- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Recursion Pharmaceuticals (RXRX) Sees 14% Price Surge Over Last Month

Reviewed by Simply Wall St

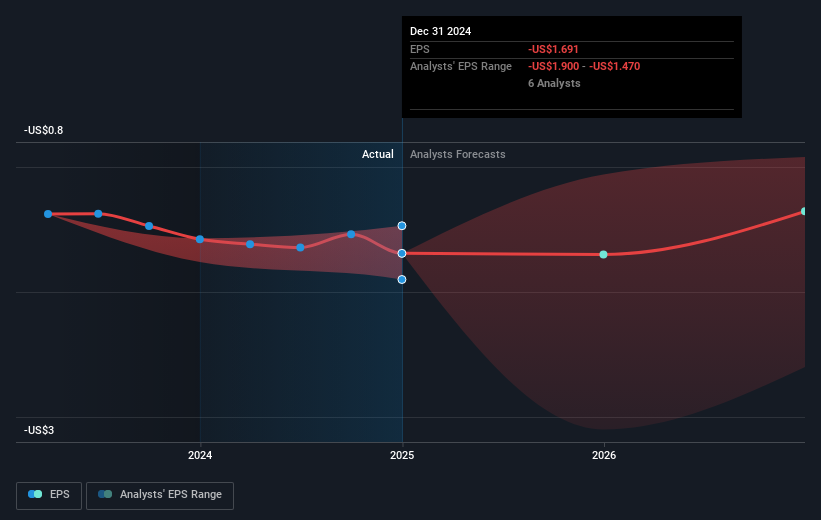

Recursion Pharmaceuticals (RXRX) recently experienced a share price increase of 14% over the last month. This upward movement comes amid a flat broader market trend in the last week and coincides with a stable market performance rising 15% over the past year. While the latest key developments surrounding the company have not been provided, any events from the last month would either reinforce or counteract the broader market dynamics. Despite market predictions anticipating 15% annual earnings growth in the coming years, RXRX's recent price shift stands out, potentially indicative of company-specific factors influencing investor sentiment.

Recursion Pharmaceuticals' recent uptick in share price could signify a shift in investor sentiment, aligning with ongoing trials and partnerships that underscore its potential for future growth. Despite a 23.26% decline in total shareholder returns over the past year, the recent 14% monthly rebound could reflect optimism surrounding the positive clinical trials of REC-617 and REC-994, as these developments promise enhanced revenue streams and potential earnings growth.

Within the past year, the company's performance, while underwhelming compared to a 15% rise in the broader market, remains affected by its significant cash burn and R&D expenditures, which weigh on profitability. Analysts project a revenue growth rate of 39.9% annually, suggesting that recent developments may bolster these projections, even though profitability remains elusive in the foreseeable future.

The current share price of US$5.84 is approximately 22% below the analysts' consensus price target of US$7.14. This gap implies potential upside, assuming that the drivers behind the share price increase materialize as anticipated. However, the disparity also highlights uncertainties, particularly given analysts' differing price targets ranging from US$4.00 to US$10.00. As investors evaluate the situation, these factors underscore both the potential and the risks inherent in Recursion Pharmaceuticals' evolving landscape.

Understand Recursion Pharmaceuticals' track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives