- Turkey

- /

- Capital Markets

- /

- IBSE:HUBVC

Spotlight On Middle Eastern Penny Stocks: Hub Girisim Sermayesi Yatirim Ortakligi Leads The Trio

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently seen a rebound, with UAE bourses recovering as energy and financial shares climb. For investors willing to explore beyond the well-known giants, penny stocks—typically representing smaller or newer companies—remain an intriguing area of interest. Despite being a term from past market eras, these stocks can offer a mix of affordability and growth potential when backed by strong financials. In this article, we highlight three penny stocks that stand out for their financial strength in the current market landscape.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.71 | SAR2.11B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.69 | SAR1.48B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.835 | ₪344.3M | ✅ 3 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.04 | AED2.1B | ✅ 5 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.30 | AED381.15M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.08 | AED13.05B | ✅ 2 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.82 | AED503.63M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.705 | ₪212.34M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 79 stocks from our Middle Eastern Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hub Girisim Sermayesi Yatirim Ortakligi A.S. operates as a venture capital investment trust with a market capitalization of TRY840 million.

Operations: No revenue segments have been reported for this venture capital investment trust.

Market Cap: TRY840M

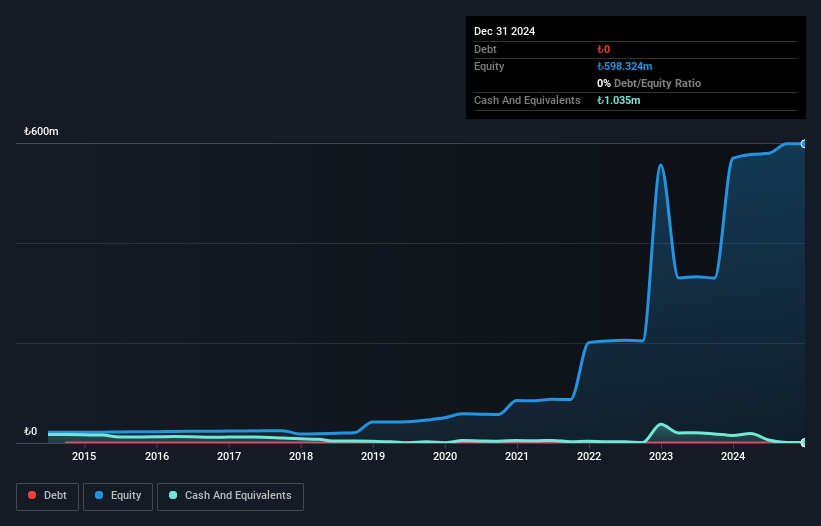

Hub Girisim Sermayesi Yatirim Ortakligi A.S., a venture capital investment trust with a market cap of TRY840 million, is currently pre-revenue and unprofitable, having reported a net loss of TRY 373.1 million for the first half of 2025. Despite its financial challenges, the company benefits from being debt-free and having sufficient short-term assets to cover liabilities. Additionally, it maintains a cash runway exceeding three years even as free cash flow shrinks. However, its share price remains highly volatile and its board lacks seasoned experience with an average tenure below three years.

- Click here to discover the nuances of Hub Girisim Sermayesi Yatirim Ortakligi with our detailed analytical financial health report.

- Assess Hub Girisim Sermayesi Yatirim Ortakligi's previous results with our detailed historical performance reports.

Neft Alsharq For Chemical Industry (SASE:9605)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Neft Alsharq For Chemical Industry Company specializes in the manufacturing and sale of industrial motor oils, as well as lithium and calcium greases, with a market cap of SAR94.50 million.

Operations: The company generates revenue primarily from its Oil Sales Sector, amounting to SAR74.96 million.

Market Cap: SAR94.5M

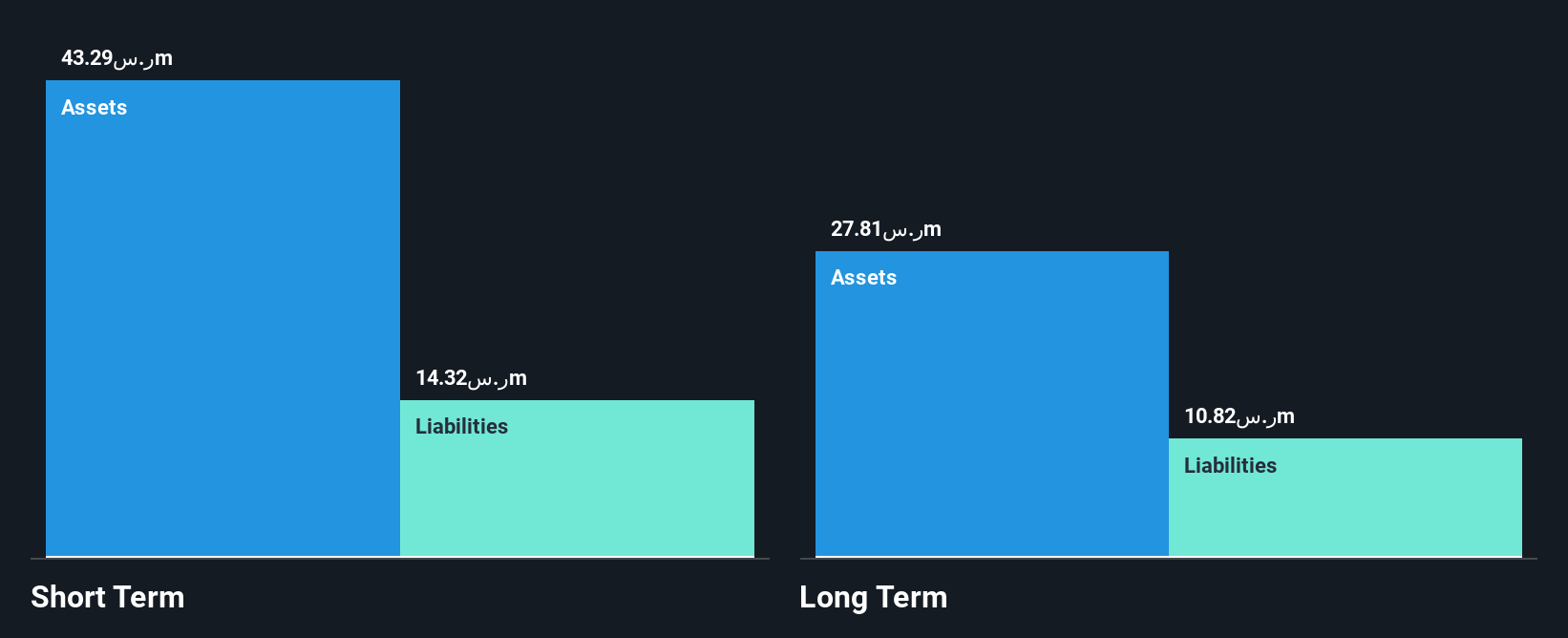

Neft Alsharq For Chemical Industry, with a market cap of SAR94.50 million, has shown revenue growth in its Oil Sales Sector but faces challenges with recent net losses of SAR1.91 million for the half year ended June 2025. Despite stable weekly volatility and satisfactory net debt to equity ratio (4.4%), the company struggles with negative operating cash flow and low return on equity (0.9%). The launch of Petro Neft service centers aims to diversify income and improve long-term profitability, yet current profit margins have declined from last year. Short-term assets comfortably cover both short- and long-term liabilities, indicating financial stability amidst expansion efforts.

- Jump into the full analysis health report here for a deeper understanding of Neft Alsharq For Chemical Industry.

- Learn about Neft Alsharq For Chemical Industry's historical performance here.

Big Tech 50 R&D-Limited Partnership (TASE:BIGT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Big Tech 50 R&D-Limited Partnership focuses on investing in technology companies in Israel and has a market cap of ₪18.76 million.

Operations: The revenue segment for Big Tech 50 R&D-Limited Partnership, identified as "Blank Checks," shows a value of -$2.08 million.

Market Cap: ₪18.76M

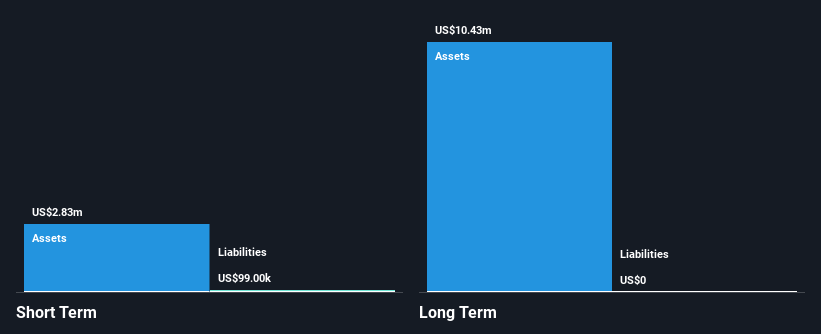

Big Tech 50 R&D-Limited Partnership, with a market cap of ₪18.76 million, is pre-revenue and currently unprofitable, experiencing increased losses over the past five years at an annual rate of 35.8%. Despite this, the company has no debt and maintains sufficient cash runway for over three years based on current free cash flow. Recent earnings results show a turnaround with net income of US$0.806 million for the half year ended June 30, 2025, compared to a loss in the previous year. However, its share price remains highly volatile and dividend sustainability is questionable due to insufficient coverage by earnings or free cash flows.

- Click here and access our complete financial health analysis report to understand the dynamics of Big Tech 50 R&D-Limited Partnership.

- Evaluate Big Tech 50 R&D-Limited Partnership's historical performance by accessing our past performance report.

Make It Happen

- Discover the full array of 79 Middle Eastern Penny Stocks right here.

- Interested In Other Possibilities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hub Girisim Sermayesi Yatirim Ortakligi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:HUBVC

Hub Girisim Sermayesi Yatirim Ortakligi

Hub Girisim Sermayesi Yatirim Ortakligi A.S.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives