Should You Be Impressed By Inspirisys Solutions' (NSE:INSPIRISYS) Returns on Capital?

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. In light of that, when we looked at Inspirisys Solutions (NSE:INSPIRISYS) and its ROCE trend, we weren't exactly thrilled.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Inspirisys Solutions:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.10 = ₹89m ÷ (₹3.1b - ₹2.2b) (Based on the trailing twelve months to June 2020).

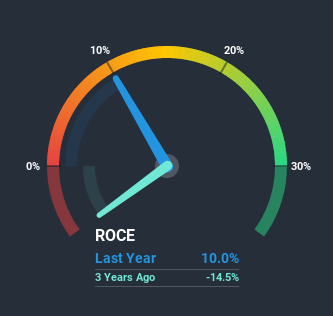

So, Inspirisys Solutions has an ROCE of 10.0%. Ultimately, that's a low return and it under-performs the IT industry average of 13%.

View our latest analysis for Inspirisys Solutions

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Inspirisys Solutions, check out these free graphs here.

What Can We Tell From Inspirisys Solutions' ROCE Trend?

We've noticed that although returns on capital are flat over the last five years, the amount of capital employed in the business has fallen 57% in that same period. When a company effectively decreases its assets base, it's not usually a sign to be optimistic on that company. Not only that, but the low returns on this capital mentioned earlier would leave most investors unimpressed.

On another note, while the change in ROCE trend might not scream for attention, it's interesting that the current liabilities have actually gone up over the last five years. This is intriguing because if current liabilities hadn't increased to 71% of total assets, this reported ROCE would probably be less than10.0% because total capital employed would be higher.The 10.0% ROCE could be even lower if current liabilities weren't 71% of total assets, because the the formula would show a larger base of total capital employed. So with current liabilities at such high levels, this effectively means the likes of suppliers or short-term creditors are funding a meaningful part of the business, which in some instances can bring some risks.What We Can Learn From Inspirisys Solutions' ROCE

It's a shame to see that Inspirisys Solutions is effectively shrinking in terms of its capital base. Since the stock has declined 55% over the last five years, investors may not be too optimistic on this trend improving either. On the whole, we aren't too inspired by the underlying trends and we think there may be better chances of finding a multi-bagger elsewhere.

If you want to continue researching Inspirisys Solutions, you might be interested to know about the 2 warning signs that our analysis has discovered.

While Inspirisys Solutions isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you decide to trade Inspirisys Solutions, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:INSPIRISYS

Inspirisys Solutions

Provides information technology services in India and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.