- United States

- /

- Electric Utilities

- /

- NYSE:OKLO

Oklo (NYSE:OKLO) Announces US$400 Million Follow-on Equity Offering

Reviewed by Simply Wall St

In a remarkable turn, Oklo (NYSE:OKLO) witnessed a 101% surge over the past month, which seems largely influenced by the company's active strategic maneuvers and financial initiatives. The announcement of a $400 million Follow-on Equity Offering on June 2 likely played a role, signaling strong investor interest and confidence. Additionally, Oklo's collaboration with Korea Hydro & Nuclear Power through a Memorandum of Understanding on developing nuclear technology further strengthened market sentiment. These corporate developments coincided with a largely positive market trend, as the broader market saw significant gains over the same period.

Be aware that Oklo is showing 4 risks in our investment analysis and 1 of those is a bit unpleasant.

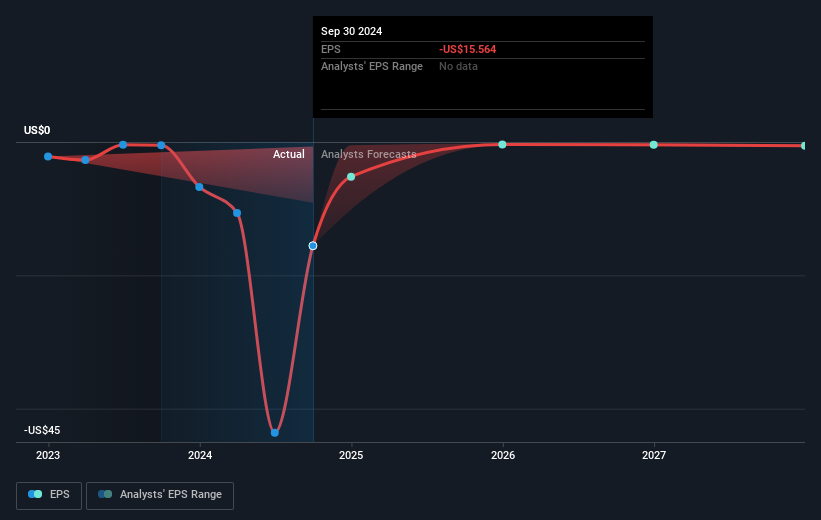

Oklo's shares have experienced a very large total return over the last year, reflecting a strong boost in investor confidence amid several corporate developments. This performance surpassed both the US Market, which returned 11.5%, and the US Electric Utilities industry, which returned 13.4%. However, detailed analysis shows that Oklo remains unprofitable with zero revenue and a net loss exceeding US$73.62 million in FY 2024. Despite these financial challenges, the company has seen substantial share price appreciation, potentially driven by its collaborations, equity offerings, and infrastructure projects highlighted in recent news.

The recent significant price movement indicates investor enthusiasm potentially tied to the company's strategic efforts, including the $400 million Follow-on Equity Offering and partnerships with KHNP. However, Oklo's current share price remains closely aligned with consensus analyst price targets, indicating potentially limited upside unless further substantial progress is made in its projects and collaborations. With forecasts suggesting continued unprofitability and stagnation in revenue growth, the market seems to be betting on the long-term innovative potential rather than immediate financial turnaround. The company's current Price-To-Book Ratio, noted to be expensive, underscores this optimism, albeit with specific risks associated with the anticipated financial performance.

Explore historical data to track Oklo's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKLO

Oklo

Develops advanced fission power plants to provide clean, reliable, and affordable energy at scale to the customers in the United States.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives