- United States

- /

- Software

- /

- NYSE:NOW

ServiceNow (NYSE:NOW) Revolutionizes LOTO Management With New AI-Powered CTRL WRK Platform

Reviewed by Simply Wall St

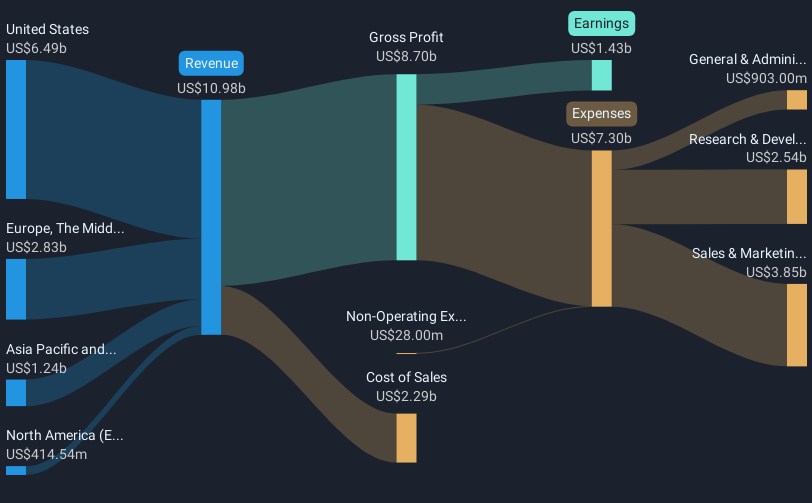

The recent launch of CTRL WRK on the ServiceNow Store marks an important development for ServiceNow (NYSE:NOW) in enhancing operational risk management with artificial intelligence-driven features. This major client announcement likely contributed positively to the company’s 11% price increase over the last quarter. Additionally, ServiceNow's positive earnings report, which highlighted significant revenue growth, and ongoing strategic partnerships, such as those with Juniper Networks and Tanium, added to the upward momentum amid a generally favorable market environment. Despite broader market fluctuations and global trade tensions, ServiceNow's advancements and partnerships helped sustain its upward trend.

Be aware that ServiceNow is showing 2 warning signs in our investment analysis.

The introduction of CTRL WRK to the ServiceNow Store signifies a key advancement in ServiceNow's push towards AI-enhanced operational risk management, which could bolster its long-term growth strategy despite potential short-term revenue fluctuations. The development supports ServiceNow’s narrative of prioritizing AI-driven solutions, potentially affecting earnings forecasts as the hybrid pricing model may initially impact revenue visibility. Over the past five years, ServiceNow's shares delivered a remarkable total return of 161.51%, indicating robust fundamental growth, compared to a one-year performance where it surpassed both the US market's 11.5% and US Software industry's 23.4% returns.

Recent strides such as strategic partnerships and positive earnings alignment have reinforced ServiceNow's competitive position, potentially offsetting pricing pressures amid an evolving AI landscape. Despite these advancements, the company's present share price of US$812.70 remains below the consensus price target of US$1082.92, indicating a 7.1% discount. This signals potential room for growth should the AI-focused initiatives pan out as envisioned. Moreover, these expansions could pressure net margins and prompt near-term revenue volatility given the geopolitical and currency-related challenges, but may offer longer-term operational gains. Therefore, while the news propels ServiceNow toward future capabilities, investors must weigh these developments against current valuation metrics.

Our expertly prepared valuation report ServiceNow implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives