- United States

- /

- Insurance

- /

- NYSE:OSCR

Oscar Health (NYSE:OSCR) Sees 14% Q1 Price Rise

Reviewed by Simply Wall St

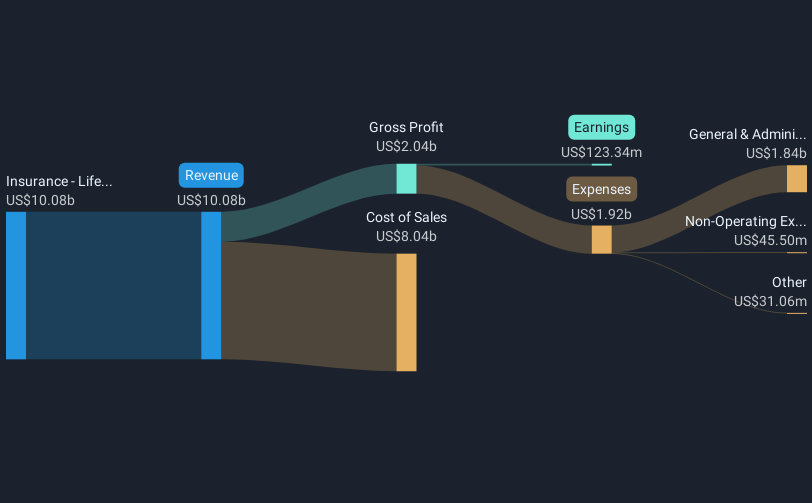

Oscar Health (NYSE:OSCR) reported a notable 14% increase in share price over the past quarter. This rise coincided with the company's Q1 2025 earnings report, which showed substantial revenue growth from the previous year, contributing positively to investor sentiment. The announcement of the Annual General Meeting and its agenda likely provided further investor confidence, aligning with the overall flat market performance in the last week, although the market has seen a 13% increase over the past year. These company-specific developments added weight to Oscar Health's upward trend, reflecting broader market expectations for earnings growth.

We've identified 2 warning signs for Oscar Health that you should be aware of.

The recent 14% increase in Oscar Health's share price coinciding with its Q1 2025 earnings report suggests enhanced investor confidence, primarily driven by revenue growth and upcoming AGM announcements. Over the past three years, the company's shares have experienced a very large 197.11% total return, indicating substantial long-term shareholder gains despite shorter-term fluctuations. In comparison to recent one-year benchmarks, Oscar Health underperformed the US Market, which returned 13%, and the US Insurance industry, which returned 11.6%.

The quarterly developments could positively impact the company's revenue and earnings forecasts, as strategic pricing, product innovation, and AI integration aim to enhance efficiency and future profitability. Currently, Oscar Health's shares trade at a discount of 13.4% to the consensus price target of US$16.31, yet analysts' expectations suggest potential upside, provided earnings reach the anticipated US$564.5 million by 2028, supported by revenue growth initiatives and market expansion.

Examine Oscar Health's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSCR

Oscar Health

Operates as a healthcare technology company in the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives