- Italy

- /

- Electrical

- /

- BIT:PRY

Prysmian S.p.A. (BIT:PRY) Looks Interesting, And It's About To Pay A Dividend

Readers hoping to buy Prysmian S.p.A. (BIT:PRY) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Therefore, if you purchase Prysmian's shares on or after the 22nd of April, you won't be eligible to receive the dividend, when it is paid on the 24th of April.

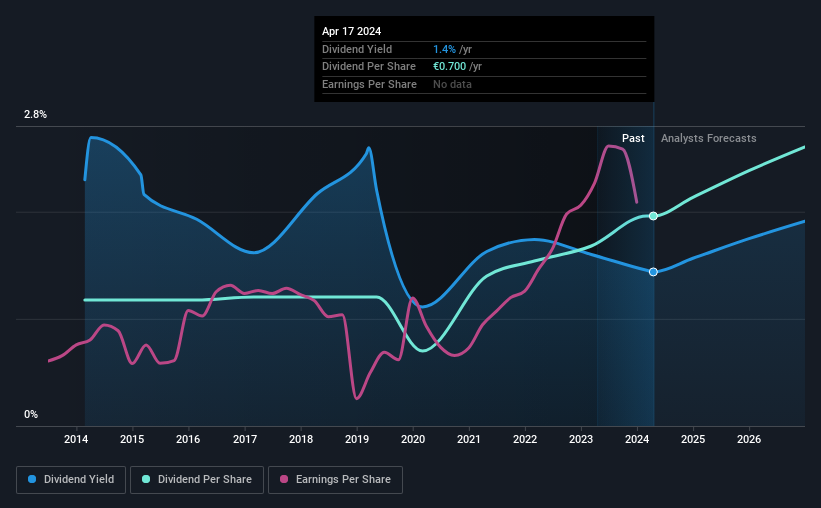

The company's next dividend payment will be €0.70 per share. Last year, in total, the company distributed €0.70 to shareholders. Based on the last year's worth of payments, Prysmian has a trailing yield of 1.4% on the current stock price of €48.68. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Prysmian

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fortunately Prysmian's payout ratio is modest, at just 36% of profit. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Luckily it paid out just 20% of its free cash flow last year.

It's positive to see that Prysmian's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. That's why it's comforting to see Prysmian's earnings have been skyrocketing, up 52% per annum for the past five years. Earnings per share have been growing very quickly, and the company is paying out a relatively low percentage of its profit and cash flow. This is a very favourable combination that can often lead to the dividend multiplying over the long term, if earnings grow and the company pays out a higher percentage of its earnings.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the past 10 years, Prysmian has increased its dividend at approximately 5.2% a year on average. Earnings per share have been growing much quicker than dividends, potentially because Prysmian is keeping back more of its profits to grow the business.

Final Takeaway

Should investors buy Prysmian for the upcoming dividend? Prysmian has grown its earnings per share while simultaneously reinvesting in the business. Unfortunately it's cut the dividend at least once in the past 10 years, but the conservative payout ratio makes the current dividend look sustainable. Overall we think this is an attractive combination and worthy of further research.

In light of that, while Prysmian has an appealing dividend, it's worth knowing the risks involved with this stock. Case in point: We've spotted 2 warning signs for Prysmian you should be aware of.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:PRY

Prysmian

Produces, distributes, and sells power and telecom cables and systems, and related accessories under the Prysmian, Draka, and General Cable brands worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)