- India

- /

- Hospitality

- /

- NSEI:TAJGVK

TAJGVK Hotels & Resorts Limited (NSE:TAJGVK) Earns A Nice Return On Capital Employed

Today we are going to look at TAJGVK Hotels & Resorts Limited (NSE:TAJGVK) to see whether it might be an attractive investment prospect. To be precise, we'll consider its Return On Capital Employed (ROCE), as that will inform our view of the quality of the business.

Firstly, we'll go over how we calculate ROCE. Then we'll compare its ROCE to similar companies. Then we'll determine how its current liabilities are affecting its ROCE.

Return On Capital Employed (ROCE): What is it?

ROCE measures the amount of pre-tax profits a company can generate from the capital employed in its business. All else being equal, a better business will have a higher ROCE. In brief, it is a useful tool, but it is not without drawbacks. Renowned investment researcher Michael Mauboussin has suggested that a high ROCE can indicate that 'one dollar invested in the company generates value of more than one dollar'.

How Do You Calculate Return On Capital Employed?

The formula for calculating the return on capital employed is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

Or for TAJGVK Hotels & Resorts:

0.11 = ₹707m ÷ (₹7.5b - ₹1.1b) (Based on the trailing twelve months to December 2019.)

Therefore, TAJGVK Hotels & Resorts has an ROCE of 11%.

View our latest analysis for TAJGVK Hotels & Resorts

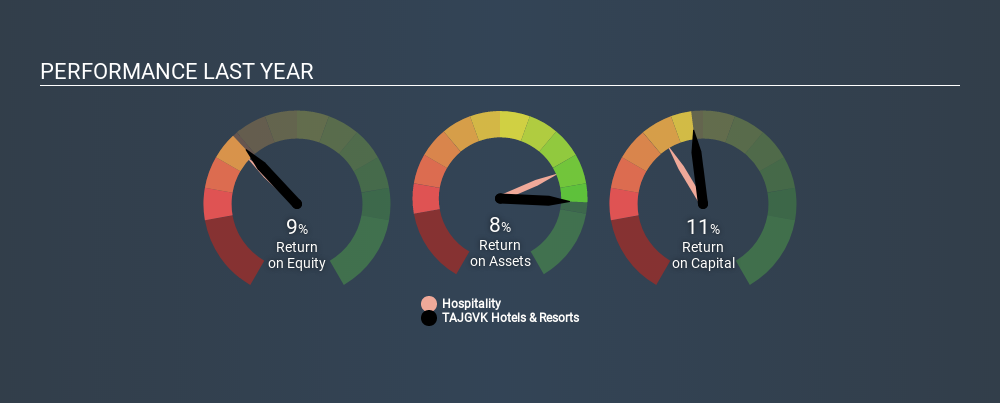

Does TAJGVK Hotels & Resorts Have A Good ROCE?

ROCE is commonly used for comparing the performance of similar businesses. TAJGVK Hotels & Resorts's ROCE appears to be substantially greater than the 7.8% average in the Hospitality industry. I think that's good to see, since it implies the company is better than other companies at making the most of its capital. Separate from how TAJGVK Hotels & Resorts stacks up against its industry, its ROCE in absolute terms is mediocre; relative to the returns on government bonds. Readers may find more attractive investment prospects elsewhere.

Our data shows that TAJGVK Hotels & Resorts currently has an ROCE of 11%, compared to its ROCE of 8.3% 3 years ago. This makes us think the business might be improving. The image below shows how TAJGVK Hotels & Resorts's ROCE compares to its industry, and you can click it to see more detail on its past growth.

When considering this metric, keep in mind that it is backwards looking, and not necessarily predictive. ROCE can be deceptive for cyclical businesses, as returns can look incredible in boom times, and terribly low in downturns. This is because ROCE only looks at one year, instead of considering returns across a whole cycle. Since the future is so important for investors, you should check out our free report on analyst forecasts for TAJGVK Hotels & Resorts.

What Are Current Liabilities, And How Do They Affect TAJGVK Hotels & Resorts's ROCE?

Current liabilities include invoices, such as supplier payments, short-term debt, or a tax bill, that need to be paid within 12 months. Due to the way the ROCE equation works, having large bills due in the near term can make it look as though a company has less capital employed, and thus a higher ROCE than usual. To counter this, investors can check if a company has high current liabilities relative to total assets.

TAJGVK Hotels & Resorts has total assets of ₹7.5b and current liabilities of ₹1.1b. Therefore its current liabilities are equivalent to approximately 15% of its total assets. It is good to see a restrained amount of current liabilities, as this limits the effect on ROCE.

The Bottom Line On TAJGVK Hotels & Resorts's ROCE

If TAJGVK Hotels & Resorts continues to earn an uninspiring ROCE, there may be better places to invest. Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

When trading TAJGVK Hotels & Resorts or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

Valuation is complex, but we're here to simplify it.

Discover if TAJGVK Hotels & Resorts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:TAJGVK

TAJGVK Hotels & Resorts

Engages in the business of owning, operating, and managing hotels, palaces, and resorts under the TAJ brand in India.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives