- United States

- /

- Commercial Services

- /

- NYSE:EBF

Shoe Carnival And 2 Other Leading Dividend Stocks

Reviewed by Simply Wall St

In the current U.S. market landscape, investors are navigating through a mix of geopolitical tensions and fluctuating oil prices, which have contributed to recent volatility in major indices like the Dow Jones Industrial Average and the S&P 500. Amid these uncertainties, dividend stocks such as Shoe Carnival offer a potential avenue for investors seeking steady income streams; these stocks can provide a cushion against market swings by delivering regular payouts regardless of broader economic conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.47% | ★★★★★★ |

| Southside Bancshares (SBSI) | 5.16% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.65% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.95% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 7.10% | ★★★★★★ |

| Ennis (EBF) | 5.34% | ★★★★★★ |

| Dillard's (DDS) | 6.28% | ★★★★★★ |

| Credicorp (BAP) | 5.09% | ★★★★★☆ |

| CompX International (CIX) | 4.96% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.37% | ★★★★★★ |

Click here to see the full list of 150 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Shoe Carnival (SCVL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shoe Carnival, Inc. operates as a family footwear retailer in the United States with a market cap of $520.75 million.

Operations: Shoe Carnival, Inc. generates revenue of $1.18 billion from the sale of footwear and related merchandise in the United States.

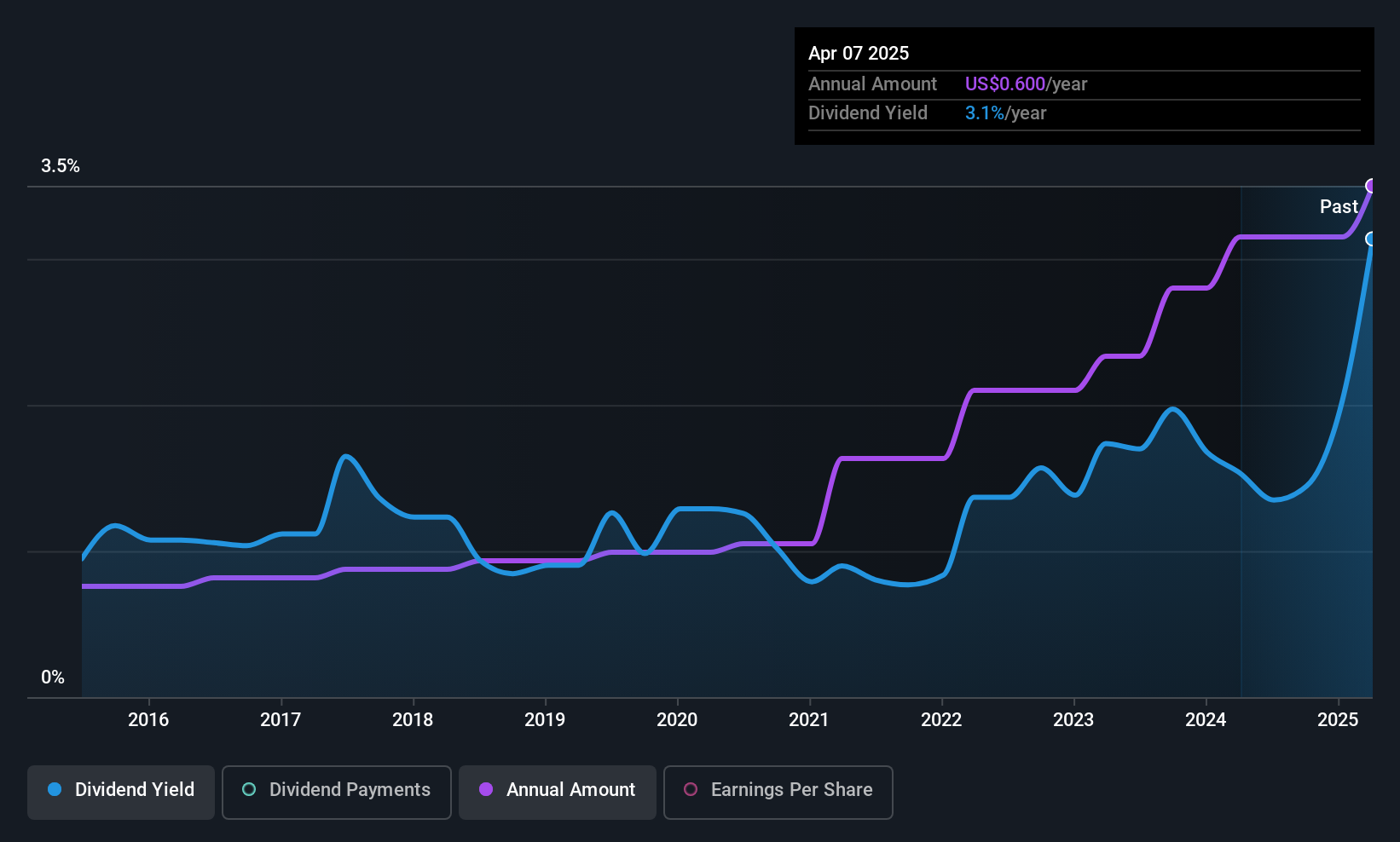

Dividend Yield: 3%

Shoe Carnival offers a stable dividend yield of 3%, though it's lower than the top U.S. dividend payers. The company recently increased its quarterly dividend to $0.15 per share, reflecting an annualized rate of $0.60 per share, underpinned by a sustainable payout ratio of 22.9% from earnings and 41.4% from cash flows. Despite recent earnings declines, dividends have been reliable over the past decade, supported by strategic leadership changes aimed at growth through acquisitions.

- Navigate through the intricacies of Shoe Carnival with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Shoe Carnival's current price could be quite moderate.

Ennis (EBF)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Ennis, Inc. produces and sells business forms and other printed products in the United States with a market cap of $475.66 million.

Operations: Ennis, Inc.'s revenue is primarily generated from its print segment, which accounts for $394.62 million.

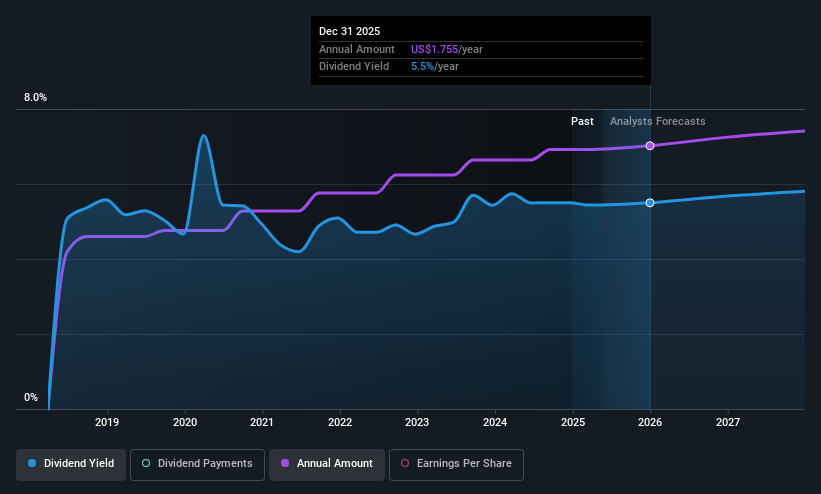

Dividend Yield: 5.3%

Ennis provides a compelling dividend profile with a 5.34% yield, placing it in the top 25% of U.S. dividend payers. The dividends are sustainable, underpinned by a payout ratio of 64.7% and cash payout ratio of 43%. Despite recent earnings declines, dividends have remained stable and reliable over the past decade. Recent board changes include nominating Wally Gruenes to succeed Michael Schaefer as Audit Committee chair, potentially enhancing governance oversight.

- Get an in-depth perspective on Ennis' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Ennis shares in the market.

VICI Properties (VICI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VICI Properties Inc. is an S&P 500 experiential real estate investment trust that owns a significant portfolio of gaming, hospitality, and entertainment destinations, including iconic venues like Caesars Palace Las Vegas and MGM Grand, with a market cap of approximately $33.94 billion.

Operations: VICI Properties Inc. generates its revenue primarily from real property and real estate lending activities, totaling approximately $3.88 billion.

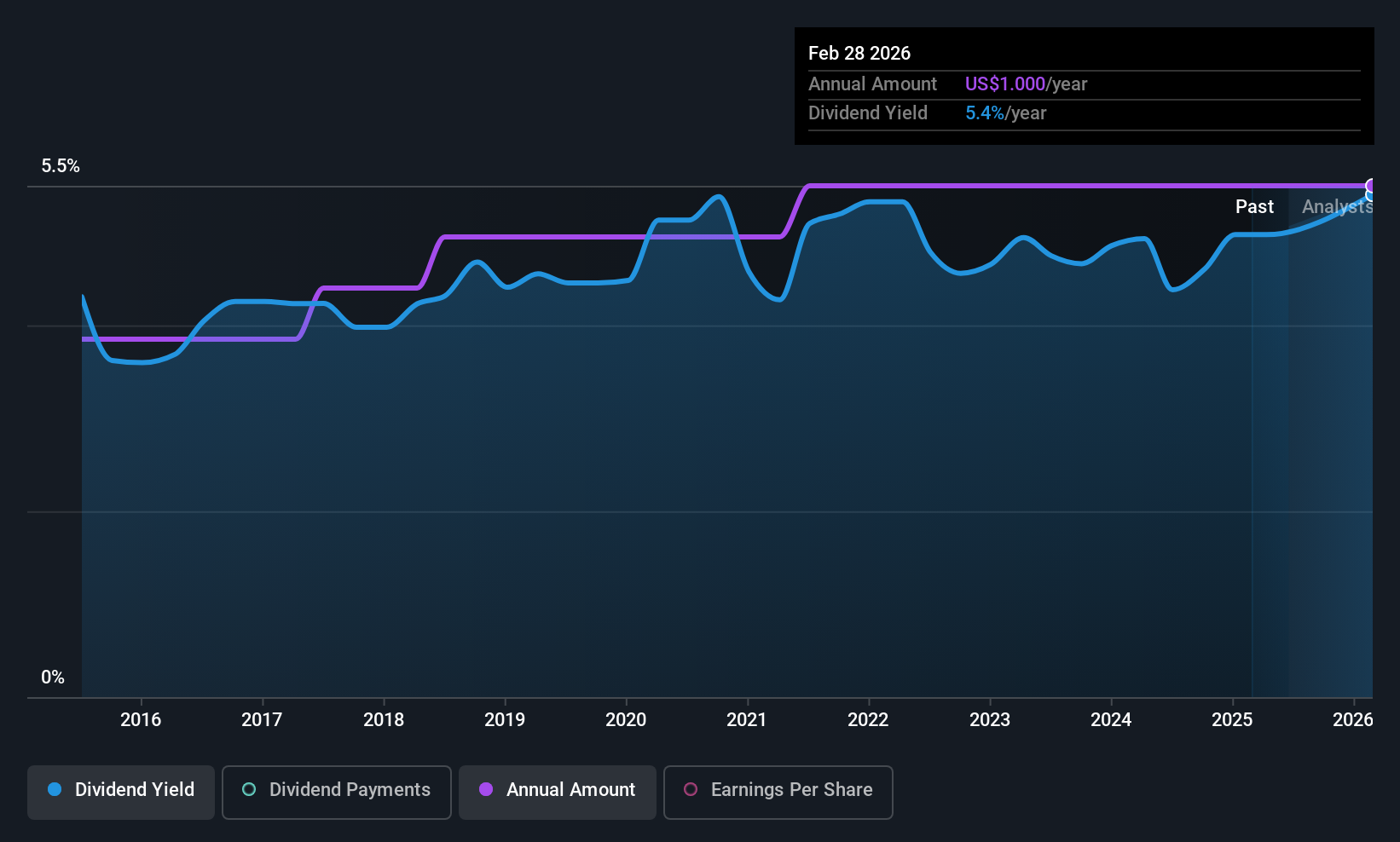

Dividend Yield: 5.4%

VICI Properties offers an attractive dividend yield of 5.38%, ranking in the top 25% of U.S. dividend payers, with a sustainable payout ratio of 67.5% and cash payout ratio of 75.2%. Recent earnings results show revenue growth to US$984.2 million, though net income slightly declined year-over-year to US$543.61 million. The company recently affirmed its quarterly dividend at $0.4325 per share, maintaining stability despite having paid dividends for less than a decade.

- Take a closer look at VICI Properties' potential here in our dividend report.

- Our valuation report unveils the possibility VICI Properties' shares may be trading at a discount.

Where To Now?

- Gain an insight into the universe of 150 Top US Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ennis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EBF

Ennis

Produces and sells business forms and other printed products in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives