- Australia

- /

- Diversified Financial

- /

- ASX:SZL

Sezzle (ASX:SZL) Stock Surges 43% Over Last Quarter

Reviewed by Simply Wall St

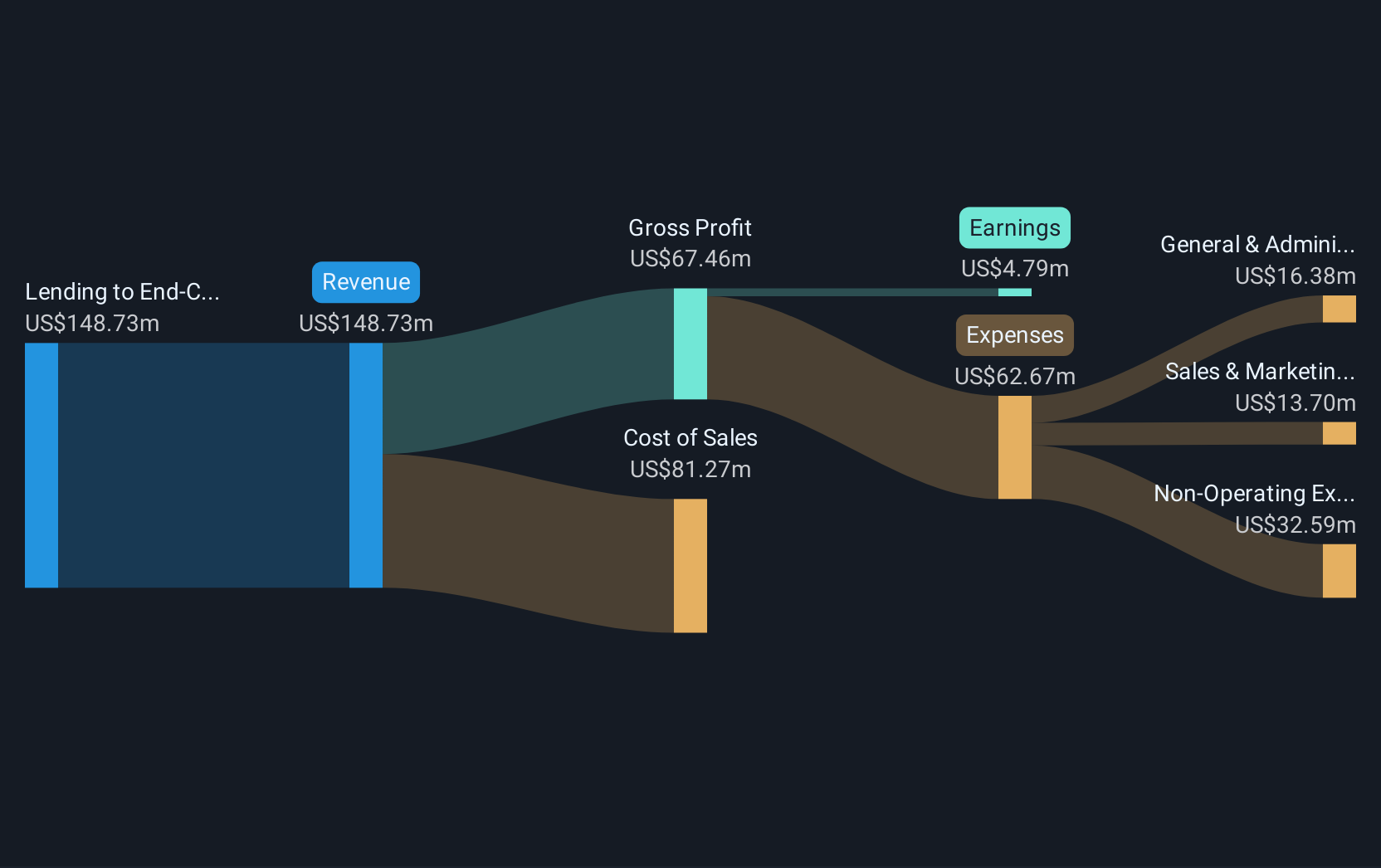

Sezzle (ASX:SZL) recently launched new consumer-focused features, including Sezzle Balance and Express Checkout, which are showing strong user adoption. Alongside these developments, the company faced exclusions from several indexes like the Russell 3000E, signaling market challenges. Despite these headwinds, Sezzle's share price rose 43% over the last quarter, a movement that aligns with its robust financial performance, including a considerable jump in net income. In contrast, market uncertainties surrounding Federal Reserve policies and mixed earnings reports from major banks contributed to broader stability, highlighting that Sezzle's gains are supported by its internal advancements.

We've identified 4 risks for Sezzle (3 are significant) that you should be aware of.

Over the last year, Sezzle's total shareholder return, which includes both share price appreciation and dividends, was 13.41%. This performance surpasses the Australian diversified financial industry's 4.7% return and the broader Australian market's 9.6% return over the same period. This outperformance is indicative of the company's growth initiatives and strong financial results, driven by innovative product offerings like Sezzle Balance and Express Checkout.

The company's recent developments, highlighted in the introduction, will likely have varying effects on future revenue and earnings forecasts. While new product features and partnerships may support higher revenue, market perception and financial projections could be impacted by the removal from Russell indices. This mixed outlook is further complicated by a forecasted decline in annual profit and revenue over the next three years. With the share price at A$24.35, there remains a gap to the analyst consensus price target of A$29.82, suggesting potential room for growth if the company can overcome some of these challenges and achieve its revised financial guidance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SZL

Sezzle

Operates as a technology-enabled payments company primarily in the United States and Canada.

Medium with questionable track record.

Similar Companies

Market Insights

Community Narratives