- United States

- /

- Luxury

- /

- NYSE:NKE

NIKE (NYSE:NKE) Removed From Multiple Russell Growth And Defensive Indexes

Reviewed by Simply Wall St

NIKE (NYSE:NKE) saw a significant price movement of 20% last week, amid being dropped from multiple Russell indices on June 30, 2025, which might affect investor sentiment due to reduced visibility. Simultaneously, despite reporting a year-over-year decline in earnings and sales, the broader market was buoyant, with the S&P 500 and Nasdaq reaching new highs. The company's stock buyback activities and prevailing optimism in economic conditions likely provided a counterbalance to the negative earnings report, illustrating a complex interaction of factors influencing NIKE's market performance amidst a generally rising market.

Be aware that NIKE is showing 1 weakness in our investment analysis.

NIKE's recent removal from multiple Russell indices on June 30, 2025, could impact its market visibility and investor sentiment, potentially affecting shareholder returns. Last week, its share price experienced a significant movement of 20%, a response that runs contrary to its year-over-year earnings and sales decline. Over the previous year, NIKE's total shareholder return, including share price movement and dividends, was a 2.37% decline. This performance is in contrast with the broader market indices like the S&P 500, which saw gains, highlighting a year of challenges for NIKE relative to market growth.

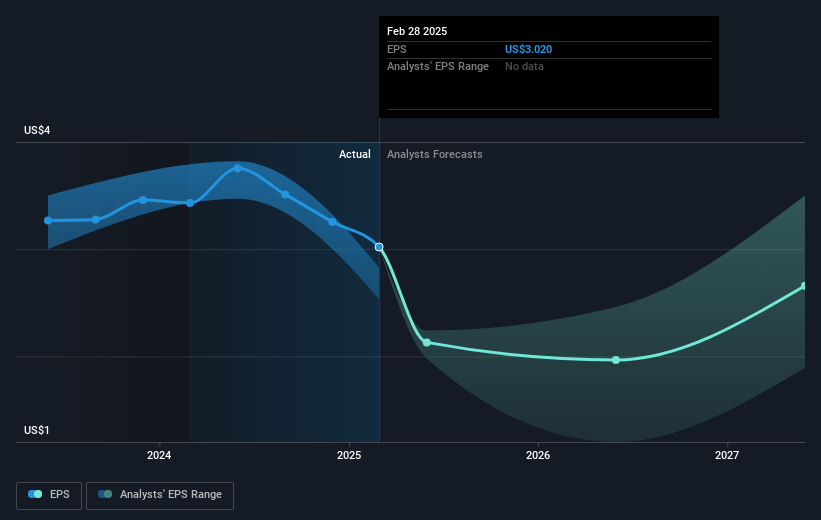

The stock buyback program and broader economic optimism may have buoyed the share price despite negative earnings news. Analysts forecast a modest revenue growth of 1.8% annually over the next three years, with earnings predicted to rise to US$5.0 billion by 2028. The shift towards sports performance products is expected to foster growth, but high inventories and macroeconomic uncertainties pose ongoing risks. The recent price movement positions the share price at US$57.04, about 22.8% below the consensus analyst price target of US$73.86. Investors may scrutinize these dynamics as they weigh NIKE's transitional strategies against its current market valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NKE

NIKE

Engages in the design, development, marketing, and sale of athletic footwear, apparel, equipment, accessories, and services worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives