- United States

- /

- Luxury

- /

- NYSE:NKE

NIKE (NYSE:NKE) Revamps Leadership Team With New Executive Appointments

Reviewed by Simply Wall St

NIKE (NYSE:NKE) recently initiated significant changes within its leadership under CEO Elliott Hill, appointing Michael Gonda as Executive Vice President and Chief Communications Officer. These moves are part of a broader strategy to invigorate the brand amid evolving market dynamics. Over the past month, NIKE's stock rose by 5%, outpacing the market's 2% gain during the same period. While the broader market trends imply general optimism, the company's specific leadership transformations likely added momentum to its price performance, highlighting investor confidence in its renewed focus on growth and innovation.

Buy, Hold or Sell NIKE? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

The recent leadership changes at NIKE, led by CEO Elliott Hill, appointing Michael Gonda as Executive Vice President and Chief Communications Officer, are part of an effort to invigorate the brand amidst evolving market dynamics. These moves could significantly impact the company's strategic focus on growth and innovation. Over the past year, however, NIKE's total return, including share price and dividends, decreased by 33.38%, a stark contrast to the broader market's notable gains. This long-term performance highlights challenges faced by the company despite recent positive momentum in the stock price.

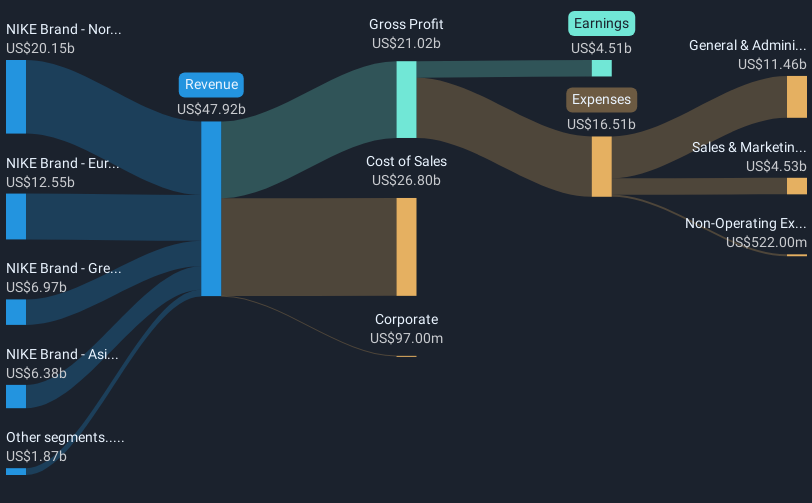

With NIKE stock rising by 5% in the past month, it remains significantly below the consensus analyst price target of US$73.86, which is nearly 23% higher than the current share price of US$57.04. The latest leadership appointments could support efforts to transition NIKE's product portfolio toward sports performance products, potentially boosting future revenue and earnings. Analysts project a gradual increase in profit margins, anticipating earnings to grow to US$5 billion by May 2028. These forecasts and leadership shifts emphasize a focus on digital and promotional strategies, potentially stabilizing financial performance over the longer term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NKE

NIKE

Engages in the design, development, marketing, and sale of athletic footwear, apparel, equipment, accessories, and services worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives