- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

Northern Trust (NTRS) Launches US$2,500 Million Share Repurchase Program

Reviewed by Simply Wall St

Northern Trust (NTRS) recently announced a significant share repurchase program worth $2,500 million, which coincided with a robust 38% increase in its stock price over the last quarter. This substantial buyback initiative highlights the company's commitment to enhancing shareholder value and was further reinforced by their completed repurchases under a prior program. Additionally, the company's increased dividend announcements and firm stance on maintaining independence amidst merger rumors align with these efforts. Despite mixed earnings results, the broader market trends, including strong corporate earnings and economic optimism, may have further supported Northern Trust's positive stock performance relative to market indices.

We've spotted 1 warning sign for Northern Trust you should be aware of.

The recent announcement of Northern Trust's US$2,500 million share repurchase program and its subsequent 38% stock price increase over the last quarter suggest a robust commitment to enhancing shareholder value, which may temporarily alleviate concerns about long-term margin pressure due to fee challenges. Over a longer five-year period, the company's total shareholder return, including dividends, stood at 91.37%, indicating solid performance and potential investor confidence in their strategic initiatives. Comparatively, in the past year, Northern Trust's return also outperformed the US market benchmark of 17.3%, but did not keep pace with the US Capital Markets industry return of 35.9%.

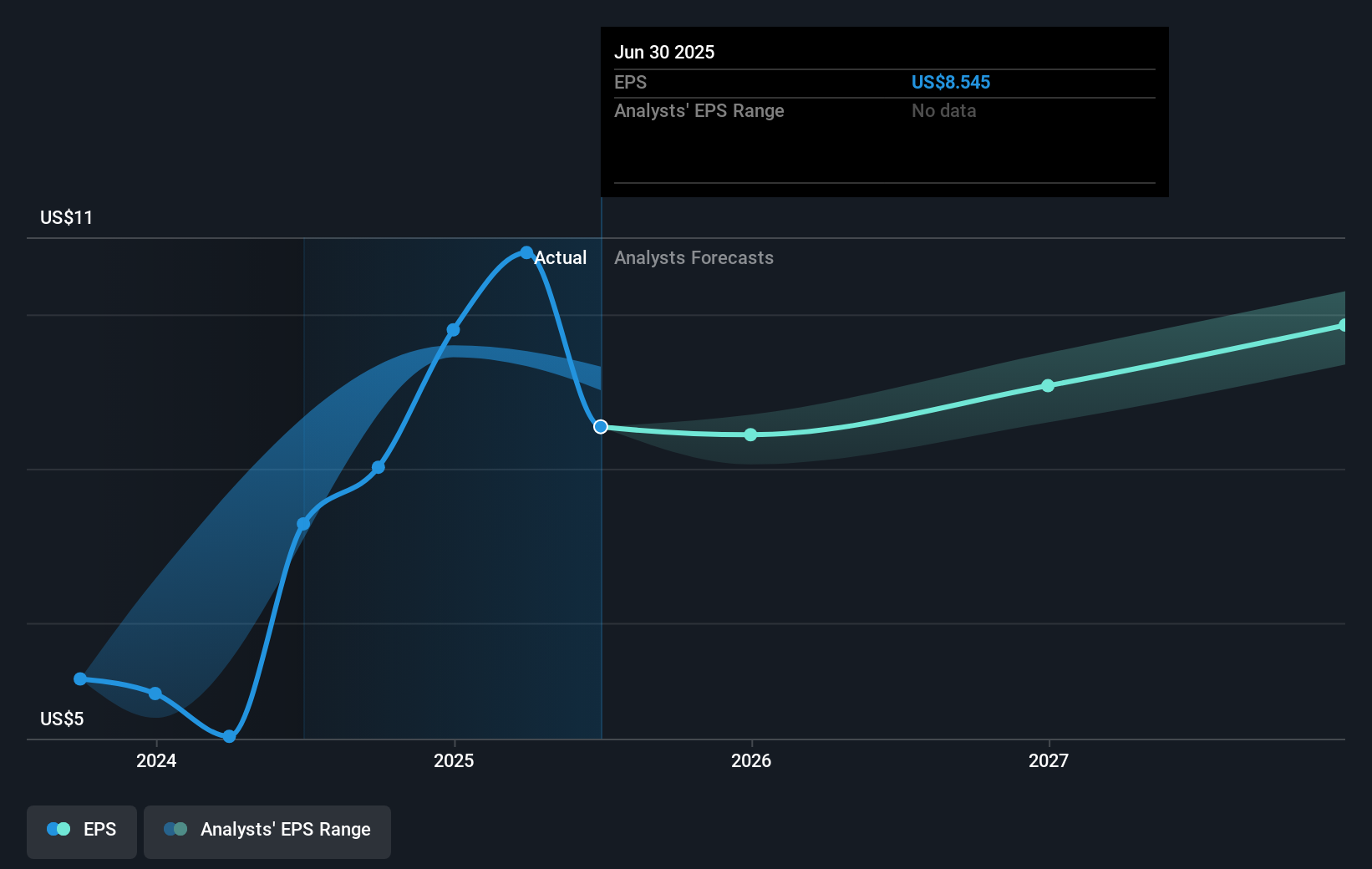

The current and anticipated share repurchases may influence short-term positive sentiment, potentially impacting analyst revenue and earnings forecasts, but the underlying pressures such as increased tech costs and passive investing fee pressure remain relevant challenges. The price movement to US$129.78, compared with the price target of US$120.54, reflects a share price trading above the analyst consensus estimate, signaling investor sentiment that may be more optimistic than analyst expectations. With revenue anticipated to decline at 1.6% annually over the next three years and profit margins expected to contract to 17.6%, the current valuation is pricing in a more favorable operational and market outcome than the consensus scenarios. As Northern Trust navigates these challenges, they will need to continually demonstrate their ability to drive efficiencies and scale in their alternatives and digital initiatives for sustainable future growth.

Explore Northern Trust's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives