- Australia

- /

- Diversified Financial

- /

- ASX:SZL

Sezzle (ASX:SZL) Reports Earnings Growth and Raises Financial Guidance

Reviewed by Simply Wall St

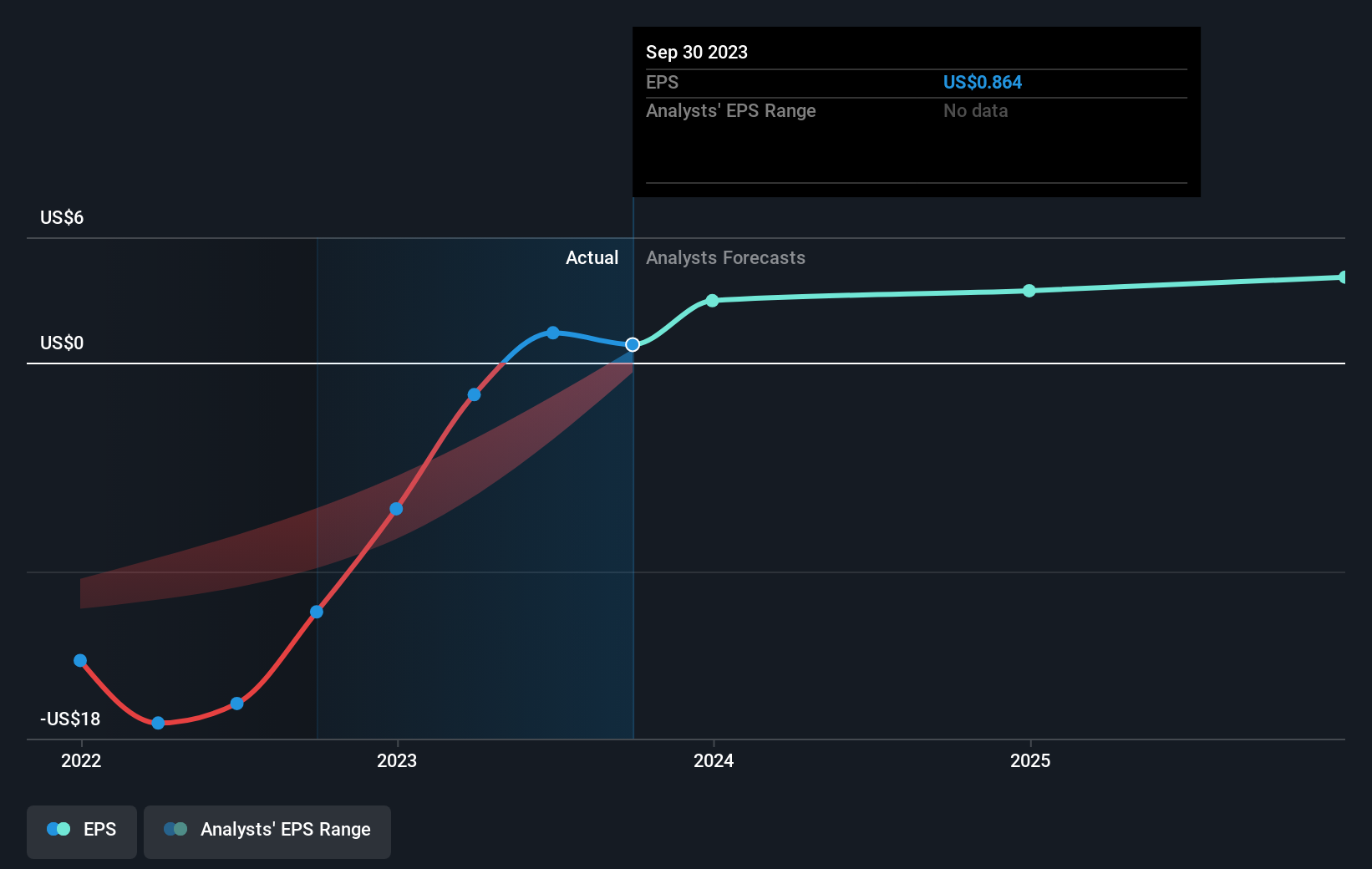

Sezzle (ASX:SZL) has recently introduced a suite of new features, including a price comparison tool and a digital wallet, which aim to enhance the user experience. During the last quarter, Sezzle announced significant earnings growth and raised its financial guidance, showcasing strong corporate performance. Meanwhile, the broader market experienced fluctuations due to macroeconomic concerns like new tariff implementations and weak job data, which did impact overall market sentiment. Additionally, Sezzle faced a setback when it was dropped from multiple Russell indices, potentially affecting its market visibility, although the company's share price still rose 43%, reflecting resilience amidst these mixed influences.

Over the past year, Sezzle (ASX:SZL) shares have achieved a total return of 13.41%. This performance is particularly strong given the backdrop of broader economic fluctuations. In comparison, while Sezzle outpaced the Australian Diversified Financial industry, which returned 4.7%, it also exceeded the overall Australian market, which returned 9.6% in the same period. These figures highlight Sezzle's ability to outperform despite market volatility.

The company's recent innovations, such as the digital wallet and cost-saving tools, alongside substantial earnings growth, are likely contributing factors to its robust financial performance. Moreover, with raised financial guidance expecting significant revenue growth, these developments are poised to impact future financial forecasts positively. However, despite the upbeat earnings outlook, Sezzle's current share price of A$24.35 trades below the analyst consensus price target of A$29.82, indicating potential further appreciation as market conditions align with the company's growth initiatives and improved earnings.

Click to explore a detailed breakdown of our findings in Sezzle's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SZL

Sezzle

Operates as a technology-enabled payments company primarily in the United States and Canada.

Medium with questionable track record.

Similar Companies

Market Insights

Community Narratives