- United States

- /

- Banks

- /

- OTCPK:OFED

Oconee Federal Financial Corp. (NASDAQ:OFED) Goes Ex-Dividend In 4 Days

Oconee Federal Financial Corp. (NASDAQ:OFED) stock is about to trade ex-dividend in 4 days time. Ex-dividend means that investors that purchase the stock on or after the 6th of May will not receive this dividend, which will be paid on the 21st of May.

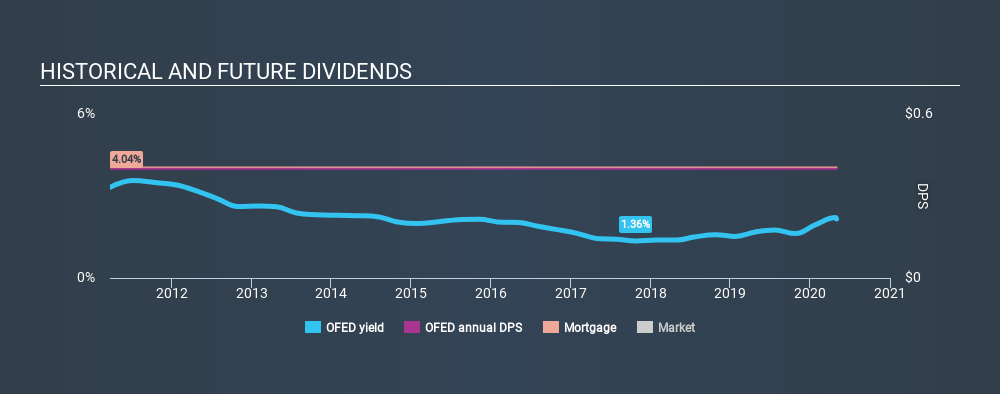

Oconee Federal Financial's next dividend payment will be US$0.10 per share. Last year, in total, the company distributed US$0.40 to shareholders. Based on the last year's worth of payments, Oconee Federal Financial has a trailing yield of 2.2% on the current stock price of $18.48. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

View our latest analysis for Oconee Federal Financial

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Oconee Federal Financial paid out 57% of its earnings to investors last year, a normal payout level for most businesses.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Click here to see how much of its profit Oconee Federal Financial paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That explains why we're not overly excited about Oconee Federal Financial's flat earnings over the past five years. Better than seeing them fall off a cliff, for sure, but the best dividend stocks grow their earnings meaningfully over the long run.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. It looks like the Oconee Federal Financial dividends are largely the same as they were nine years ago.

The Bottom Line

Is Oconee Federal Financial worth buying for its dividend? Oconee Federal Financial's earnings are effectively flat over recent years, even as the company pays out more than half of its earnings to shareholders as dividends. At best we would put it on a watch-list to see if business conditions improve, as it doesn't look like a clear opportunity right now.

However if you're still interested in Oconee Federal Financial as a potential investment, you should definitely consider some of the risks involved with Oconee Federal Financial. To help with this, we've discovered 2 warning signs for Oconee Federal Financial (1 is concerning!) that you ought to be aware of before buying the shares.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OTCPK:OFED

Oconee Federal Financial

Operates as a holding company for Oconee Federal Savings and Loan Association that provides various banking products and services in the Oconee and Pickens County areas of northwestern South Carolina, and the northeast area of Georgia in Stephens County and Rabun County.

Low unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives