- United States

- /

- Machinery

- /

- NasdaqCM:MVST

Spotlight On Promising Penny Stocks For August 2025

Reviewed by Simply Wall St

As August 2025 unfolds, the U.S. stock market is experiencing a mix of optimism and caution, with investors closely watching major indices that have recently hit record highs. Amid this backdrop, penny stocks remain an intriguing segment for those seeking opportunities in smaller or newer companies at lower price points. While the term "penny stocks" might seem outdated, these equities can still offer significant growth potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.265 | $484.33M | ✅ 5 ⚠️ 0 View Analysis > |

| ATRenew (RERE) | $4.475 | $1B | ✅ 3 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.785 | $647.38M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.15 | $191.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.99 | $264.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.005 | $23.87M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (TBTC) | $4.55 | $20.27M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.9423 | $6.81M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.00 | $90.86M | ✅ 3 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.85 | $166.03M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 385 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Microvast Holdings (MVST)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Microvast Holdings, Inc. specializes in battery technologies for electric vehicles and energy storage solutions, with a market cap of approximately $877.14 million.

Operations: The company generates revenue primarily from its Batteries / Battery Systems segment, which accounted for $422.61 million.

Market Cap: $877.14M

Microvast Holdings, Inc. has been navigating a challenging financial landscape with its focus on battery technologies for electric vehicles and energy storage solutions. Despite being unprofitable, the company reported a revenue increase to US$91.34 million in Q2 2025 from US$83.68 million the previous year, while net losses widened slightly to US$106.06 million. The company maintains a high net debt to equity ratio of 79.9% but benefits from an experienced management team and sufficient cash runway exceeding three years, even as it continues investing in growth amid volatile stock performance and recent index inclusions across multiple Russell benchmarks.

- Navigate through the intricacies of Microvast Holdings with our comprehensive balance sheet health report here.

- Gain insights into Microvast Holdings' future direction by reviewing our growth report.

GoPro (GPRO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GoPro, Inc. is a company that offers cameras, mountable and wearable accessories, along with subscription services across various regions including the Americas, Europe, the Middle East, Africa, and the Asia Pacific; it has a market cap of approximately $0.19 billion.

Operations: The company generates revenue primarily from its Photographic Equipment & Supplies segment, which accounted for $746.73 million.

Market Cap: $191.4M

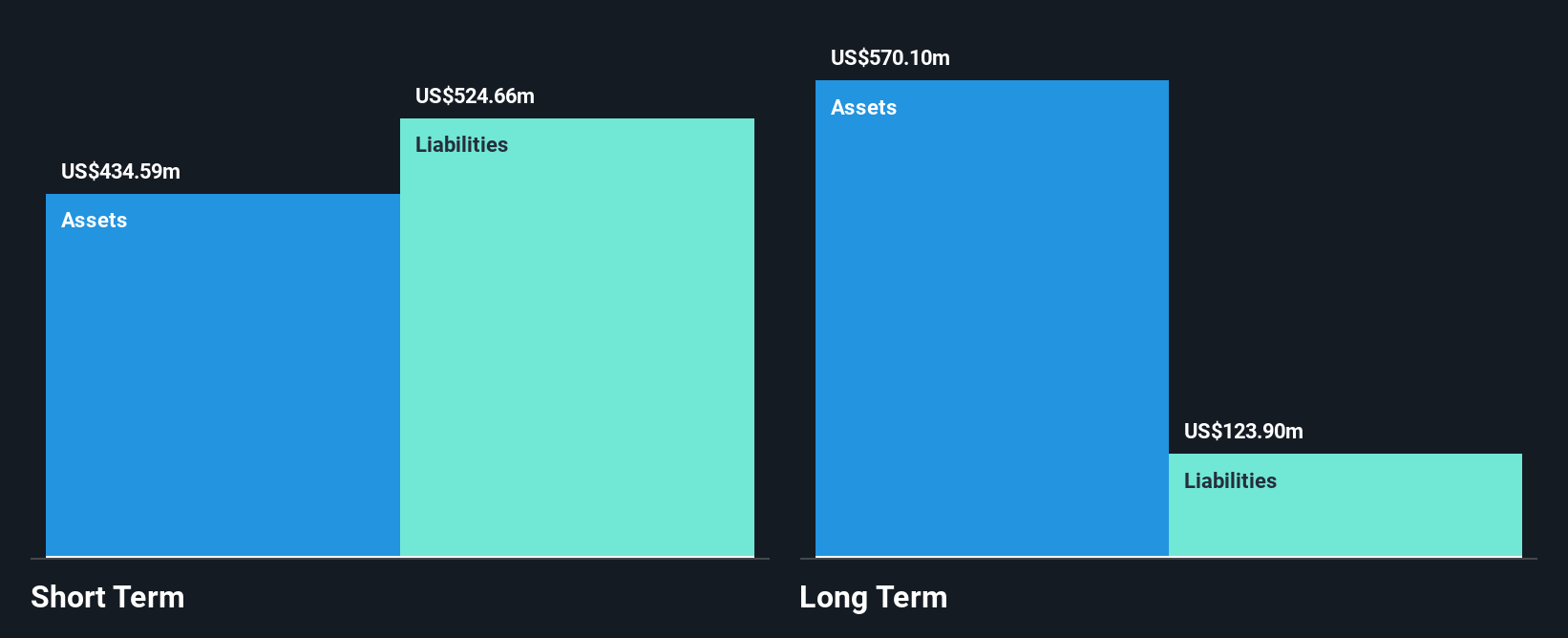

GoPro, Inc. faces financial challenges as it navigates the competitive landscape of photographic equipment and supplies. Despite a market cap of US$0.19 billion, the company remains unprofitable with a negative return on equity and increased losses over five years. Recent earnings guidance indicates revenue declines for Q3 2025 by 38% year-over-year to approximately US$160 million. While GoPro's debt to equity ratio has improved, its short-term assets fall short of covering liabilities, prompting strategic debt financing initiatives including a US$50 million secured term loan to bolster liquidity and repay convertible debt maturing in November 2025.

- Get an in-depth perspective on GoPro's performance by reading our balance sheet health report here.

- Gain insights into GoPro's outlook and expected performance with our report on the company's earnings estimates.

ProPetro Holding (PUMP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ProPetro Holding Corp. is an integrated oilfield services company with a market cap of approximately $515.68 million.

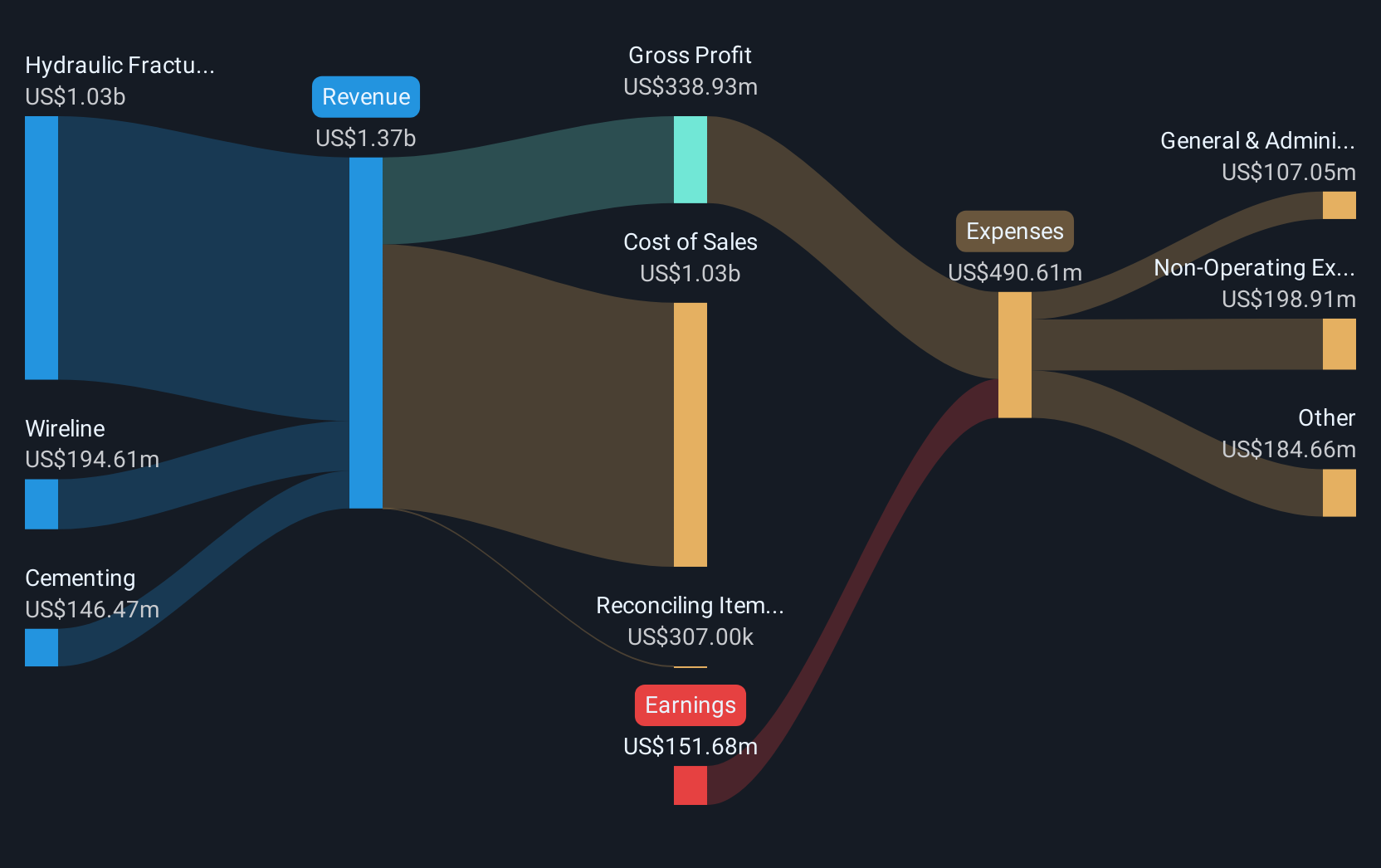

Operations: The company's revenue is primarily derived from its Hydraulic Fracturing segment, which generated $1.03 billion, followed by Wireline and Cementing services contributing $194.61 million and $146.47 million respectively.

Market Cap: $515.68M

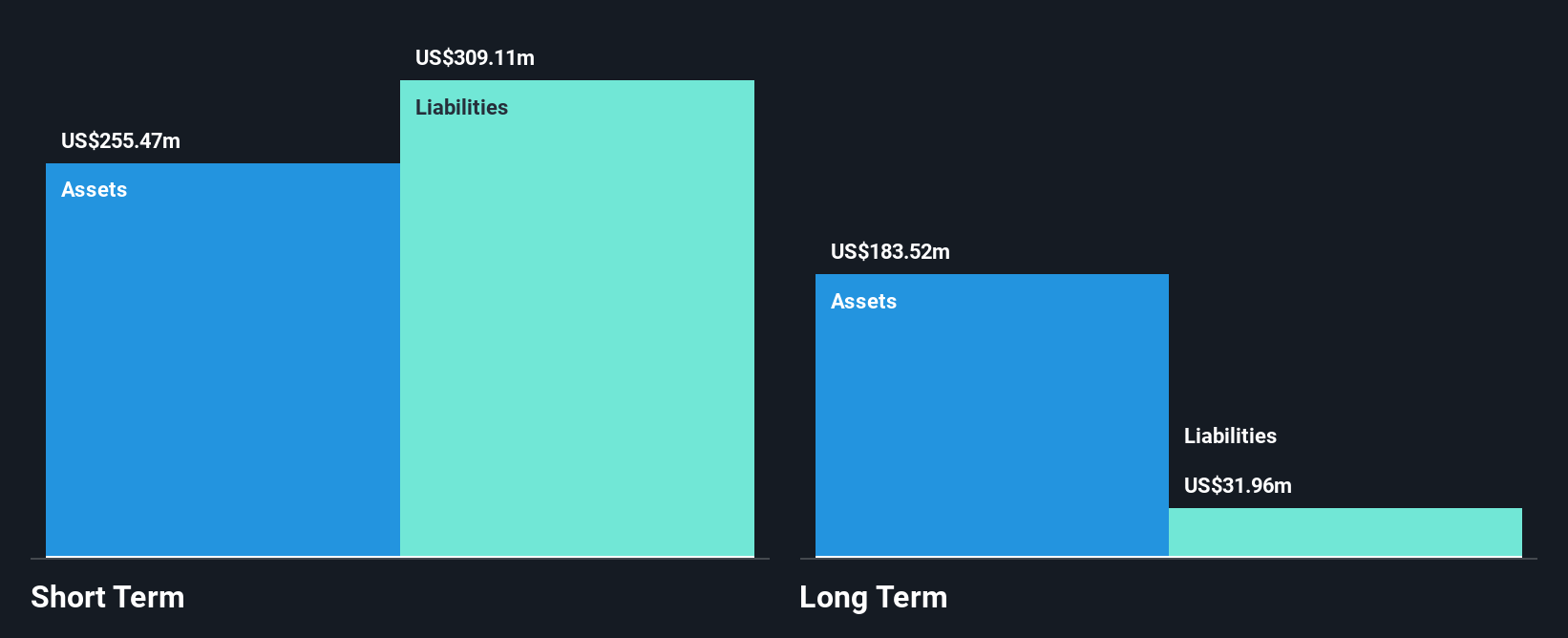

ProPetro Holding Corp., with a market cap of US$515.68 million, faces challenges as an unprofitable entity in the oilfield services sector. Despite generating significant revenue from its Hydraulic Fracturing segment (US$1.03 billion), the company reported a net loss of US$7.16 million for Q2 2025, compared to a smaller loss last year. Management changes include appointing Caleb Weatherl as CFO, potentially bringing fresh strategic insights. The company's short-term assets exceed liabilities, indicating sound liquidity management despite increased debt levels over five years and recent exclusion from key indices like the Russell 2000 Defensive Index.

- Unlock comprehensive insights into our analysis of ProPetro Holding stock in this financial health report.

- Evaluate ProPetro Holding's prospects by accessing our earnings growth report.

Seize The Opportunity

- Unlock our comprehensive list of 385 US Penny Stocks by clicking here.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MVST

Microvast Holdings

Provides battery technologies for electric vehicles and energy storage solutions.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives