- United States

- /

- Aerospace & Defense

- /

- NYSE:RDW

Redwire (NYSE:RDW) Secures Contract for Space-Based Cancer Research with Aspera Biomedicines

Reviewed by Simply Wall St

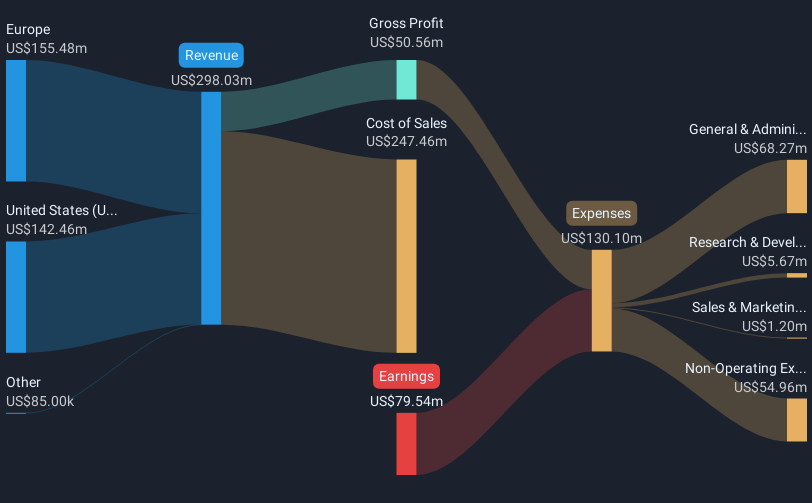

Redwire (NYSE:RDW) recently secured a contract from Aspera Biomedicines to utilize its Pharmaceutical In-space Laboratory for cancer research, potentially impacting its stock performance. The company saw its share price rise by 14% last month, in part reflecting broader market trends, which were up by 12% over the past year. Redwire's recent financial reports showed improved net loss figures despite a decline in sales, while new contracts, such as the delivery of an ESA Comet Interceptor onboard computer, further aligned with these positive developments. These elements, alongside shareholder-approved governance changes, likely added weight to the stock's upward trajectory.

We've spotted 3 possible red flags for Redwire you should be aware of.

The recent contract win from Aspera Biomedicines, allowing Redwire to use its Pharmaceutical In-space Laboratory for cancer research, is poised to bolster the company's strategic positioning. This development could not only enhance Redwire's reputation as an innovative space solution provider but also potentially contribute to revenue growth by integrating high-margin microgravity manufacturing opportunities into its revenue streams. These advancements align with Redwire's narrative of leveraging technological expertise and partnerships to move up the value chain.

Over the past three years, Redwire's total shareholder return was 223.95%. This substantial return illustrates the company's capacity to deliver value to its investors, despite short-term fluctuations and financial challenges. In the past year, Redwire's share performance surpassed the US market, which returned 11.9%, and outpaced the US Aerospace & Defense industry, which returned 31.1%, indicating strong competitive standing.

Looking ahead, the Aspera Biomedicines contract, along with other secured projects, supports an optimistic outlook for revenue and earnings forecasts. Analysts project a shift from current losses to profitability within three years, with earnings expected to hit US$29.4 million by 2028. As Redwire continues to grow its pipeline, these initiatives may help overcome current challenges related to inconsistent cash flow and execution risks. With a trading price of US$11.23, the stock remains significantly below the consensus price target of US$25.80, suggesting potential upside if forecasted improvements materialize.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDW

Redwire

Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives