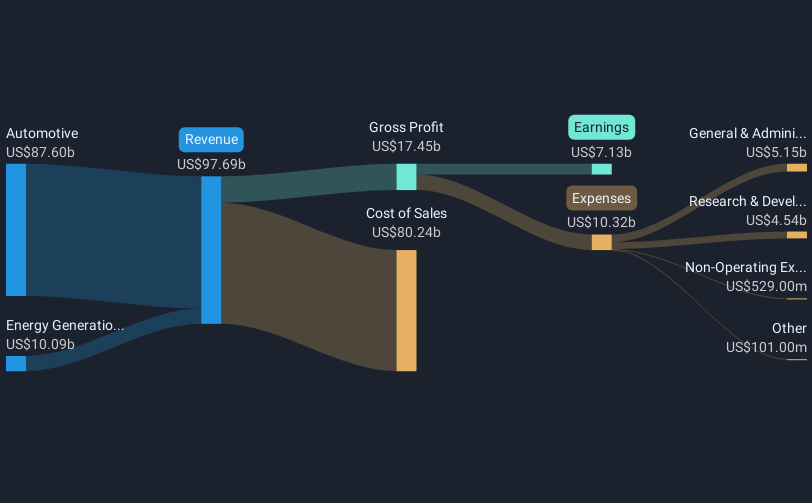

Notably, Tesla’s price increase over the last quarter aligns with executive changes, perhaps reflecting market confidence in adapted leadership and strategic direction. However, the current share price of US$275.35 positions it near the analyst consensus price target of US$289.44, indicating limited expected room for upside in the near term. The company's future revenue growth, pegged at 16.6% annually over the next three years, and expected earnings increase to US$14.7 billion, hinge on successful execution of its ventures into autonomous technology and energy sectors. These projections, although optimistic, underline the importance of Tesla mitigating execution risks to align realized performance with market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives