- United States

- /

- Hospitality

- /

- NasdaqGS:CBRL

Should You Use Cracker Barrel Old Country Store's (NASDAQ:CBRL) Statutory Earnings To Analyse It?

Broadly speaking, profitable businesses are less risky than unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. Today we'll focus on whether this year's statutory profits are a good guide to understanding Cracker Barrel Old Country Store (NASDAQ:CBRL).

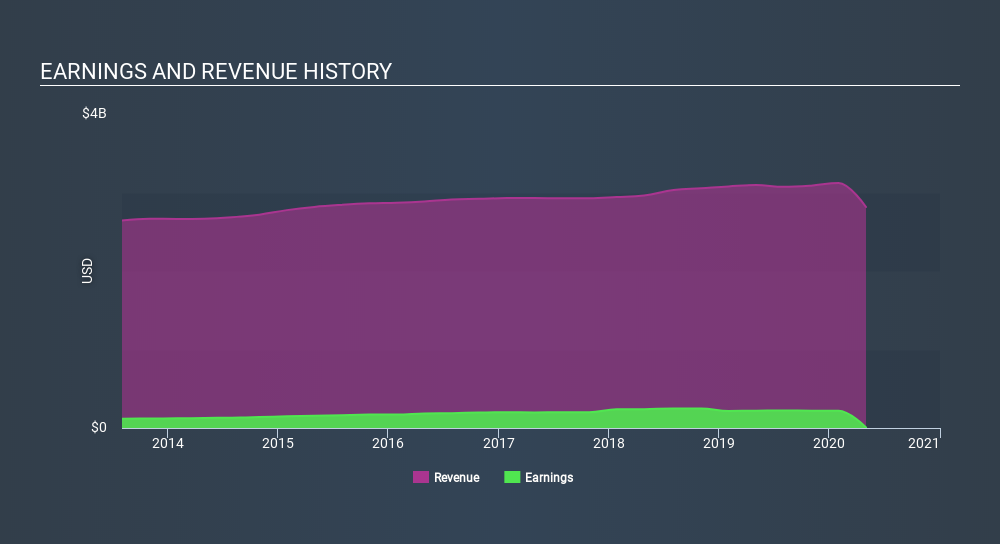

We like the fact that Cracker Barrel Old Country Store made a profit of US$7.48m on its revenue of US$2.81b, in the last year. The chart below shows that both revenue and profit have declined over the last three years.

See our latest analysis for Cracker Barrel Old Country Store

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. This article, will discuss how unusual items and a tax benefit have impacted Cracker Barrel Old Country Store's most recent bottom line results. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

Importantly, our data indicates that Cracker Barrel Old Country Store's profit was reduced by US$23m, due to unusual items, over the last year. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. If Cracker Barrel Old Country Store doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Cracker Barrel Old Country Store received a tax benefit which contributed US$23m to the bottom line. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! Of course, prima facie it's great to receive a tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Cracker Barrel Old Country Store's Profit Performance

In its last report Cracker Barrel Old Country Store received a tax benefit which might make its profit look better than it really is on a underlying level. Having said that, it also had a unusual item reducing its profit. Based on these factors, it's hard to tell if Cracker Barrel Old Country Store's profits are a reasonable reflection of its underlying profitability. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. At Simply Wall St, we found 4 warning signs for Cracker Barrel Old Country Store and we think they deserve your attention.

Our examination of Cracker Barrel Old Country Store has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NasdaqGS:CBRL

Cracker Barrel Old Country Store

Develops and operates the Cracker Barrel Old Country Store concept in the United States.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives