- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

Robinhood Markets (NasdaqGS:HOOD) Reports Remarkable Q1 2025 Earnings Performance

Reviewed by Simply Wall St

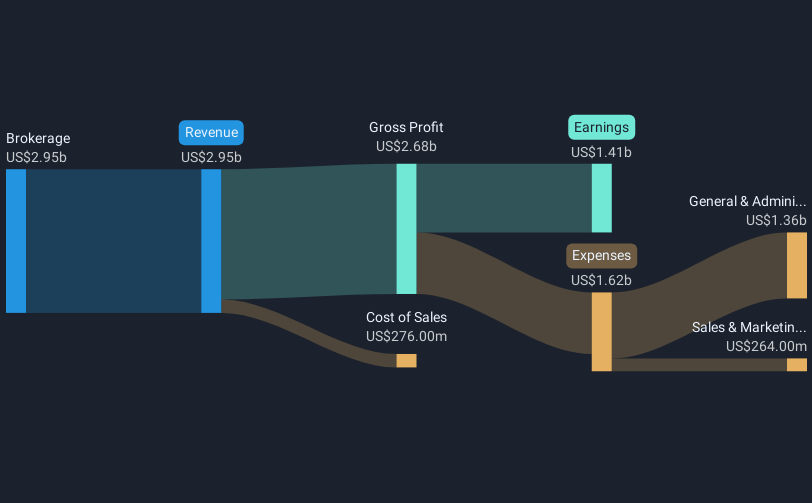

Robinhood Markets (NasdaqGS:HOOD) recently declared its Q1 2025 earnings, showcasing a remarkable increase in revenue and net income. This financial performance was complemented by their $500 million expansion in the share buyback program, potentially influencing the 61% jump in the company's stock price over the last quarter. The recent addition of Robinhood to the FTSE All-World Index possibly further bolstered investor confidence. Despite concerns in broader markets due to ongoing trade talks and economic data, Robinhood’s strong quarterly results underscore its active engagement in boosting shareholder value.

We've identified 2 risks for Robinhood Markets that you should be aware of.

Robinhood's Q1 2025 earnings report highlights substantial revenue and net income growth, alongside a US$500 million share buyback, potentially driving recent share price gains. This performance aligns with strategic expansions into futures, crypto, and international markets, reinforcing its growth narrative. Over the past three years, Robinhood's total returns, including dividends, soared over 762% —an impressive feat compared to a typical market performance. In the shorter term, Robinhood's shares outpaced both the US Capital Markets industry, returning significantly more than the industry’s 25.1% over the past year, and the broader US Market, which saw an 11.6% return.

Robinhood's entry into the FTSE All-World Index could further enhance its visibility and investor confidence, possibly influencing future revenue and earnings growth. Current analyst forecasts expect revenue growth of 11.8% annually, with earnings slightly decreasing over three years. However, these estimates face challenges from regulatory shifts and competitive pressures. The recent share price of US$48.69 remains 17.9% below the analyst consensus price target of US$59.29, suggesting potential upside but also indicating a premium valuation risk that investors must assess. Investors should consider these aspects while forming views on Robinhood's likely trajectory.

Assess Robinhood Markets' previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives