Sanofi (ENXTPA:SAN) Partners With Viz.ai To Enhance AI Solutions For COPD Management

Reviewed by Simply Wall St

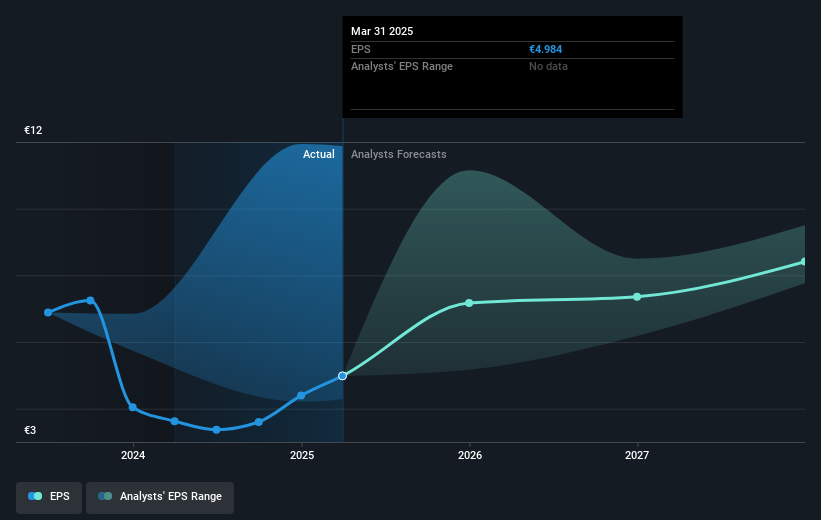

Sanofi (ENXTPA:SAN) recently entered into a multi-year partnership with Viz.ai and Regeneron to develop an AI-powered solution for COPD management, reflecting its focus on innovation. Over the last month, the company’s stock increased by 1.71%, paralleling broader market trends, which have seen modest gains amid easing trade concerns and strong corporate earnings. This stock movement coincides with Sanofi's robust Q1 earnings growth and a significant share buyback completion. The company’s announcements of acquisitions and ongoing corporate strategies have likely complemented the market's positive sentiments, contributing to the slight rise in its share price.

Buy, Hold or Sell Sanofi? View our complete analysis and fair value estimate and you decide.

The recent partnership between Sanofi and Viz.ai emphasizes a commitment to innovation, potentially bolstering the company's growth narrative by enhancing its reputation in AI-powered medical solutions. This strategic move aligns with Sanofi's focus on expanding its market penetration through new product launches like Dupixent and vaccines, possibly influencing revenue and earnings positively. Analysts foresee a revenue growth of 4.3% annually over the next three years, driven by these strategic advancements, although competitive and regulatory pressures remain challenges.

Over the last five years, Sanofi's total shareholder return, including dividends, was 28.21%, reflecting a reasonable performance in a volatile market. In the past year, Sanofi outperformed the French Pharmaceuticals industry with a return of 1%, compared to the industry's broader trends. Currently, Sanofi’s share price of €95.9 sits at a discount to the consensus price target of €117.70, suggesting potential growth opportunities ahead. If the partnership proves successful, it could strengthen revenue and earnings projections, justifying the current price target estimates.

Gain insights into Sanofi's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAN

Sanofi

A healthcare company, engages in the research, development, manufacture, and marketing of therapeutic solutions in the United States, Europe, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives