- France

- /

- Oil and Gas

- /

- ENXTPA:EC

Some Total Gabon (EPA:EC) Shareholders Have Copped A Big 64% Share Price Drop

Generally speaking long term investing is the way to go. But no-one is immune from buying too high. For example the Total Gabon (EPA:EC) share price dropped 64% over five years. That's not a lot of fun for true believers. And it's not just long term holders hurting, because the stock is down 33% in the last year. The falls have accelerated recently, with the share price down 22% in the last three months. However, one could argue that the price has been influenced by the general market, which is down 25% in the same timeframe.

See our latest analysis for Total Gabon

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Total Gabon moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

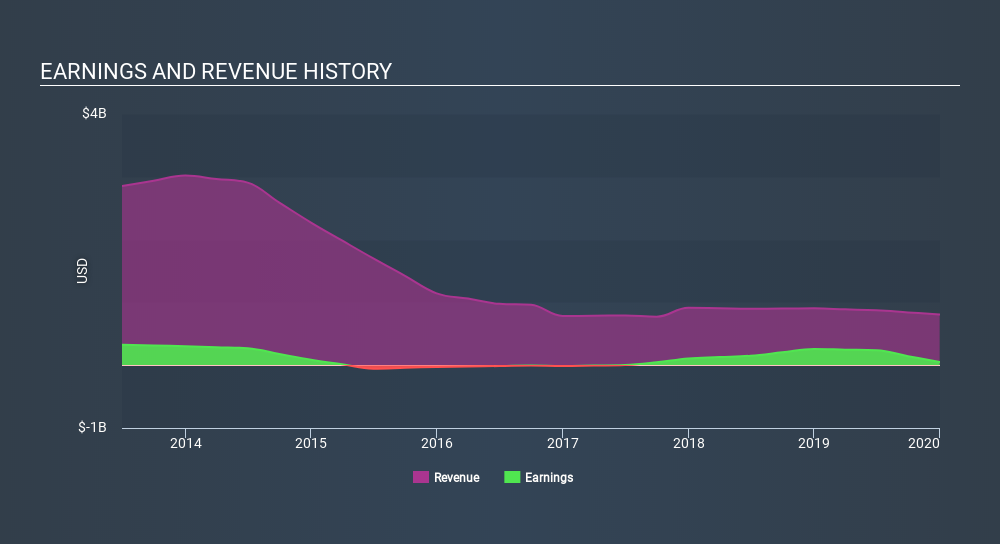

The steady dividend doesn't really explain why the share price is down. It could be that the revenue decline of 18% per year is viewed as evidence that Total Gabon is shrinking. With revenue weak, and increased payouts of cash, the market might be taking the view that its best days are behind it.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Total Gabon stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Total Gabon, it has a TSR of -57% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We regret to report that Total Gabon shareholders are down 28% for the year (even including dividends) . Unfortunately, that's worse than the broader market decline of 12%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 16% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Total Gabon better, we need to consider many other factors. For example, we've discovered 3 warning signs for Total Gabon that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ENXTPA:EC

TotalEnergies EP Gabon Société Anonyme

Engages in the mining, exploration, and production of crude oil in Gabon.

Excellent balance sheet second-rate dividend payer.