- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

ON Semiconductor (NasdaqGS:ON) Sees 31% Price Move Over Past Month

Reviewed by Simply Wall St

ON Semiconductor (NasdaqGS:ON) experienced a notable price move of 31% over the past month, potentially influenced by broader market trends in the tech sector, especially amid ongoing trade talks between the U.S. and China. As major indexes showed modest gains driven by renewed optimism on trade, tech stocks, including ON Semiconductor, likely benefited from these broader positives. The company's performance remains aligned with market gains, as its price movement reflects general confidence in tech stocks and possible expectations of continued growth in AI-related demand. While unrelated company events occurred during this period, they likely did not significantly alter the market-driven price dynamics for ON.

ON Semiconductor has 2 possible red flags we think you should know about.

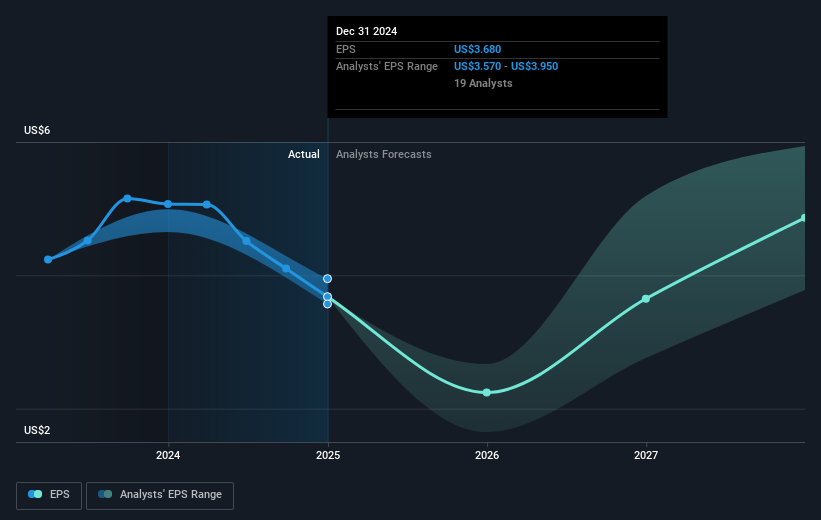

In light of ON Semiconductor's recent price move, the company's strategic focus on expanding its Fab-Right strategy and silicon carbide technology appears to align well with the optimism currently seen in the broader tech sector. The ongoing U.S.-China trade talks could continue to impact the tech market, potentially influencing revenue and earnings forecasts positively. However, challenges in the automotive sector persist, with a 26% revenue decline sequentially, which may dampen some of the anticipated gains from other market recoveries.

Over a five-year period, ON Semiconductor's total shareholder return was 158.38%, indicating substantial growth beyond the recent short-term movements. In the past year, however, the company underperformed both the U.S. market and the semiconductor industry average, suggesting mixed results relative to broader benchmarks.

The recent share price adjustment aligns closely with the analyst consensus price target of US$48.56, just 2.4% above the current price of US$47.37. This proximity indicates a view of the company being fairly valued by the market, with little expectation for drastic near-term deviations unless unexpected developments occur. Investors may need to consider how ON Semiconductor's strategies address current challenges, such as geopolitical risk and revenue pressures, to assess future potential relative to these consensus expectations.

Understand ON Semiconductor's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives