- United States

- /

- Beverage

- /

- NasdaqGS:PEP

PepsiCo (PEP) Raises Quarterly Dividend By 5% To US$1.42 Per Share

Reviewed by Simply Wall St

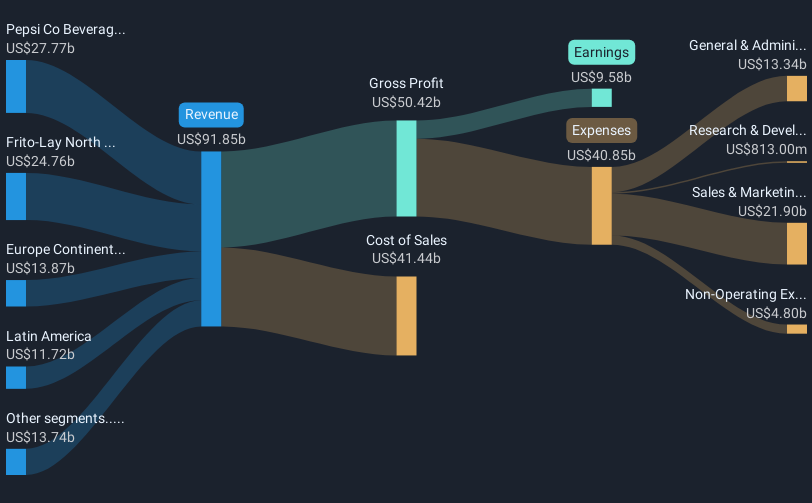

PepsiCo (PEP) recently announced a quarterly dividend affirmation, increasing it by 5%, which came alongside various strategic initiatives, including collaborations with brands like Cargill and Samii Ryan. Despite the company's net income experiencing a significant decline, its share move of 10% over the past month aligns with broader market trends where major indexes hit new highs. The positive sentiment from the dividend increase and share buyback announcements, combined with the broader market strength, provided support to PepsiCo's stock performance even as economic data and earnings drove market optimism overall.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

PepsiCo's recent announcement of a 5% dividend increase, alongside strategic collaborations with Cargill and Samii Ryan, aligns with its focus on market expansion and health-oriented products. These initiatives may bolster revenue growth and support premium pricing, contributing to a potential long-term positive impact on earnings. Despite a significant decline in net income, PepsiCo's stock increased by 10% in the past month, which correlates with stronger market trends. Over a five-year period, PepsiCo achieved a total shareholder return of 21.81%, reflecting a solid long-term performance despite short-term challenges.

Over the past year, however, PepsiCo underperformed both the US Beverage industry, which declined by 4.3%, and the US Market, which grew by 18%. The company's growth strategies, especially its international expansion and health trend adaptation, are expected to influence future earnings positively, yet higher agricultural input costs and sustainability demands pose risks. The current share price of US$144.51 sits below the analyst consensus price target of US$152.65, suggesting potential room for appreciation. The combination of market momentum, business strategies, and recent developments may support PepsiCo's revenue and earnings growth forecasts as outlined by analysts.

Gain insights into PepsiCo's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives