- Belgium

- /

- Medical Equipment

- /

- ENXTBR:NYXH

Nyxoah Leads The Charge In European Penny Stocks

Reviewed by Simply Wall St

As European markets navigate a complex landscape of mixed stock index performances and monetary policy decisions, investors are keenly observing opportunities that might arise amidst these fluctuations. In this context, penny stocks—often smaller or newer companies—remain an intriguing investment area despite the term's somewhat outdated connotation. When backed by solid financials, these stocks can offer significant growth potential and hidden value, making them worth considering for those seeking to explore beyond the more prominent market names.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.258 | €1.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.08 | €16.04M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €238.45M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.95 | €40.14M | ✅ 3 ⚠️ 3 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.49 | RON16.57M | ✅ 2 ⚠️ 4 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.26 | €10.34M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.53 | €400.38M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.055 | €284.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.908 | €30.62M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 327 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Nyxoah (ENXTBR:NYXH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nyxoah SA is a medical technology company that develops and commercializes solutions for treating obstructive sleep apnea, with a market cap of €160.60 million.

Operations: The company's revenue is generated entirely from its Medical Products segment, amounting to €4.93 million.

Market Cap: €160.6M

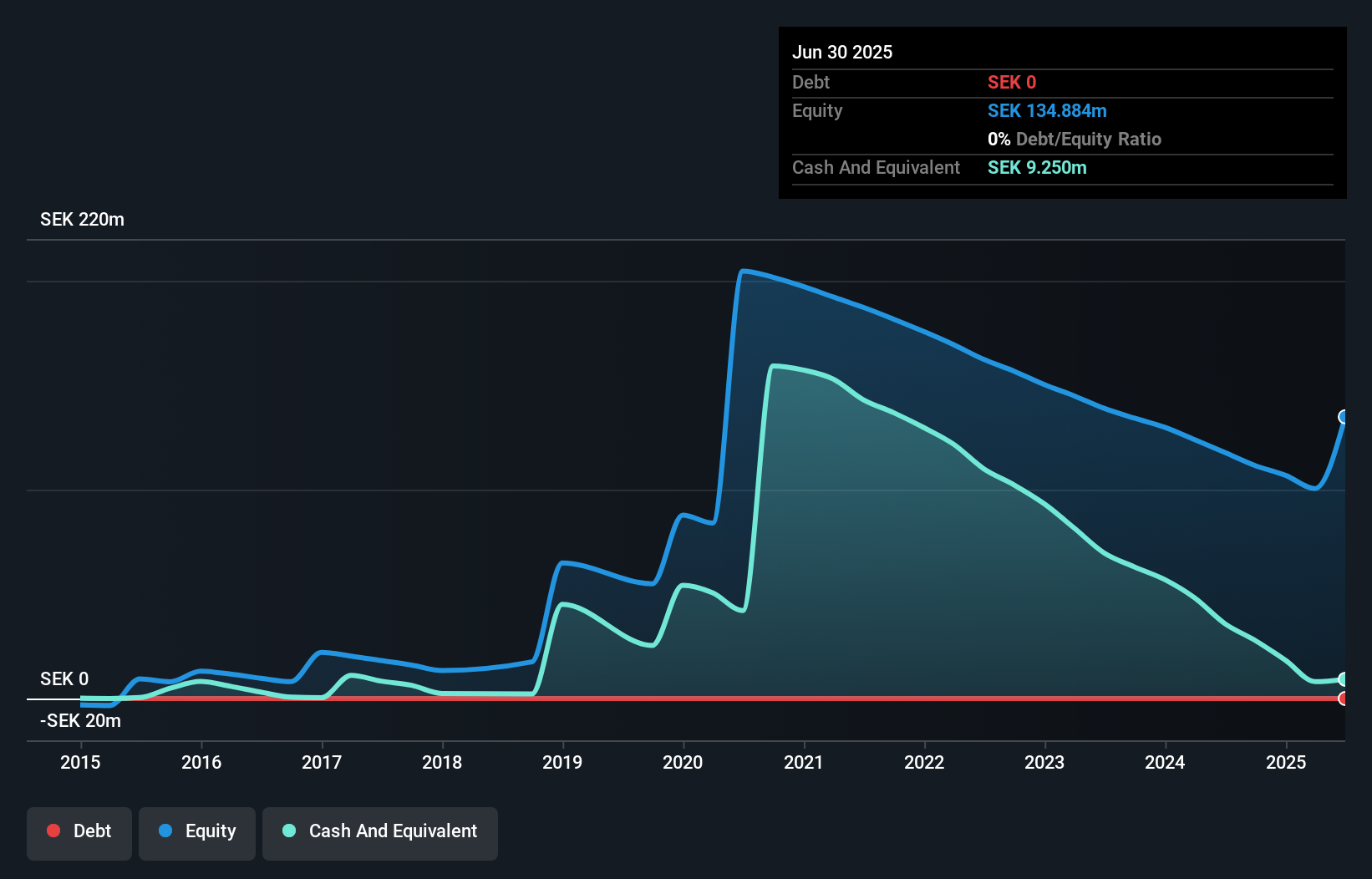

Nyxoah SA, with a market cap of €160.60 million, is navigating the penny stock landscape with its innovative Genio system for obstructive sleep apnea. Despite being unprofitable and experiencing increased losses over the past five years, Nyxoah's revenue from its Medical Products segment reached €4.93 million, indicating growth potential in this niche market. The recent FDA approval of Genio for specific patient groups marks a significant milestone and could drive future revenue growth. However, the company faces challenges such as high share price volatility and less than one year of cash runway based on current free cash flow trends.

- Dive into the specifics of Nyxoah here with our thorough balance sheet health report.

- Assess Nyxoah's future earnings estimates with our detailed growth reports.

genOway Société anonyme (ENXTPA:ALGEN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: genOway Société anonyme is a biotechnology company that develops and commercializes custom genetically modified mouse, rat, and cell line models globally, with a market cap of €28.21 million.

Operations: The company's revenue is entirely derived from its biotechnology segment, totaling €27.53 million.

Market Cap: €28.21M

genOway Société anonyme, with a market cap of €28.21 million, operates in the biotechnology sector and has achieved profitability over the past five years, growing earnings by 67.1% annually. The company maintains satisfactory debt levels with a net debt to equity ratio of 3.4%, and its interest payments are well covered by EBIT at 15.7 times coverage. While its recent earnings growth of 16.8% lags behind industry performance, genOway's financial stability is supported by short-term assets exceeding both short- and long-term liabilities and improving profit margins from last year’s figures.

- Click to explore a detailed breakdown of our findings in genOway Société anonyme's financial health report.

- Understand genOway Société anonyme's track record by examining our performance history report.

SpectraCure (OM:SPEC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SpectraCure AB (publ) focuses on developing cancer treatment systems and has a market cap of SEK30.11 million.

Operations: SpectraCure AB (publ) has not reported any revenue segments.

Market Cap: SEK30.11M

SpectraCure AB, with a market cap of SEK30.11 million, remains pre-revenue with earnings results reflecting a net loss of SEK 7.2 million in Q2 2025 and an annual revenue decline to SEK0.763 million for the first half of the year. The company is debt-free but faces financial challenges with less than a year of cash runway based on current free cash flow trends and increasing losses over five years at 6.4% annually. While its board and management team are experienced, SpectraCure's high share price volatility and negative return on equity underscore its precarious position in the biotech sector.

- Unlock comprehensive insights into our analysis of SpectraCure stock in this financial health report.

- Examine SpectraCure's past performance report to understand how it has performed in prior years.

Key Takeaways

- Access the full spectrum of 327 European Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nyxoah might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:NYXH

Nyxoah

A medical technology company, develops and commercializes solutions to treat obstructive sleep apnea (OSA).

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives