- United States

- /

- Professional Services

- /

- NasdaqGS:PAYX

Paychex (NasdaqGS:PAYX) Enhances Accountant Tools With New Partner Pro Portal

Reviewed by Simply Wall St

Paychex (NasdaqGS:PAYX) recently launched Paychex Partner Pro, an advanced accounting tool designed to enhance client management and advisory services for accountants. This development potentially added weight to the company's 6% share price increase over the last month, aligning with broader market trends where the market remained flat over the last week but increased 13% over the past year. The introduction of new, client-centric features might have bolstered investor confidence in Paychex's innovative capabilities, promoting a positive outlook despite the absence of specific market catalysts during the period.

Buy, Hold or Sell Paychex? View our complete analysis and fair value estimate and you decide.

Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

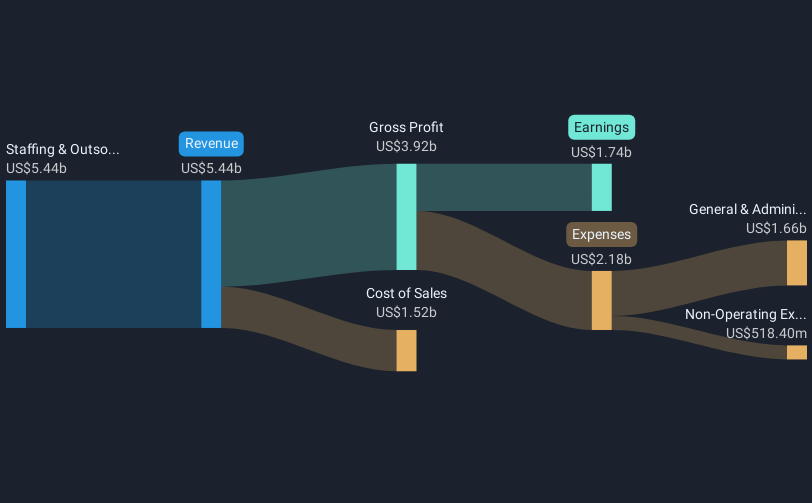

The introduction of Paychex's Paychex Partner Pro tool could strengthen the company's competitive edge, potentially boosting future revenue and client engagement. While this new development has been linked to a recent share price increase of 6%, it's important to consider the firm's long-term performance. Over the past five years, Paychex's total return, including share price and dividends, surged 133.9%, signaling robust growth compared to its industry peers, which returned 14.7% over the past year.

Currently trading around US$149.02, Paychex's share price is slightly above the consensus analyst price target of US$144.96. With the pending acquisition of Paycor and investment in AI tools, earnings and revenue forecasts may see upward revisions, though integration challenges and rising costs could impact margins. The markets seem to reflect a fair valuation, but the recent product rollout and strategic initiatives might offer additional revenue growth opportunities. However, given the minor discount of 6.84% to the analyst target, potential investors should weigh these developments against inherent risks.

Explore Paychex's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAYX

Paychex

Provides integrated human capital management solutions (HCM) for payroll, benefits, human resources (HR), and insurance services for small to medium-sized businesses in the United States, Europe, and India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives