- Belgium

- /

- Wireless Telecom

- /

- ENXTBR:OBEL

Orange Belgium S.A. Just Beat Earnings Expectations: Here's What Analysts Think Will Happen Next

It's been a good week for Orange Belgium S.A. (EBR:OBEL) shareholders, because the company has just released its latest quarterly results, and the shares gained 5.9% to €15.40. Revenues of €303m fell slightly short of expectations, but earnings were a definite bright spot, with statutory per-share profits of €0.33 an impressive 26% ahead of estimates. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for Orange Belgium

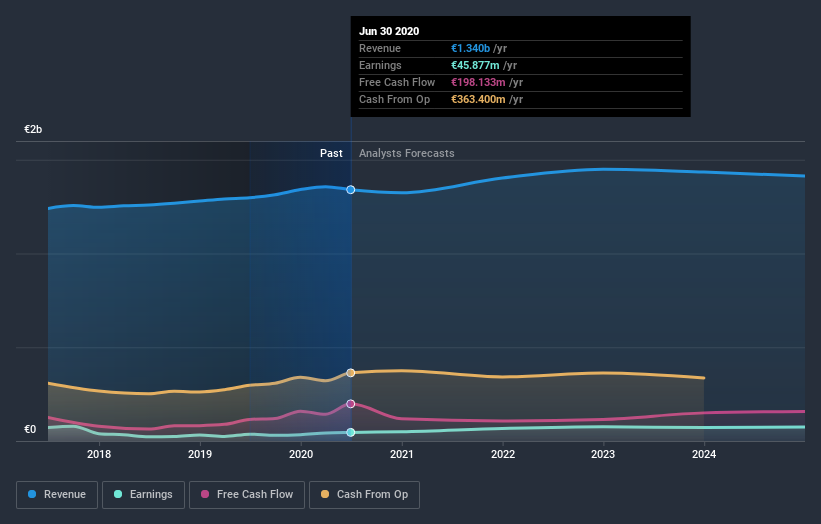

Following last week's earnings report, Orange Belgium's 19 analysts are forecasting 2020 revenues to be €1.32b, approximately in line with the last 12 months. Statutory earnings per share are predicted to increase 8.6% to €0.83. Before this earnings report, the analysts had been forecasting revenues of €1.36b and earnings per share (EPS) of €0.81 in 2020. If anything, the analysts look to have become slightly more optimistic overall; while they decreased their revenue forecasts, EPS predictions increased and ultimately earnings are more important.

The consensus has made no major changes to the price target of €21.65, suggesting the forecast improvement in earnings is expected to offset the decline in revenues next year. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Orange Belgium analyst has a price target of €29.30 per share, while the most pessimistic values it at €14.90. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast revenue decline of 1.2%, a significant reduction from annual growth of 1.9% over the last five years. Yet aggregate analyst estimates for other companies in the industry suggest that industry revenues are forecast to decline 1.8% next year. So it's pretty clear that Orange Belgium's revenues are expected to shrink slower than the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Orange Belgium following these results. Sadly they also cut their revenue estimates, although at least the company is expected to perform a bit better than the wider industry. Still, earnings per share are more important to value creation for shareholders. The consensus price target held steady at €21.65, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Orange Belgium going out to 2024, and you can see them free on our platform here..

We don't want to rain on the parade too much, but we did also find 3 warning signs for Orange Belgium that you need to be mindful of.

If you decide to trade Orange Belgium, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTBR:OBEL

Orange Belgium

Engages in the provision of telecommunication services in Belgium and Luxembourg.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives