The simplest way to benefit from a rising market is to buy an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by creditshelf Aktiengesellschaft (ETR:CSQ) shareholders over the last year, as the share price declined 9.8%. That falls noticeably short of the market return of around 18%. Because creditshelf hasn't been listed for many years, the market is still learning about how the business performs.

Check out our latest analysis for creditshelf

creditshelf isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year creditshelf saw its revenue grow by 53%. That's well above most other pre-profit companies. Given the revenue growth, the share price drop of 9.8% seems quite harsh. Our sympathies to shareholders who are now underwater. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

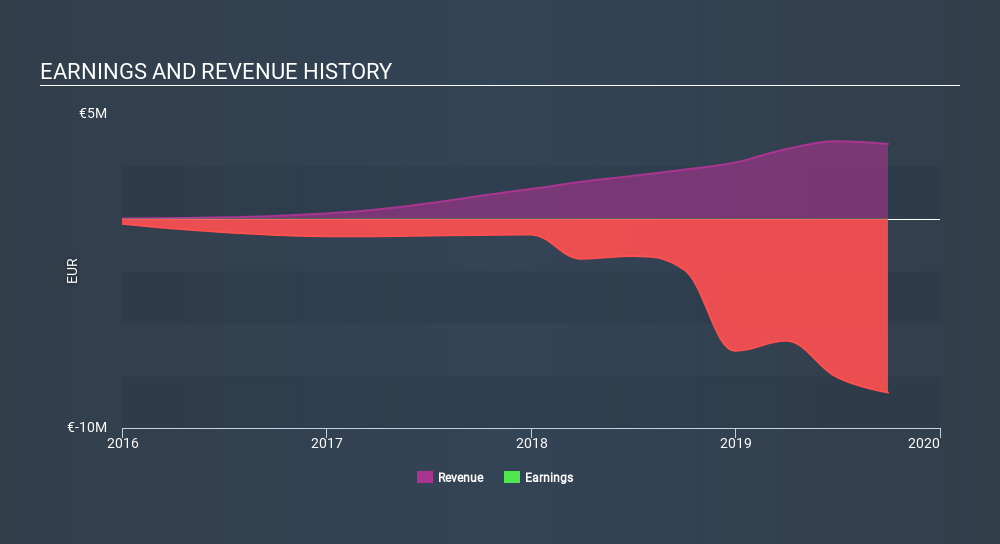

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While creditshelf shareholders are down 9.8% for the year, the market itself is up 18%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 0.9%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand creditshelf better, we need to consider many other factors. Be aware that creditshelf is showing 2 warning signs in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About XTRA:CSQ

creditshelf

Operates as a digital small and medium-sized enterprises financing company in Germany.

Slightly overvalued with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives