- United States

- /

- Insurance

- /

- NYSE:RYAN

Ryan Specialty Holdings (NYSE:RYAN) Amends Certificate Of Incorporation After Stockholder Vote

Reviewed by Simply Wall St

Ryan Specialty Holdings (NYSE:RYAN) recently approved amendments to its bylaws at the 2025 annual stockholders meeting. During the past month, the company’s share price experienced an increase of 3.6%. This movement aligns with a broader market uptick, where the Dow Jones, S&P 500, and Nasdaq indices also reported gains amid positive trade discussions between the U.S. and China. The amendments in the company's corporate structure might have added some weight to its share price progress, though its movement mainly mirrored the general market trend of rising investor confidence during this period.

Find companies with promising cash flow potential yet trading below their fair value.

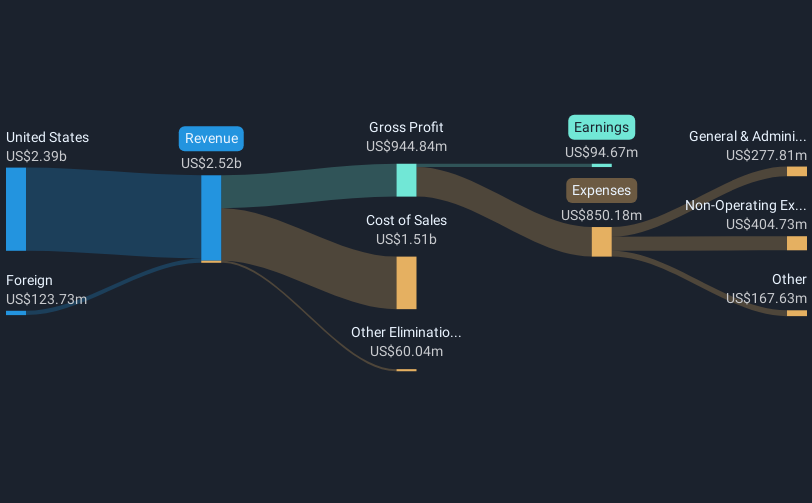

Ryan Specialty Holdings' recent bylaw amendments could influence its revenue and earnings predictions by bolstering investor confidence, potentially supporting positive market sentiment and share price momentum. Over the past three years, Ryan Specialty achieved a total return of 88.26%, indicating significant long-term value growth for shareholders. This is particularly notable, as the company outperformed the US Insurance industry and broader market over the past year, surpassing their respective returns of 19.6% and 12.6%.

The amendments may impact analysts' revenue and earnings projections, which already anticipate Ryan Specialty's revenue to grow by 18.3% annually over the next three years. This growth is expected alongside a substantial increase in profit margins from 2% to 27.1%. However, factors such as reliance on acquisitions and economic uncertainties remain key considerations. The company's current share price of US$69.23 remains 8.8% below the analyst consensus price target of US$75.9, suggesting analysts see further room for potential growth. As always, it's crucial for investors to evaluate these factors against their own assumptions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RYAN

Ryan Specialty Holdings

Operates as a service provider of specialty products and solutions for insurance brokers, agents, and carriers in the United States, Canada, the United Kingdom, rest of Europe, India, and Singapore.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives