- United States

- /

- Banks

- /

- OTCPK:OFED

Oconee Federal Financial Corp. (NASDAQ:OFED) Will Pay A US$0.10 Dividend In Four Days

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Oconee Federal Financial Corp. (NASDAQ:OFED) is about to trade ex-dividend in the next 4 days. If you purchase the stock on or after the 5th of August, you won't be eligible to receive this dividend, when it is paid on the 20th of August.

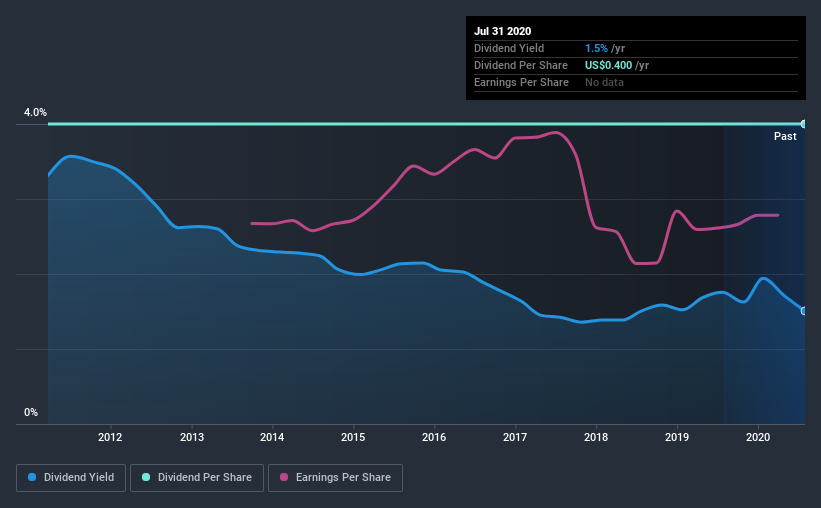

Oconee Federal Financial's next dividend payment will be US$0.10 per share. Last year, in total, the company distributed US$0.40 to shareholders. Calculating the last year's worth of payments shows that Oconee Federal Financial has a trailing yield of 1.5% on the current share price of $26.51. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for Oconee Federal Financial

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Oconee Federal Financial paid out more than half (57%) of its earnings last year, which is a regular payout ratio for most companies.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see how much of its profit Oconee Federal Financial paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're not enthused to see that Oconee Federal Financial's earnings per share have remained effectively flat over the past five years. We'd take that over an earnings decline any day, but in the long run, the best dividend stocks all grow their earnings per share.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. It looks like the Oconee Federal Financial dividends are largely the same as they were nine years ago.

To Sum It Up

Is Oconee Federal Financial worth buying for its dividend? Oconee Federal Financial has been struggling to generate growth while also paying out more than half of its earnings to shareholders as dividends. It doesn't appear an outstanding opportunity, but could be worth a closer look.

However if you're still interested in Oconee Federal Financial as a potential investment, you should definitely consider some of the risks involved with Oconee Federal Financial. To that end, you should learn about the 2 warning signs we've spotted with Oconee Federal Financial (including 1 which can't be ignored).

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Oconee Federal Financial, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OTCPK:OFED

Oconee Federal Financial

Operates as a holding company for Oconee Federal Savings and Loan Association that provides various banking products and services in the Oconee and Pickens County areas of northwestern South Carolina, and the northeast area of Georgia in Stephens County and Rabun County.

Low unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives