- United States

- /

- Software

- /

- NasdaqCM:PGY

Pagaya Technologies (PGY) Sees Revenue Surge To US$326 Million In Strong Q2 Earnings

Reviewed by Simply Wall St

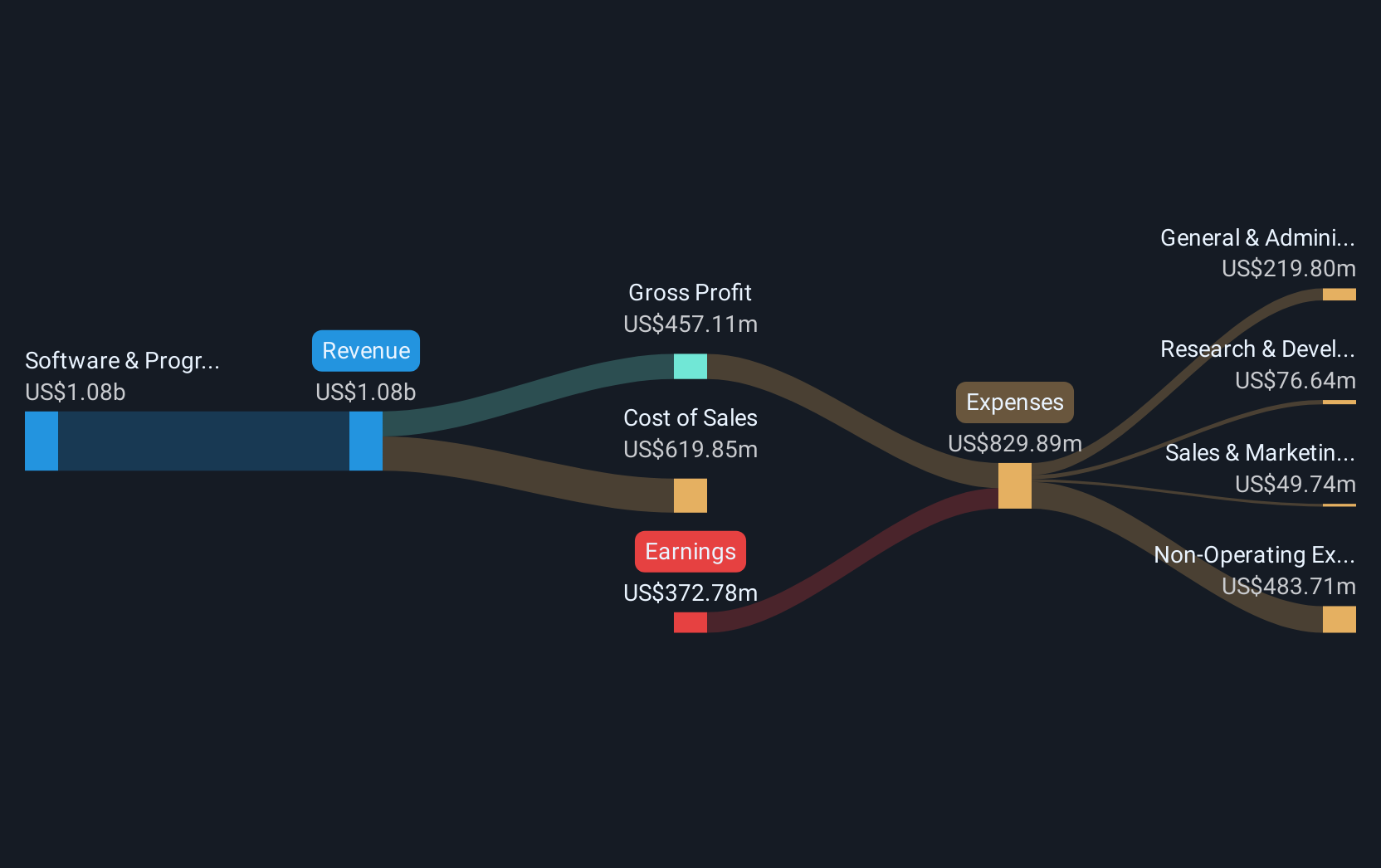

Pagaya Technologies (PGY) showcased marked improvement in its financial performance during its second quarter, with revenue soaring to $326 million and the company swinging to a net income from a prior loss. These earnings results corresponded with proactive debt management, including a highly oversubscribed $500 million debt offering, which underscores investor confidence. Such financial consolidation likely contributed to the company's significant 102% share price increase over the last quarter. The broader market's upward trend, with key indices nearing record highs, likely provided a favorable backdrop for Pagaya's outstanding shareholder returns.

We've discovered 2 risks for Pagaya Technologies that you should be aware of before investing here.

The recent developments at Pagaya Technologies underscore its strategic focus on robust financial management and market adaptability. The oversubscribed US$500 million debt offering signifies strong investor confidence, which may further enhance revenue streams by facilitating expansion and product diversification. Over the last year, Pagaya's shares have achieved a remarkable total return of over 150%, driven by strategic initiatives in advanced AI underwriting and embedded finance, broadening its market reach despite challenges in regulatory dynamics and market conditions. This performance significantly surpasses the US Software industry's one-year return of 25.4% and the broader US market's 16.2% return over the same period, highlighting Pagaya's solid performance relative to peers.

With the financial trajectory beginning to shift positively, ongoing advancements in product offerings and strategic partnerships may bolster Pagaya's revenue growth and mitigate earnings pressures. Analysts project revenues to grow at 15.1% annually, with projected earnings of US$311.7 million by 2028. However, current earnings remain a challenge, with losses still evident. The current share price of US$34.48 positions Pagaya's market valuation slightly below the consensus analyst price target of US$40.5, suggesting potential upside if the company meets growth projections. The comprehensive integration of AI in financial services is set to enhance operational efficiency, supporting future earnings growth while also presenting challenges that must be addressed strategically.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PGY

Pagaya Technologies

A product-focused technology company, deploys data science and proprietary artificial intelligence-powered technology for financial services and other service providers, their customers, and asset investors in the United States, Israel, and the Cayman Islands.

Undervalued with high growth potential.

Market Insights

Community Narratives