- United States

- /

- Luxury

- /

- NYSE:NKE

NIKE (NKE) Teams With Special Olympics For Global Youth Sport Inclusion Initiative

Reviewed by Simply Wall St

NIKE (NKE) recently announced a milestone partnership with Special Olympics, promoting sport inclusivity during the Global Week of Inclusion. This collaboration potentially bolsters the company's brand image, aligning with its longstanding community engagement. Over the last quarter, Nike's share price experienced a significant 32% rise. While the market was largely mixed due to inflation concerns and tech sector rallies, Nike's move might be partially supported by its commitment to social causes amid broader sector volatility. Additionally, despite challenging financial results and removal from key indices, the overall market uptrend could have facilitated Nike’s positive stock performance.

NIKE has 1 possible red flag we think you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

Alongside the recent partnership with Special Olympics, Nike's ongoing shift to sports performance products and digital integration could have a lasting effect on its revenue and earnings forecasts. The focus on sport performance aims to drive growth and reduce reliance on declining product lines, potentially enhancing future earnings. The company's brand enhancement through these social initiatives supports long-term strategic goals by aligning with community values, but the revenue impact remains to be seen.

Over the past year, Nike recorded a modest total return of 3.49% including dividends, reflecting on-market performance despite challenging financial times. However, when compared to the US Luxury market, which saw greater returns of 5.2% in the past year, Nike has underperformed. Despite this, its 32% share price increase in the last quarter highlights investor confidence amidst a mixed market environment.

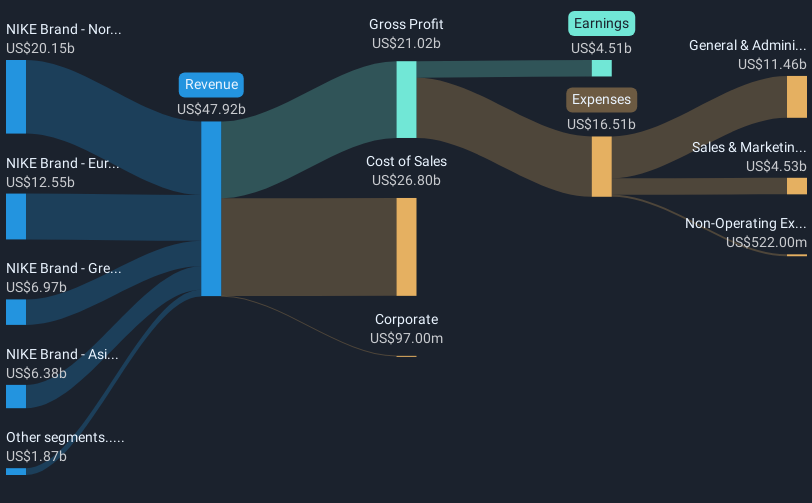

The current share price of US$72.25 is below the analyst consensus price target of US$76.02, indicating a perceived upside in market value. However, this aligns closely with the analyst consensus, reflecting varied perceptions of future performance. The anticipated growth includes revenue reaching US$50.5 billion and a potential uplift in profit margins. While Nike's commitment to inclusivity is positive for brand image, translating this into substantial financial returns could take time. As Nike navigates macroeconomic uncertainties, its valuation and strategic pivots will be closely watched by the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NKE

NIKE

Designs, develops, markets, and sells athletic and casual footwear, apparel, equipment, accessories, and services for men, women, and kids in North America, Europe, the Middle East, Africa, Greater China, the Asia Pacific, and Latin America.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives