- United States

- /

- Software

- /

- NasdaqGS:SNPS

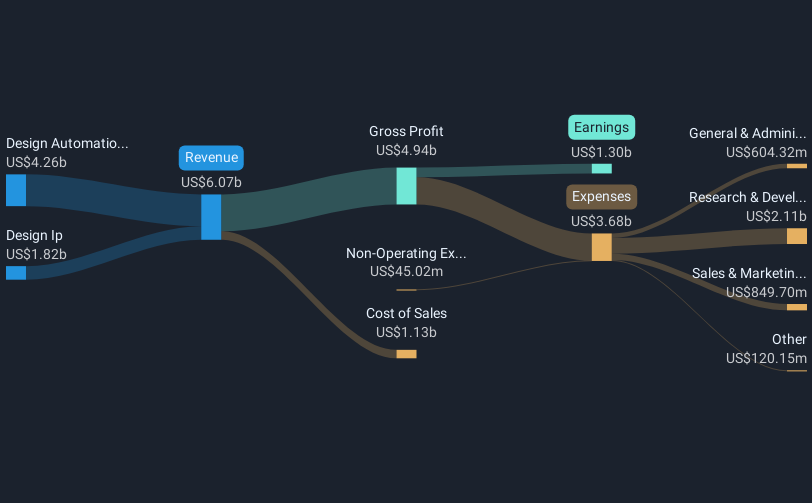

Synopsys (NasdaqGS:SNPS) Reports US$1,604 Million Revenue, Reaffirms 2025 Earnings Guidance

Reviewed by Simply Wall St

Synopsys (NasdaqGS:SNPS) recently reported strong Q2 2025 earnings with impressive growth in revenue and net income compared to the previous year, while providing optimistic guidance for the next quarter and fiscal year. With a 4% uptick in its share price over the last month, the company's market performance was aligned with the broader tech sector rally, spurred by Nvidia's strong earnings. Additionally, Synopsys' collaboration with Intel on cutting-edge semiconductor design likely reinforced positive sentiment, endorsing its strategic position in the AI and high-performance computing realms which found favor with investors amidst recovering market momentum.

Buy, Hold or Sell Synopsys? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recently announced collaboration between Synopsys and Intel, alongside better-than-expected earnings for Q2 2025, can reinforce investor confidence in the company's near-term growth trajectory. Synopsys' share price has risen by 4% in the past month, buoyed by its association with the tech rally led by Nvidia, suggesting a strong market alignment. Additionally, the partnership supports Synopsys' leadership in AI and high-performance computing, sectors known for enhancing Electronic Design Automation (EDA) performance. This could potentially boost revenue and earnings forecasts, enhancing their attractiveness to investors.

Over the past five years, Synopsys has generated a total shareholder return, including dividends and share price appreciation, of 151.03%. This long-term performance provides context for its resilience amidst broader tech fluctuations. However, in the more immediate past year, Synopsys underperformed the US Software industry and US market returns, which saw returns of 17.2% and 11.5% respectively, showing room for improvement in short-term industry performance alignment.

The current share price sits at US$473.55, below the consensus price target of around US$595.21, implying a potential upside. With a potential 20.4% increase, the outlook reflects analyst optimism about revenue growth driven by the pending Ansys acquisition and advancements in AI-powered solutions. Nonetheless, the reliance on conditions such as successful integration and AI sector stability makes these projections sensitive to market dynamics and company execution.

Learn about Synopsys' historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNPS

Synopsys

Provides electronic design automation software products used to design and test integrated circuits.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives